Headlines:

- Dollar on edge as we look to the new week

- What changed after the US NFP report?

- Central banks are still on the agenda this week

- ECB’s Vujčić says rates will be gradually lowered over time

- ECB’s Šimkus: Last week’s data were as expected

- Eurozone May Sentix investor confidence -3.6 vs -4.9 expected

- Eurozone April Final Services PMI 53.3 vs. 52.9 expected

- Eurozone March PPI -0.4% vs -0.4% m/m expected

- SNB total sight deposits w.e. 3 May CHF 473.2 bn vs CHF 475.7 bn prior

- Russia says it is to hold tactical nuclear weapons drill

Markets:

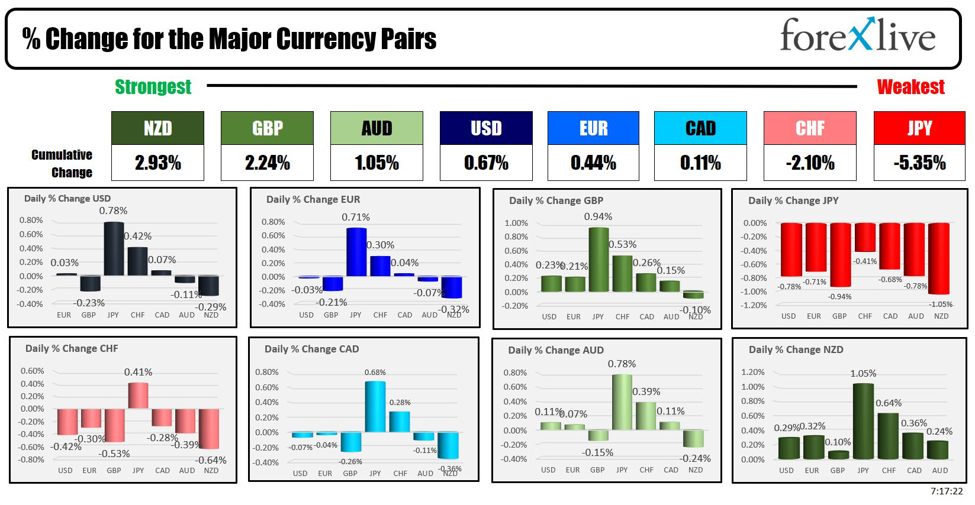

- AUD leads, JPY lags on the day

- European equities higher; S&P 500 futures up 0.3%

- US 10-year yields down 1.9 bps to 4.481%

- Gold up 0.8% to $2,319.44

- WTI crude up 1.0% to $78.87

- Bitcoin up 1.8% to $64,067

It was a slower session with London out on holiday and that saw light changes among major currencies.

The dollar is marginally softer at the balance, keeping more mixed amid a jump in USD/JPY during Asia trading. The pair moved up to near 154.00 earlier and has been holding around 153.70-80 levels mostly during the session.

Besides that, the dollar is mildly softer against the likes of the euro, pound and loonie. EUR/USD is sitting within a 20 pips range around 1.0770 while GBP/USD is up 0.2% to 1.2575 as buyers look to take the next step higher. AUD/USD is up 0.3% to 0.6628 amid a better risk mood on the day so far.

Equities are seen keeping up the gains from last week, with S&P 500 futures up nearly 0.4% while European indices are also posting modest gains today.

The minor drag in the dollar comes as yields stay on the backfoot with 10-year Treasury yields just under 4.50%. The retreat in yields is continuing after the softer data on Friday, prompting traders to step up Fed rate cut bets.

This article was written by Justin Low at www.forexlive.com.

Source link