Guess what? Yeah, it’s going to be another boring European session on the data front. The only notable events today include the US PPI and the University of Michigan Consumer Sentiment report in the American session. I don’t expect the market to react too much to them unless we get huge surprises.

12:30 GMT/08:30 ET – US June PPI

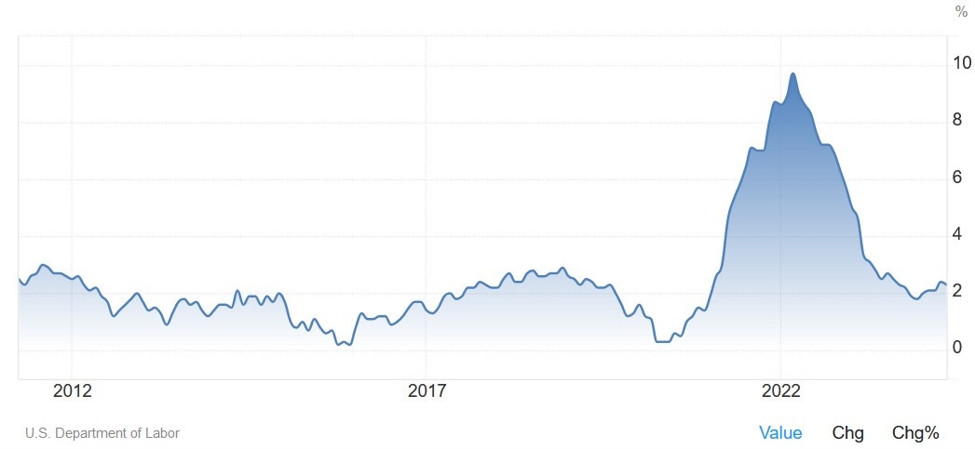

The US PPI Y/Y is expected at 2.3% vs.

2.2% prior, while the M/M measure is seen at 0.1% vs. -0.2% prior. The Core PPI

Y/Y is expected at 2.5% vs. 2.3% prior, while the M/M figures is seen at 0.2%

vs. 0.0% prior. This report will be more useful for the Core PCE calculation rather than something else. After yesterday’s US CPI, the Core PCE nowcast shows 2.4% Y/Y, which is more than enough for the Fed to cut rates in September.

14:00 GMT/10:00 ET – US July University of Michigan Consumer Sentiment

The University of Michigan

consumer sentiment is expected to tick higher to 68.5 vs. 68.2 prior. Compared

to the Conference Board consumer confidence report, which is more biased

towards the labour market, the consumer sentiment survey is more weighted towards

consumers’ finances.

In fact, analysts believe that it’s a better predictor of

consumer spending than the consumer confidence report, which is also why the expectations

index in the survey is included in the Leading Economic Index (LEI).

There are no scheduled central bank speakers today.

This article was written by Giuseppe Dellamotta at www.forexlive.com.

Source link