Today there’s no notable event in the European session and all the action will take place in the American session as we get to see the Canadian CPI data and the US Consumer Confidence report.

12:30 GMT/08:30 ET – Canada May CPI

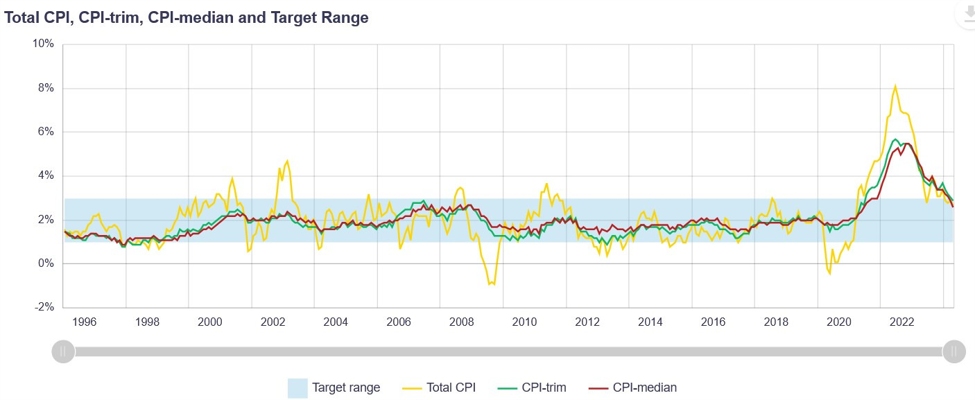

The Canadian CPI Y/Y is expected at 2.6%

vs. 2.7% prior, while the M/M measure is seen at 0.3% vs. 0.5% prior. The

Trimmed Mean CPI Y/Y is expected at 2.8% vs. 2.9% prior, while the Median CPI

Y/Y is seen at 2.6% vs. 2.6% prior.

The last

report showed the underlying inflation

measures falling back inside the BoC’s 1-3% target band which gave the central

bank the green light to deliver the first

rate cut. The market sees a 65% chance of

another rate cut in July (55.6 bps by the end of the year) but that will depend on the CPI data today.

14:00 GMT/10:00 ET – US June Consumer Confidence

The US Consumer Confidence is expected at

100 vs. 102 prior. The last

report showed confidence improving after

three consecutive months of decline. The Chief Economists at The Conference

Board highlighted that “the strong labour market continued to bolster

consumers’ overall assessment of the present situation”.

Moreover, “looking ahead, fewer consumers

expected deterioration in future business conditions, job availability, and

income”. The overall confidence gauge remained within the relatively narrow

range it has been hovering in for more than two years. The Present

Situation Index will be something to watch given the recent misses in the US

Jobless Claims as that’s generally a leading indicator

for the unemployment rate.

Central bank speakers:

- 11:00 GMT/07:00 ET – Fed’s Bowman (hawk – voter)

- 16:00 GMT/12:00 ET – Fed’s Cook (neutral – voter)

This article was written by Giuseppe Dellamotta at www.forexlive.com.

Source link