The main event in the European session was the UK CPI report which missed expectations across the board and incresed the probability of a back-to-back cut in September.

There’s not much else for the rest of the session as we will just get the Eurozone industrial production and the second estimate of the Q2 GDP. They aren’t market moving releases.

The focus will now switch to the US CPI report with the market’s sentiment skewed towards a benign print after yesterday’s soft US PPI figures.

12:30 GMT/08:30 ET – US July CPI

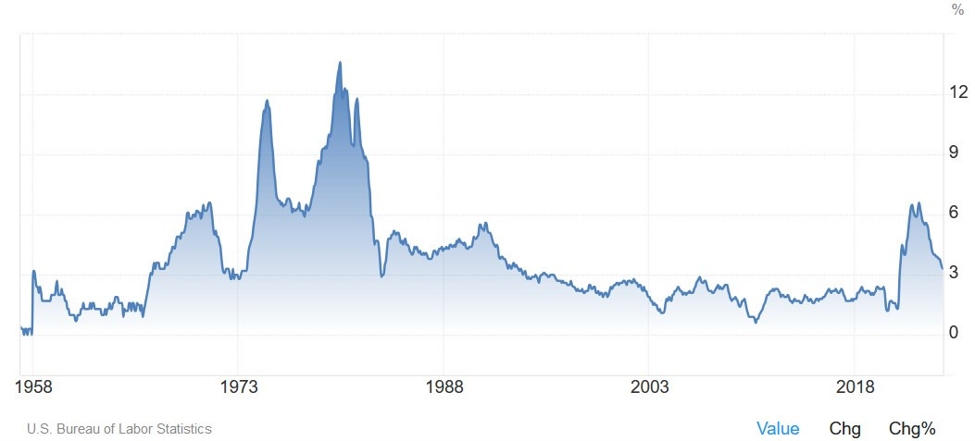

The US CPI Y/Y is

expected at 2.9% vs. 3.0% prior, while the M/M measure is seen at 0.2% vs.

-0.1% prior. The Core CPI Y/Y is expected at 3.2% vs. 3.3% prior, while the M/M

reading is seen at 0.2% vs. 0.1% prior.

This report

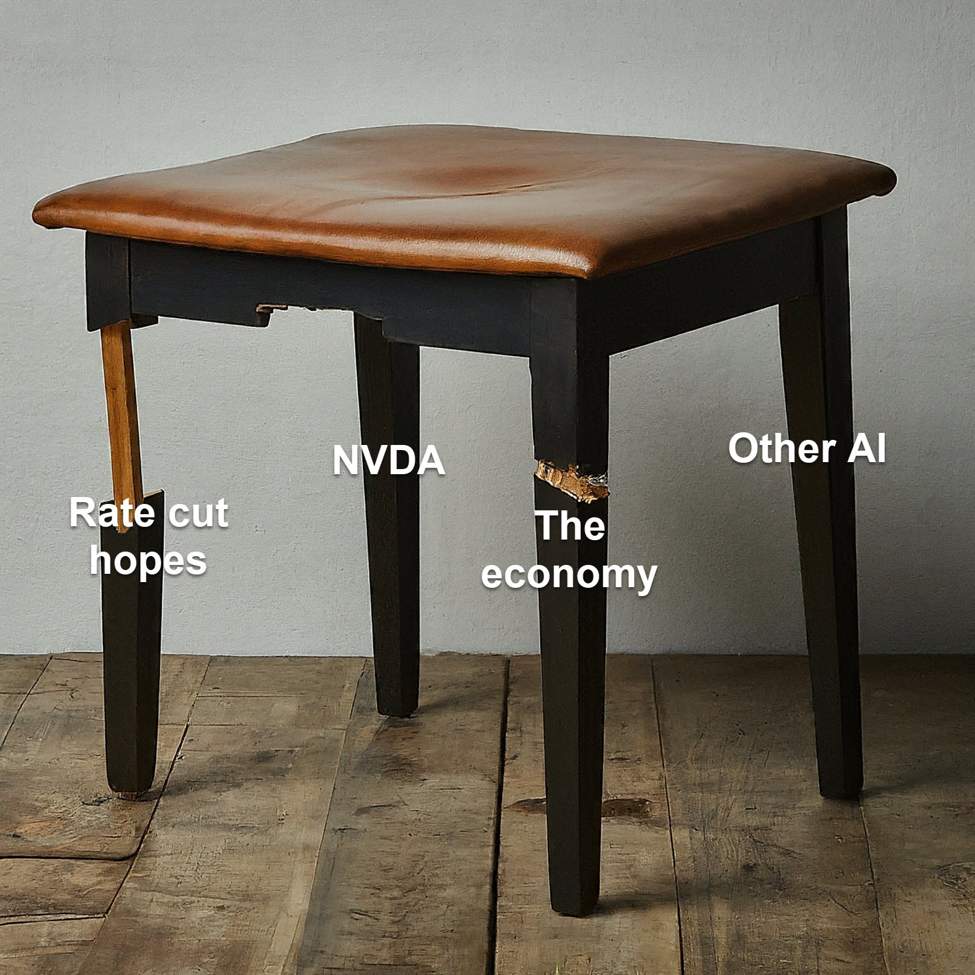

won’t change the markets expectations for a rate cut in September as that’s a given.

What could change is the difference between a 25 bps and a 50 bps cut. In fact,

right now the market is basically split equally between a 25 bps and a 50 bps

cut in September.

In case the data

beats estimates, we should see the market pricing a much higher chance of a 25

bps cut. A miss shouldn’t change much but will keep the chances of a 50 bps cut

alive for now.

Central bank speakers:

- 13:10 GMT/09:10 ET – Fed’s Musalem (slightly hawkish – non voter)

- 17:10 GMT/13:10 ET – Fed’s Harker (neutral – non voter)

This article was written by Giuseppe Dellamotta at www.forexlive.com.

Source link