- Mixed close for US stocks with the Nasdaq higher. The Dow down and the S&P little changed.

- E*TRADE considering removing Roaring Kitty (i.e..Keith Gill) off trading platform

- Former Fed Kaplan. September is a possibility, but Fed still expects the Fed to be patient

- Crude oil futures settle at $74.22

- USD extending to new lows as London/Europe exit for the day

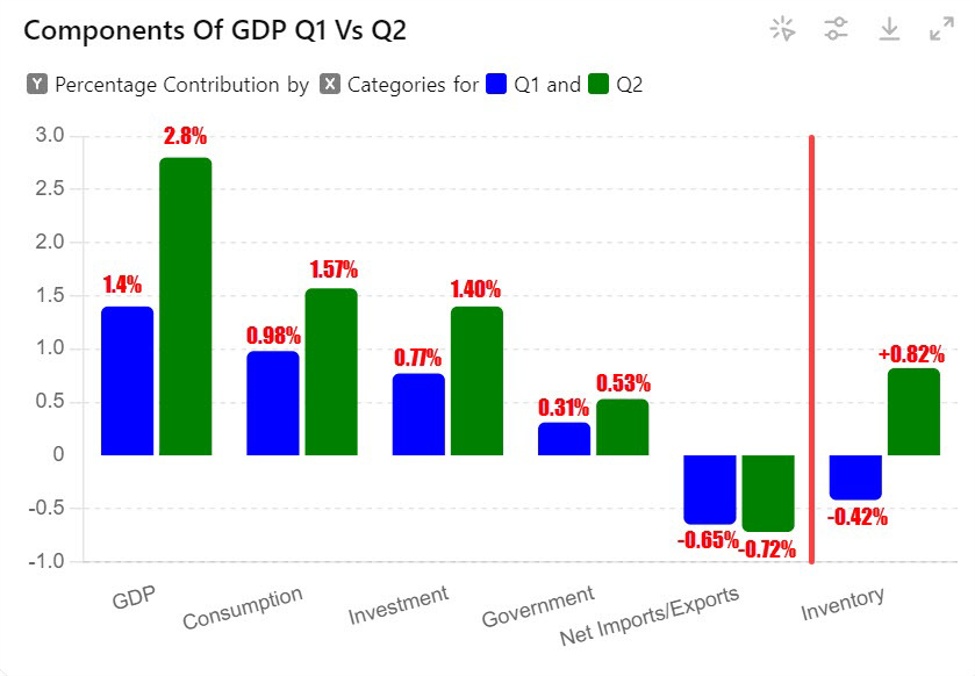

- Atlanta Fed GDPNow Q2 growth estimate 1.8%, down from 2.7% on May 31

- SkyNews/YouGov: Labour is expected to win 422 seats

- European major indices close mostly higher

- Nigel Farage to lead the Reform Party

- US ISM manufacturing for May 48.7 versus 49.6 estimate

- US S&P global manufacturing PMI for May 51.3 versus 50.9 preliminary

- Canada S&P global manufacturing PMI 49.3 versus 49.4 preliminary

- Israelis Ben_Gvir: Suspects an attempt to “whitewash a foolhardy gossip proposal”

- Kickstart the FX trading day for June 3 w/a technical look at the EURUSD, USDJPY & GBPUSD

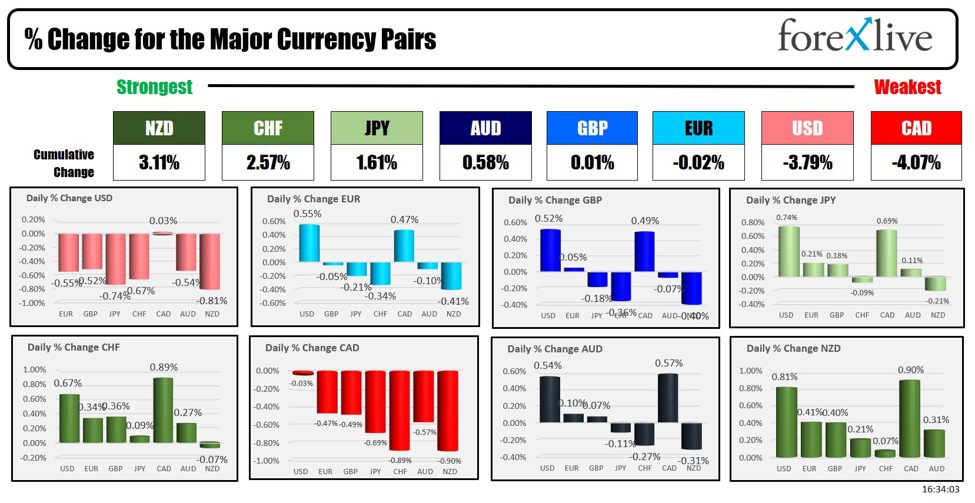

- The JPY is the strongest and the CAD is the weakest as the NA session begins.

- ForexLive European FX news wrap: Dollar mixed as yields ease a little more

The USD moved lower today and was only surpassed by the CAD as the weakest of the major currencies.

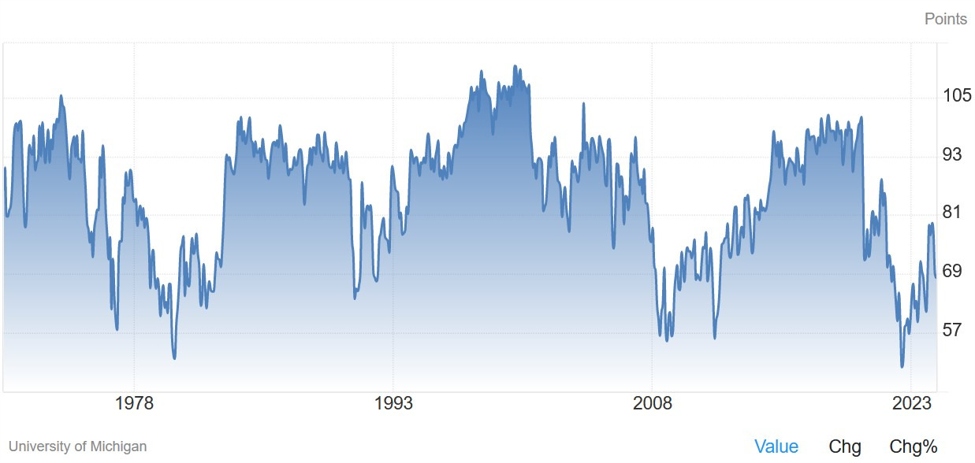

The USDs decline was kickstarted by a weaker May ISM manufacturing which came in at 48.7 vs 49.6 last month. There has only been one ISM above 50.0 (indicative of growth) in the last year. Manufacturing has lagged but the market is sensitive to weaker than expected growth (at time). There is a fine line between slower growth which will minimize inflation, but not too low to lead to larger job losses, that will lead to a “harder landing” for the economy.

The US jobs report will give a view of the jobs market with expectations now pointing to 185K job adds up from 175K but below 200K. The unemployment rate which ticked up to 3.9% last month, is expected to remain unchanged at 3.9%.

The CAD was the weakest of the majors helped by technical support holding along with perhaps some telling ofhe CAD ahead of Bank of Canada rate decision on Wednesday.

In other news, the Atlanta Fed GDPNow growth estimate for 2Q fell to its lowest level for the second quarter at 1.8% versus 2.7% on May 31.

In the US debt market, yields moved sharply lower off of the news:

- 2-year yield 4.812%, -8.1 basis points. Last week, the yield reached above 5.002% before rotating back to the downside. The yield has moved out for four consecutive days.

- 5-year yield 4.441%, -11.8 basis points.. Last week the yield reached 4.656%.

- 10 year yield 4.392% -12.0 basis points. Last, the yield rate 4.638%.

- 30-year yield 4.540%, -11.2 basis points. Last week, the yield rate 4.756%.

In the US stock market, the major indices were mixed today with the Dow industrial average falling. The S&P little changed but higher, and the NASDAQ index leading the gains:

- Dow Industrial Average average, -0.30%

- S&P index +0.11%

- NASDAQ index +0.56%

Shares of Nvidia soared 4.9% and Meta-added 2.28%. Gamestop rose 21.0%, but traders hired $40.50 before rotating lower and settling at $28 today on the back of the report that Roaring Kitty had a huge stock and option position.

Crude oil is trading down $2.93 or -3.81% at $74.05.OPEC+ meeting failed to push prices up and the lower manufacturing data weighed on prices.

Bitcoin is higher but below $70K at $69174.

This article was written by Greg Michalowski at www.forexlive.com.

Source link