There’s not much that can move the market in the European session as we have just the Final Eurozone CPI readings and the ZEW Economic Sentiment Index.

The “Final” readings are rarely impactful because the market generally moves the most on new information, especially those pieces of news that can reshape future expectations.

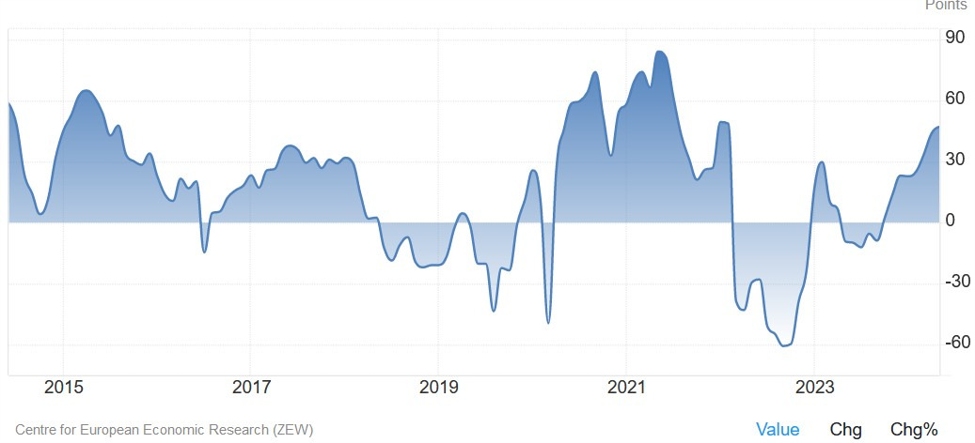

09:00 GMT – Eurozone June ZEW Economic Sentiment Index

The ZEW index is expected to tick higher to 47.8 vs. 47.0 prior as the economic activity continues to pick up amid better sentiment and rate cuts expectations. It’s a pretty good leading indicator and it generally signals turning points ealier than the PMIs even though it’s a bit more volatile.

Moving on to the American session, we will get the US Retail Sales and the US Industrial Production data with the former expected to be the most market moving release. Moreover, we will also hear from lots of Fed speakers but I don’t expect them to give clear signals until we get another NFP and CPI report.

12:30 GMT/08:30 ET – US May Retail Sales

The US Retail Sales M/M is expected at 0.2%

vs. 0.0% prior, while the ex-Autos measure is seen at 0.2% vs. 0.2% prior.

The focus will be on the Control Group figure where the consensus expects a 0.4% rebound after the 0.3% decline last month.

Consumer spending has remained stable, which is something you would expect given

the solid wage growth and resilient labour market. We are getting some worrying

signals from the UMich

Consumer Sentiment which could suggest that consumer spending is likely to

soften a bit.

Adam posted a nice preview on Retail Sales here , while you can also find the range of estimates posted by Eamonn here.

Central bank speakers:

ECB

- 10:00 GMT – ECB’s Vujcic (neutral – voter)

- 12:00 GMT/08:00 ET – ECB’s Cipollone (dove – voter)

- 13:30 GMT/09:30 ET – ECB’s de Guindos (neutral – voter)

- 16:00 GMT/12:00 ET – ECB’s Villeroy (neutral – voter)

Fed

- 14:00 GMT/10:00 ET – Fed’s Barkin (neutral – voter)

- 15:40 GMT/11:40 ET – Fed’s Collins (neutral – non voter)

- 17:00 GMT/13:00 ET – Fed’s Logan (neutral – non voter)

- 17:00 GMT/13:00 ET – Fed’s Kugler (dove – voter)

- 17:20 GMT/13:20 ET – Fed’s Musalem (neutral – non voter)

- 18:00 GMT/14:00 ET – Fed’s Goolsbee (neutral – non voter)

- 20:40 GMT/16:40 ET – Fed’s Collins (neutral – voter)

This article was written by Giuseppe Dellamotta at www.forexlive.com.

Source link