It’s going to be another boring European session today as the lack of market moving releases and the focus on the US NFP report will likely keep the markets at bay.

The highlights will be the US NFP report and the Canadian Jobs data in the American session. As it’s always the case, the US data will be the main focus for the markets.

12:30 GMT/08:30 ET – US Non-Farm Payrolls

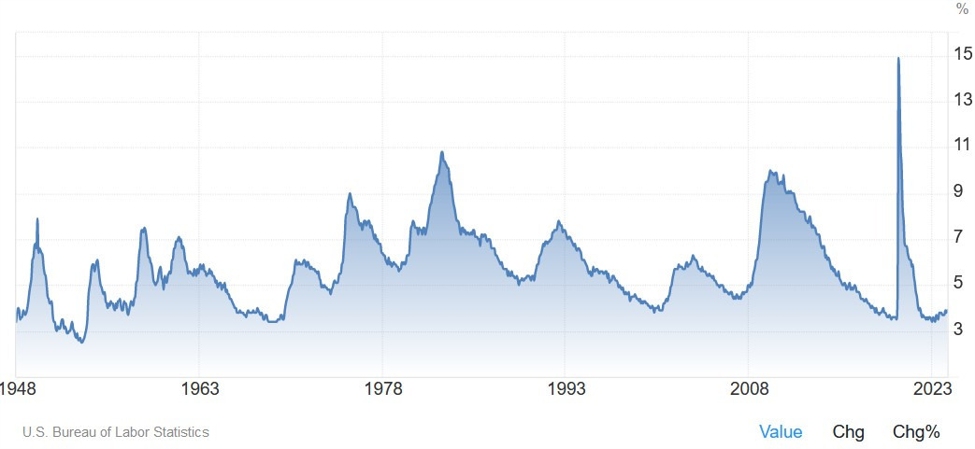

The US NFP is expected to

show 185K jobs added in May vs. 175K in April,

and the Unemployment Rate remaining unchanged at 3.9%. The Average Hourly Earnings

Y/Y is expected at 3.9% vs. 3.9% prior, while the M/M measure is seen at 0.3%

vs. 0.2% prior.

The May labour market

data we got until now has been generally positive with the employment components in the ISM PMIs improving, the US Jobless Claims holding on strong,

and the labour market details in the US Consumer Confidence report rebounding. Therefore,

the bias should be skewed towards a good release.

There’s a generally positive risk sentiment in the markets, so we will need a surprisingly bad report to change the current mood. The key things to watch will be the unemployment rate and the average hourly earnings. A big jump in the unemployment rate without a jump in the participation rate could spell trouble and trigger some risk-off flows.

The average hourly earnings will be key in case we get a hot report. If the wage growth remains stable or eases further, that would be good news for risk assets as the market wouldn’t have reasons to worry about inflation. On the other hand, an uptick in wage growth could trigger a hawkish reaction but I expect it to be short-lived as other indicators point to a downtrend in wage growth.

To sum up, I expect the risk-on sentiment to continue in basically all cases except an all-around ugly report.

12:30 GMT/08:30 ET – Canada Labour Market report

The Canadian labour market report is expected to show 22.5K jobs added in May vs. 90.4K in April and the unemployment rate ticking higher to 6.2% vs. 6.1% prior. The BoC is mainly focused on the underlying inflation data and wage growth. Therefore, the average hourly earnings in the report will be the main thing to watch.

A strong report coupled with a strong US NFP will likely send USD/CAD back to the bottom of the range at 1.36. On the other hand, a weak report could weigh a bit on the CAD but if the risk sentiment in the markets remains positive, we could see the CAD gaining ground against the USD anyway.

This article was written by Giuseppe Dellamotta at www.forexlive.com.

Source link