Today is going to be a more lively day as we get a couple of market moving data and we will hear from Fed Chair Powell in the US session. Overall, the data will likely keep things unchanged on the interest rates expectations front but should further reaffirm the disinflationary trend.

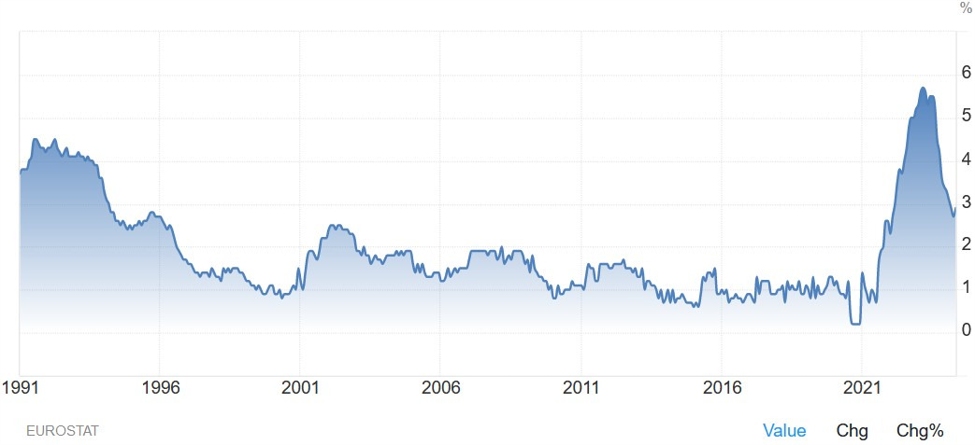

09:00 GMT – Eurozone June Flash CPI

The Eurozone CPI Y/Y is expected at 2.5%

vs. 2.6% prior, while the Core CPI Y/Y is seen at 2.8% vs. 2.9% prior. This

report won’t change anything for the ECB as they want to see the data

throughout the summer before deciding on a rate cut in September.

Nonetheless, a faster easing in inflation

during the summer or some quick deterioration in the economy should see the

market pricing in more rate cuts by the end of the year. At the moment, the

market sees 46 bps of easing by the end of the year assigning 61% probability of no

change at the July meeting and 83% chance of a cut in September.

13:30 GMT/09:30 ET – Fed Chair Powell

Fed Chair Powell

will be speaking at the European Central Bank Forum on Central Banking 2024 in

Sintra, Portugal. I don’t expect him to signal anything and just maintain the

usual neutral stance.

In my opinion, a lot will depend on the

next inflation data. I think the Fed will be more dovish if we get a good

inflation report in July. Then, if we get some more good figures in August,

Powell will likely pre-commit to a rate cut in September at the Jackson Hole

Symposium.

14:00 GMT/10:00 ET – US May Job Openings

The US Job Openings are expected to fall

to 7.850M vs. 8.059M prior. The last

report missed expectations by a big margin

with job openings falling to the lowest level since February 2021 and now

getting close to the pre-pandemic level.

This is good news for the Fed as the

labour market continues to rebalance via less jobs availability rather than

more layoffs, and inflationary pressures should keep abating. On the other

hand, the labour market is a spot to keep an eye on carefully in this part of

the cycle.

Central bank speakers:

- 07:30 GMT – ECB’s de Guindos (neutral – voter)

- 08:30 GMT – ECB’s Elderson (hawk – voter)

- 10:30 GMT – ECB’s Schnabel (hawk – voter)

- 13:00 GMT/09:00 ET – ECB’s Lagarde (neutral – voter)

This article was written by Giuseppe Dellamotta at www.forexlive.com.

Source link