Fundamental

Overview

The USD continues to be backed

by good economic data as we have also seen recently from the US PMIs last Friday and the US

Consumer Confidence report yesterday. Such data keeps the interest rates

expectations stable around two cuts by the end of the year and supports the risk

sentiment amid a pickup in growth.

The JPY in this environment

should keep losing ground against the major currencies. We will likely need

weak US growth data to see some sustained Yen strength, although it might be

short lived if it’s not enough to make the market to price in more aggressive

rate cuts for the Fed.

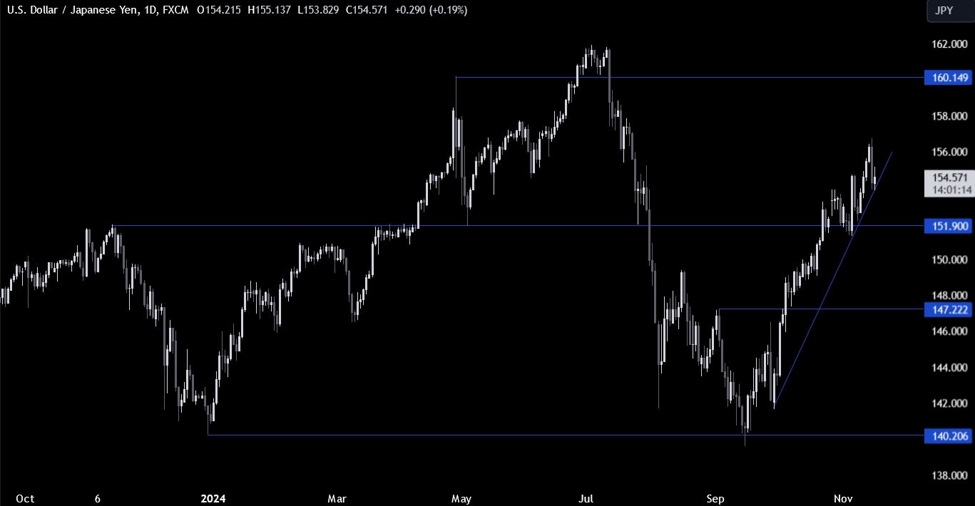

USDJPY

Technical Analysis – Daily Timeframe

On the daily chart, we can

see that USDJPY after a minor dip on Monday, rallied back to the intervention

level at the 160.00 handle. Remember, that an intervention is not guaranteed as

the Japanese are fighting against strong fundamentals and the market is much

bigger than them.

Nonetheless, we might see reactions

like we did on Monday as buyers could square their positions and the sellers

could pile in with a defined risk above the level. For now, the path of least

resistance remains to the upside.

USDJPY Technical

Analysis – 4 hour Timeframe

On the 4 hour chart, we can

see that in case we get a pullback from the intervention level, the buyers will

likely step back in around the 158.00 support

where we can also find the 38.2% Fibonacci retracement level for confluence.

The sellers, on the other

hand, will want to see the price breaking below the 158.00 support to increase

the bearish bets into the major trendline around the 156.00 level.

USDJPY Technical Analysis – 1 hour Timeframe

On the 1 hour chart, we can

see that we have another minor upward trendline defining the current bullish

momentum. The buyers will likely keep on leaning against the trendline with a

defined risk below it to position for a break above the 160.00 resistance with

a better risk to reward setup.

The sellers, on the other

hand, will want to see the price breaking lower to increase the bearish bets

into the 158.00 support. The red dotted lines define the average daily range for today.

Upcoming

Catalysts

Tomorrow we get the latest US Jobless Claims figures, while on Friday we

conclude the week with the Tokyo CPI and the US PCE.

See the video below

This article was written by Giuseppe Dellamotta at www.forexlive.com.

Source link