The US producer price index rose 2.6% y/y in the largest annual rise since March 2023. The news initially caught the market by surprise and gave a lift to the US dollar.

However the move was short-lived because it appears as though there was a one-off skew in the numbers. All the gains were driven by services while the index for final demand goods decreased 0.5%.

Within services, the BLS reported:

Nearly all the June increase is attributable to a 1.9% jump in margins for final demand trade services. (Trade indexes measure changes in margins received by wholesalers and

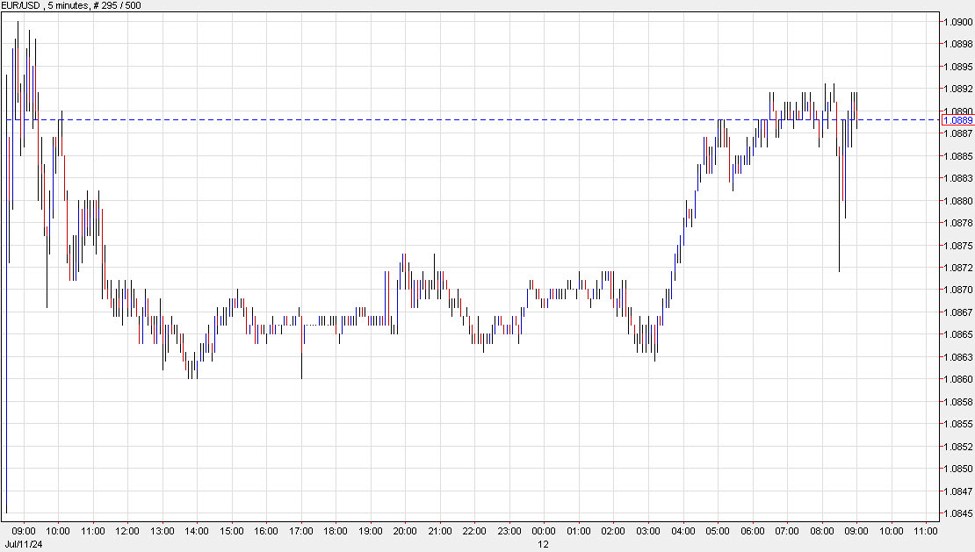

retailers.) The index for final demand services less trade, transportation, and warehousing inched up 0.1%.This refers to the to the difference between the price retailers and wholesalers pay for goods and the price at which they sell those goods. A 1.9% jump in these margins means retailers and wholesalers are marking up their prices more significantly, it what looks like a one-off.As a result, the US dollar quickly gave back its gains (shown here as the euro falling and then recovering).

Fed cut pricing also returned to 62 bps this year, which is slightly higher than before the data. A brief decline in stock futures also reversed.

This article was written by Adam Button at www.forexlive.com.

Source link