UPCOMING EVENTS:

- Monday: China

Caixin Manufacturing PMI, Swiss Retail Sales, US ISM Manufacturing PMI. - Tuesday: RBA

Meeting Minutes, Eurozone CPI, Eurozone Unemployment Rate, Canada

Manufacturing PMI, US Job Openings, Fed Chair Powell. - Wednesday:

Australia Retail Sales, China Caixin Services PMI, Swiss Manufacturing

PMI, Eurozone PPI, US ADP, US Jobless Claims, US ISM Services PMI, FOMC

Meeting Minutes. - Thursday: US

Holiday, Swiss Unemployment Rate, Swiss CPI, ECB Meeting Minutes, Canada

Services PMI, UK General Election. - Friday: Eurozone

Retail Sales, Canada Labour Market report, US NFP.

Monday

The US ISM Manufacturing PMI is expected

at 49.0 vs. 48.7. We got a great S&P

Global US Manufacturing PMI which increased

to 51.7 vs. 51.3 prior and overall the data highlighted the fastest economic

expansion for over two years, hinting at an encouragingly robust end to the

second quarter while at the same time inflation pressures have cooled.

The survey also brought welcome news in

terms of job gains, with a renewed appetite to hire being driven by

improved business optimism about the outlook. Selling price inflation has

meanwhile cooled again after ticking higher in May, down to one of the

lowest levels seen over the past four years. Historical comparisons

indicate that the latest decline brings the survey’s price gauge in line

with the Fed’s 2% inflation target.

Tuesday

The Eurozone CPI Y/Y is expected at 2.5%

vs. 2.6% prior, while the Core CPI Y/Y is seen at 2.8% vs. 2.9% prior. This

report won’t change anything for the ECB as they want to see the data

throughout the summer before deciding on a rate cut in September.

Nonetheless, a faster easing in inflation

during the summer or some quick deterioration in the economy should see the

market pricing in more rate cuts by the end of the year. At the moment, the

market sees 46 bps of easing by the end of the year assigning 61% probability of no

change at the July meeting and 83% chance of a cut in September.

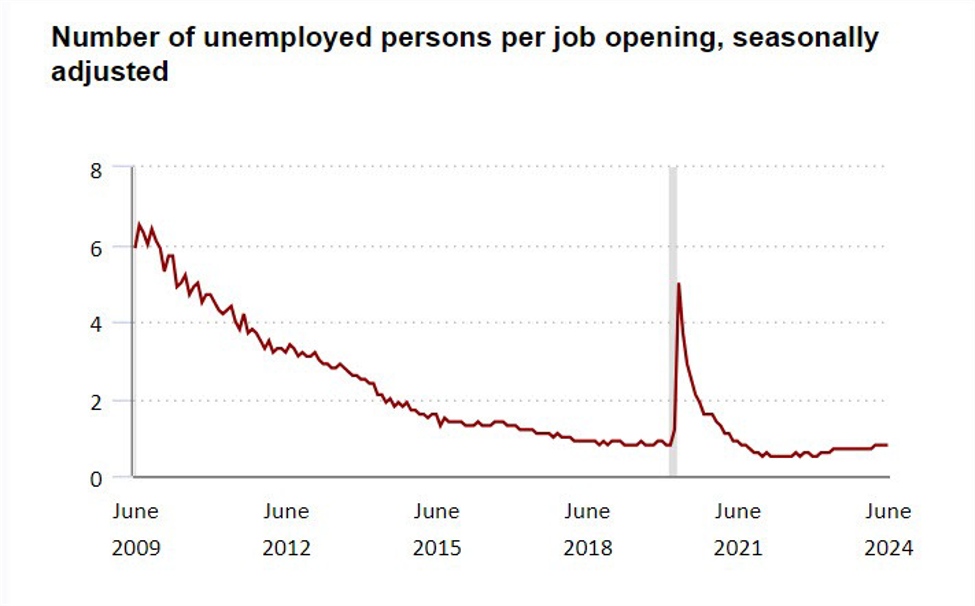

The US Job Openings are expected to fall

to 7.850M vs. 8.059M prior. The last

report missed expectations by a big margin

with job openings falling to the lowest level since February 2021 and now

getting close to the pre-pandemic level.

This is good news for the Fed as the

labour market continues to rebalance via less jobs availability rather than

more layoffs, and inflationary pressures should keep abating. On the other

hand, the labour market is a spot to keep an eye on carefully in this part of

the cycle.

We will also hear from Fed Chair Powell

who’s speaking at the European Central Bank Forum on Central Banking 2024 in

Sintra, Portugal. I don’t expect him to signal anything and just maintain the

usual neutral stance.

In my opinion, a lot will depend on the

next inflation data. I think the Fed will be more dovish if we get a good

inflation report in July. Then, if we get some more good figures in August,

Powell will likely pre-commit to a rate cut in September at the Jackson Hole

Symposium.

Wednesday

The US Jobless Claims

continue to be one of the most important releases to follow every week as it’s

a timelier indicator on the state of the labour market. Initial Claims keep on

hovering around cycle lows, while Continuing Claims have been on a sustained

rise recently with the data setting a new cycle high last week. This is

something to keep an eye on. This week Initial Claims are expected at 235K vs.

233K prior, while there’s no consensus for Continuing

Claims at the time of writing.

The US ISM Services PMI is expected at 52.5

vs. 53.8 prior. This survey hasn’t been giving any clear signal lately. As previously

mentioned, the S&P

Global US PMIs surprised to the upside

with the Services measure in particular showing a strong rise. The focus

will likely be on the employment sub-index ahead of the NFP report but the data

we got until now suggests that the US economy is doing well, and the labour

market remains resilient.

Thursday

The Swiss CPI Y/Y is

expected at 1.4% vs. 1.4% prior, while the M/M measure is seen at 0.1% vs. 0.3%

prior. As a reminder, the SNB cut interest

rates by 25 bps to

1.25% at the last meeting and lowered its inflation forecasts. The SNB also

added the line that says “will be ready to intervene in the FX market if needed

and as necessary”, so if inflation surprises to the upside in Q3 or they see

risks of inflation overshooting their projections, then we will likely get some

interventions.

For context, the central

bank expects inflation to pickup slightly and average 1.5% in Q3, so this is

going to be the baseline and if inflation were to surprise to the downside,

then the market will price in higher chances of another rate cut in September.

At the moment, the market expects just one more rate cut in 2024 and the

probability of a rate cut in September stands at 62%.

Friday

The US NFP is expected to

show 180K jobs added in June vs. 272K in May

and the Unemployment Rate to remain unchanged at 4.0%. The Average Hourly

Earnings M/M is expected at 0.3% vs. 0.4% prior. The Fed at the moment is

very focused on the labour market as they fear a quick deterioration.

As a reminder, they

forecasted the unemployment rate to average 4% in 2024, so I can see them

panicking a bit and deliver a rate cut if unemployment rises to 4.2% in the

next couple of months. For now, the data suggests that the labour market is

rebalancing via less hires than more layoffs and overall, there are no material

signs of deterioration.

The Canadian labour market

report is expected to show 25K jobs added in June vs. 26.7K in May and the Unemployment

Rate to tick higher again to 6.3% vs. 6.2% prior. The last

report surprised to the upside although we got another uptick in the unemployment

rate. The key part was wage growth jumping to 5.1% vs. 4.7% prior, which is

what the BoC is most focused on.

As a reminder, the last

week the Canadian

CPI surprised to the upside, with the underlying inflation measures rising

but remaining within the 1-3% target band. This made the market to pare back

rate cuts expectations with the probabilities now standing around 50%. We will

get another inflation report before the next BoC policy decision, but if we see

another jump in wage growth, then the central bank will likely need very good

CPI figures to deliver a rate cut in July.

This article was written by Giuseppe Dellamotta at www.forexlive.com.

Source link