Today is an important day for financial markets as we will get to see the latest US NFP report. The Fed is now more focused on the labour market than inflation, and an unexpected deterioration might force their hand to cut rates.

The European session is pretty empty on the data front as we will just get the Eurozone Retail Sales data which is rarely a market moving release.

12:30 GMT/08:30 ET – US June NFP

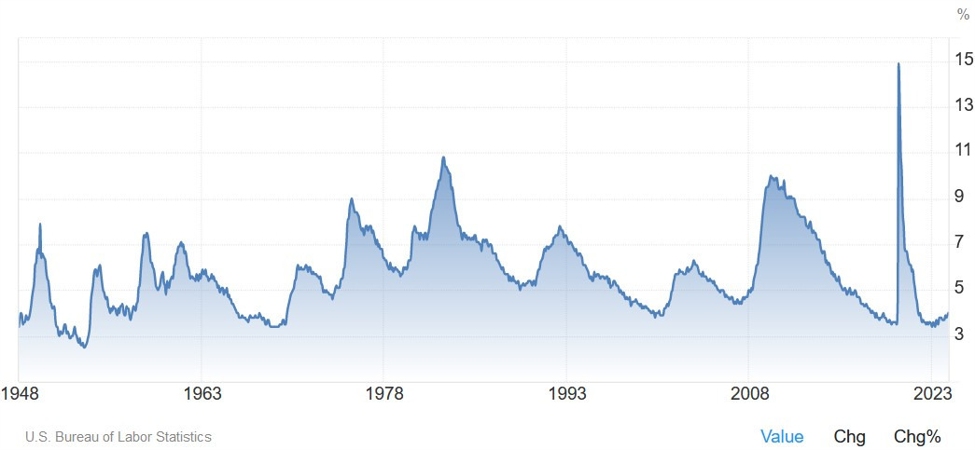

The US NFP is expected to

show 190K jobs added in June vs. 272K in May

and the Unemployment Rate to remain unchanged at 4.0%. The Average Hourly

Earnings Y/Y is expected at 3.9% vs. 4.1% prior, while the M/M measure is seen at 0.3% vs. 0.4% prior. The Fed at the moment is

very focused on the labour market as they fear a quick deterioration.

As a reminder, they

forecasted the unemployment rate to average 4% in 2024, so I can see them

panicking a bit and deliver a rate cut if unemployment rises to 4.2% in the

next couple of months. For now, the data suggests that the labour market is

rebalancing via less hires than more layoffs and overall, there are no material

signs of deterioration.

12:30 GMT/08:30 ET – Canada June Labour Market report

The Canadian labour market

report is expected to show 22.5K jobs added in June vs. 26.7K in May and the Unemployment

Rate to tick higher again to 6.3% vs. 6.2% prior. The last

report surprised to the upside although we got another uptick in the unemployment

rate. The key part was wage growth jumping to 5.1% vs. 4.7% prior, which is

what the BoC is most focused on.

As a reminder, the last

week the Canadian

CPI surprised to the upside, with the underlying inflation measures rising

but remaining within the 1-3% target band. This made the market to pare back

rate cuts expectations with the probabilities now standing around 53% for no change. We will

get another inflation report before the next BoC policy decision, but if we see

another jump in wage growth, then the central bank will likely need very good

CPI figures to deliver a rate cut in July.

Central bank speakers:

- 09:40 GMT – Fed’s Williams (neutral – voter)

- 12:15 GMT/08:15 ET – ECB’s Elderson (neutral – voter)

- 17:15 GMT/13:15 ET – ECB’s Lagarde (neutral – voter)

This article was written by Giuseppe Dellamotta at www.forexlive.com.

Source link