Headlines:

- The UK heads to the polls today

- What has changed after yesterday’s US data?

- Bitcoin drops again, faces mounting technical pressure

- ECB’s Lane: Wage tracker shows much lower wage growth in 2025 and 2026

- ECB accounts show some mixed views on confidence towards inflation outlook

- Germany May industrial orders -1.6% vs +0.5% m/m expected

- Germany June construction PMI 39.7 vs 38.5 prior

- UK June construction PMI 52.2 vs 53.6 expected

- Switzerland June CPI +1.3% vs +1.4% y/y expected

Markets:

- JPY leads, USD lags on the day

- European equities higher; CAC 40 +0.8%

- Gold up 0.1% to $2,358.40

- WTI crude down 0.8% to $83.17

- Bitcoin down 3.1% to $57,667

With it being a US holiday, there wasn’t much for traders to work with as well in European morning trade today.

The dollar remains sluggish, keeping with the mood from yesterday after the softer US ISM services PMI data. The greenback was lightly changed early on but is now down a touch across the board.

The changes in the euro and pound are light but USD/JPY is down 0.4% to test waters back under 161.00 on the day. Besides that, USD/CHF is also down 0.2% to 0.8995 and AUD/USD up 0.4% to 0.6730 currently.

In the equities space, European indices were more tentative early on but are now picking up steam again with French stocks continuing to rally ahead of the second round of the elections this weekend. Regional markets also seem to pass the test of the latest French 10-year bond auction earlier in the day.

Besides that, there is a bit of focus on Bitcoin as it tumbles further to its lowest levels since early May. The cryptocurrency is under pressure on a fall back below $60,000, with key technicals being challenged on the week.

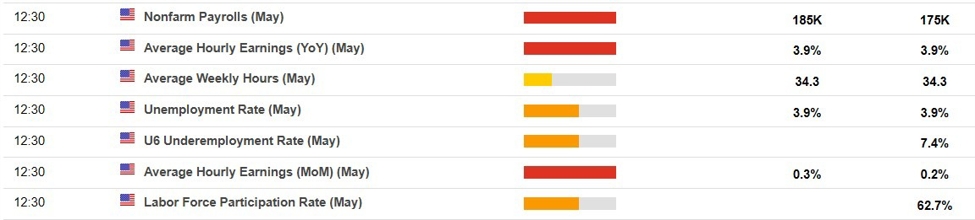

Liquidity conditions will be thin in US trading later, so just be wary of that with the greenback starting to see its resilience crack this week. All this ahead of the non-farm payrolls data tomorrow.

This article was written by Justin Low at www.forexlive.com.

Source link