For once, USD/JPY is settling within a 50 pips range so far on the day. Overall, the reaction to the US CPI report yesterday has been rather underwhelming. The dollar did nudge a little lower while stocks climbed but not by a whole lot.

Then again, traders are pricing between a 25 bps and 50 bps rate cut by the Fed. So, it’s not that there is much catching up to do there. And perhaps there was some frontrunning from the PPI data on Tuesday.

But there’s still one more key release on the calendar later today in the form of the US retail sales. So, we’ll have to see if that can complete the run of comfort for markets this week.

Going back to FX, EUR/USD is trying to target a firm hold and break above 1.1000 for now. That said, there are large option expiries in play at the figure level today and tomorrow and that could still be a pull factor.

Besides that, USD/JPY is keeping in a consolidative mood still this week so there’s not much to scrutinise until we break the mold there.

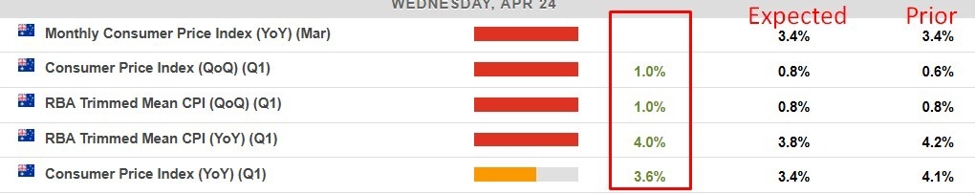

The notable mover so far today is the Australian dollar though. And that comes after a more solid jobs report earlier here. The unemployment rate may have ticked higher but that owes to a rise in the participation rate mostly. Otherwise, the employment numbers were firmer than expected and that won’t pressure the RBA to rush into rate cuts.

It’s been a back and forth week for AUD/USD, now trading back above 0.6600 and back above its key daily moving averages at 0.6598-04.

This article was written by Justin Low at www.forexlive.com.

Source link