Headlines:

- Far-right movement makes waves in Europe over the weekend

- Italy-Germany 10-year bond yields spread widens by the most since April

- Was the US NFP a gamechanger?

- ECB’s Nagel: We must be cautious about future rate moves

- Eurozone June Sentix investor confidence 0.3 vs -1.8 expected

- SNB total sight deposits w.e. 7 June CHF 459.8 bn vs CHF 461.9 bn prior

Markets:

- AUD leads, EUR lags on the day

- European equities lower; S&P 500 futures down 0.1%

- US 10-year yields up 3.7 bps to 4.465%

- Gold up 0.3% to $2,299.63

- WTI crude up 0.6% to $75.98

- Bitcoin up 0.3% to $69,502

In what will be a big week for markets, things are off to a rather slow start.

The big news came over the weekend as the results of the European parliamentary election sent shockwaves across the region. The far-right movement is gaining traction and that saw some humiliating defeats for incumbent governments in France and Germany especially.

In the case of the former, it prompted Macron to even call a snap election. The political angst is weighing on European bonds and also the euro currency, with the latter opening today with a gap lower.

EUR/USD opened down at around 1.0777 before sliding further to 1.0732 during the session. The pair is now down 0.5% still on the day at around 1.0750 currently. This comes as the spread between periphery yields and German bund yields is seen widening. At the same time, European indices were offered with French stocks the main drag.

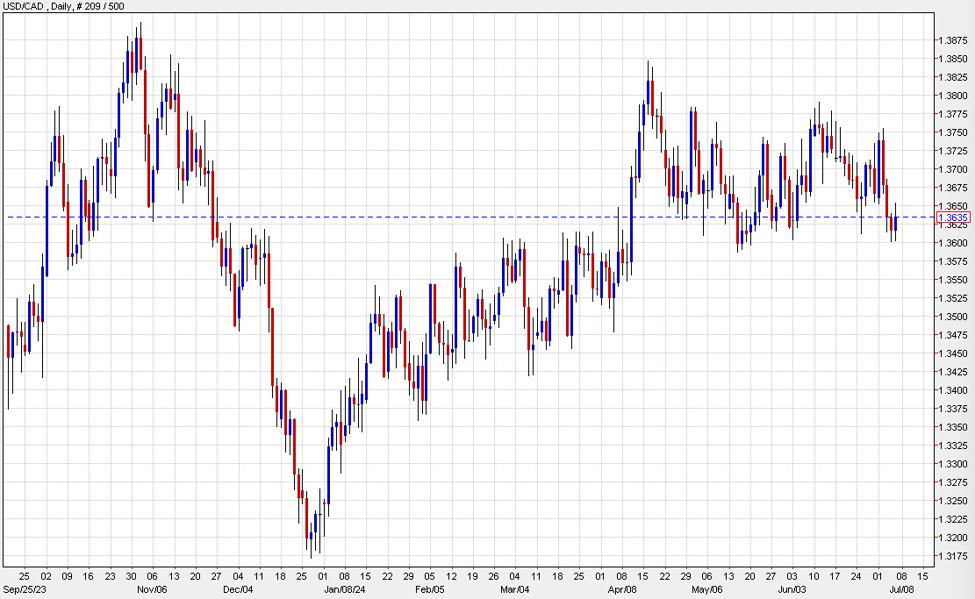

Other major currencies didn’t get up to much, with the dollar keeping largely steadier. All eyes are on the bigger events coming up later this week instead. USD/JPY is hugging levels just under 157.00 while the commodity currencies are all little changed against the greenback.

As European yields shoot higher, that’s spilling over to Treasury yields too. 10-year yields are back up to 4.46% to start the week but it’s still early days.

Wednesday will be the main one to watch as we’ll have both the US CPI report and FOMC meeting falling on the same day for the first time since June 2020.

This article was written by Justin Low at www.forexlive.com.

Source link