The May US CPI surprised to the downside yesterday making the market to fully price back in 2 rate cuts by the end of the year and expecting a more dovish Fed. Unfortunatelly, that wasn’t the case because the Fed’s projections and dot plot surprised on the hawkish side.

Projections

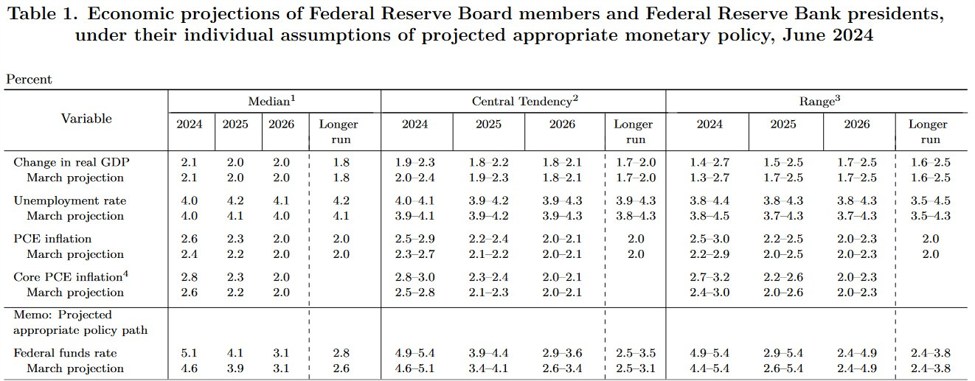

The Dot Plot showed just one rate cut for this year compared to two expected by the market going into the decision.

They had the chance to revise their projections after seeing the CPI data but decided not to do it. That’s curious. Maybe they just wanted to err on the cautious side.

The split was also narrow with 7 members pencilling two cuts and 8 going for just one. So, I wouldn’t read much into it at this point given that it’s all about the next set of data anyway.

Moreover, the longer run rate, which is their projection of the neutral interest rate (R*) was revised upwards which kind of shows that they consider the policy less restrictive than expected previously (but nonetheless still restrictive). I would also add that estimating the neutral rate is pretty useless.

The inflation projections were also revised upwards but one could also argue that that makes it easier to get a rate cut if inflation were to undershoot their expectations.

All in all, it was a bit more hawkish than expected.

Press Conference

The press conference made the projections kinda stale as Fed Chair Powell backpedalled pretty strongly on them saying things like “Regardless of the dots, everyone at the FOMC would say they’re very data dependent” and “We don’t have a high confidence in forecasts”.

As always, they will be guided by the economic data, so if we see another soft CPI report you can expect them coming out with comments like “if we keep getting such good data, two cuts might be possible”.

Summary

To sum up, the CPI and the FOMC didn’t change much the big picture, which at the moment is about resilient growth and ongoing disinflation. Even if we keep flip flopping between 1 and 2 cuts, we still have growth and disinflation. This should still be a good environment for risk assets and the risk sentiment in general.

This article was written by Giuseppe Dellamotta at www.forexlive.com.

Source link