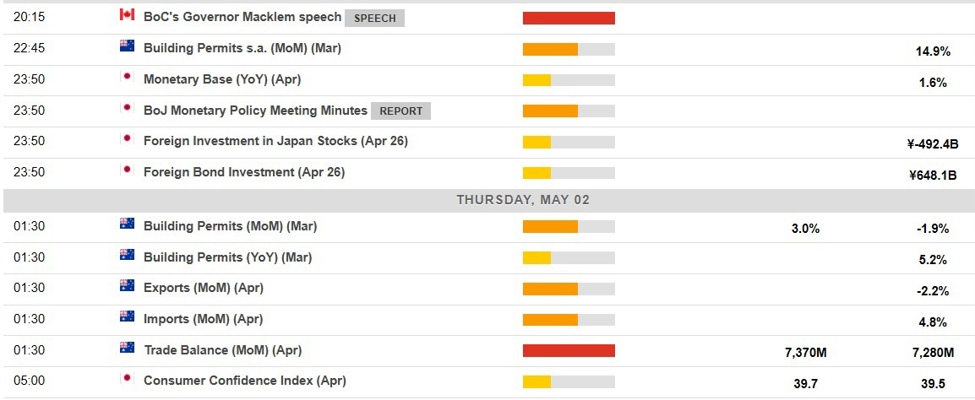

The main event in the European session will be the release of the Eurozone July Flash CPI report. In the American session, we will get the US ADP, the Canadian GDP, the US Q2 Employment Cost Index, the Treasury Refunding Announcement and finally the FOMC Policy Decision.

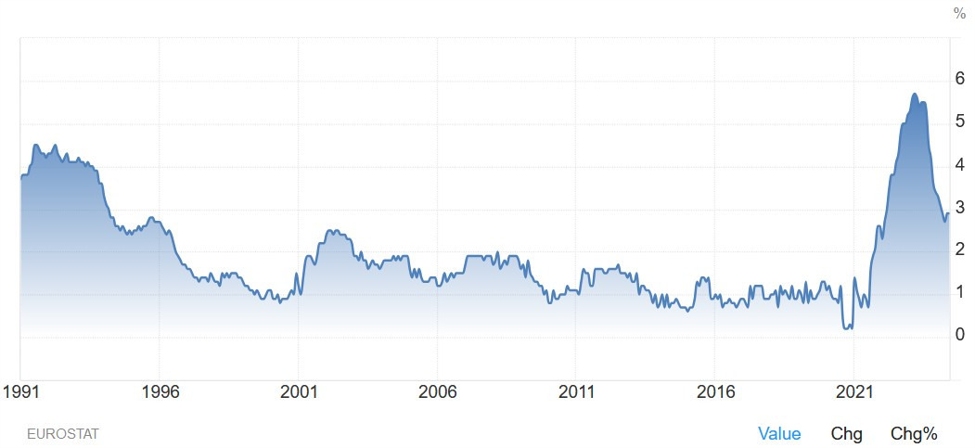

09:00 GMT – Eurozone July Flash CPI

The Eurozone Flash

CPI Y/Y is expected at 2.4% vs. 2.5% prior, while the Core CPI Y/Y is seen at

2.8% vs. 2.9% prior. The ECB members continue to repeat that September is a

live meeting for another rate cut and that the markets expectations of two more

cuts this year “seem reasonable”.

Having said that,

after this report we will get another one at the end of August before the ECB

decision on September 12th. The central bank will want to see the

disinflationary trend to remain intact to deliver a rate cut in September, if

we were to see a reacceleration, they might hold off and skip for another

month.

12:30 GMT/08:30 ET – US Q2 Employment Cost Index

The US Q2 Employment

Cost Index (ECI) is expected at 1.0% vs. 1.2% prior. This is the most

comprehensive measure of labour costs, but unfortunately, it’s not as timely as

the Average Hourly Earnings data. The Fed though watches this indicator

closely. Although wage growth remains high by historic standards, it’s been

easing for the past two years.

18:00 GMT/14:00 ET – FOMC Policy Decision

The Fed is

expected to keep rates steady at 5.25-5.50%. The overall decision will likely

be dovish given the easing in the labour market and inflation. Lots of people have been calling for the Fed to signal a rate cut in September already at today’s decision, so we will see if they will accomodate those expectations.

The market has already fully

priced in a rate cut in September and December with some chances of a

back-to-back cut in November. I personally think that the next CPI

release will be key (barring a quick deterioration in the labour market) as

another benign report will likely see Fed Chair Powell pre-committing to a rate

cut in September at the Jackson Hole Symposium.

This article was written by Giuseppe Dellamotta at www.forexlive.com.

Source link