The US yields are trading at new session lows. The two-year is trading at 3.598%. That’s the lowest level going back to March 2023. The 10 year yield is an 3.642%. That’s its lowest level going back to June 2023.

The low in yields has the USDJPY also extending back toward session lows for the day.

Technically, the price high today stalled near the high of a swing area at 143.67 (the high reached 143.70). The price moved back below its 100-hour moving average (blue line currently at 143.128 and moving lower). That is now a risk level for shorts looking for more downside momentum. A move back above the 100-hour MA would disappoint the sellers in the short term at least.

The next targets on the downside will now look toward the low price from Monday at 141.942. Below that, and the low price from Friday reached 141.756, and the low price from early August extended to 141.678.

Not shown is the low price for the year which was reached on the first trading day of the year at 140.807. Surely, the low for the year won’t be on the first day of the year? RIght?

Meanwhile, the EURJPY is also heading to new lows for the day, but remains comfortably above its early August low at 154.397. The pair is below the 157.00 level to a new low for the day at 156.90. There is a downward sloping trend line that cuts across near 156.62 (and moving lower). Of note, is the high price today stalled ahead of the 100 hour MA . The low price from Friday extended to 157.388, and that is now close resistance.

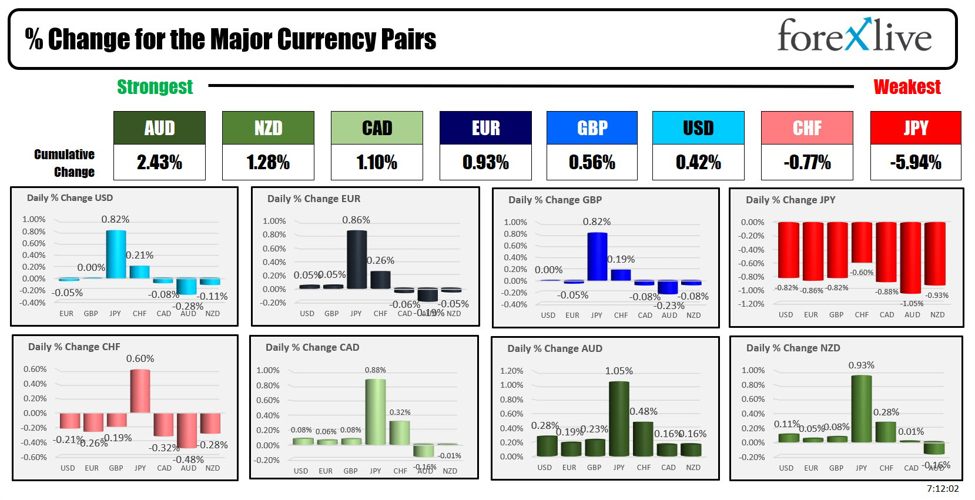

The JPY is higher despite the BOJ reportedly seeing little need to hike interest rate next week (according to Bloomberg sources). Officials are not ruling out another hike later this year or in early 2025 contingent on the economy and market.

This article was written by Greg Michalowski at www.forexlive.com.

Source link