The European session today is going to be empty as we get just some low tier releases. In the American session we get the Final US Q1 GDP, the US Durable Goods Orders and the US Jobless Claims figures.

The GDP report is the “Final” one, so it’s very old news (as it’s always the case for GDP anyway), while the Durable Goods Orders is rarely a market mover because of its very volatile nature.

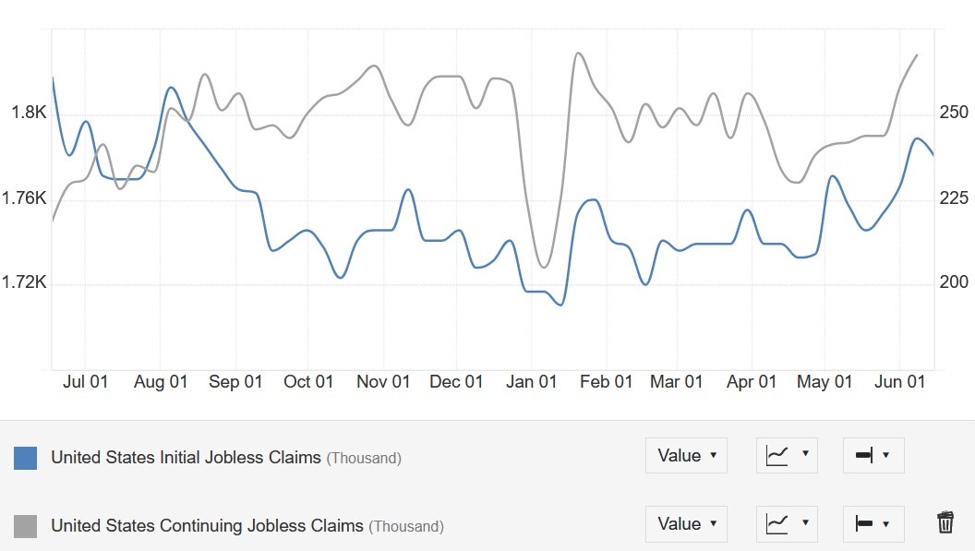

12:30 GMT/08:30 ET – US Jobless Claims

The US Jobless Claims

continue to be one of the most important releases to follow every week as it’s

a timelier indicator on the state of the labour market. Initial Claims keep on

hovering around cycle lows, while Continuing Claims remain firm around the

1800K level.

This has led to a weaker

and weaker market reaction as participants become used to these numbers.

Nonetheless, in the last two weeks we started to see the data missing

expectations, although it remains below the cycle highs. This is something

to keep an eye on.

This week Initial Claims

are expected at 236K vs. 238K prior, while Continuing Claims are seen at 1824K vs.

1828K prior. If Initial Claims jump above the 260K mark to a new cycle high, then we should see a big reaction in the markets.

Central bank speakers:

- 08:00 GMT – ECB’s Kazimir (hawk – voter)

- 12:15 GMT – ECB’s Elderson (neutral – voter)

This article was written by Giuseppe Dellamotta at www.forexlive.com.

Source link