Fundamental

Overview

The US Dollar continues to

consolidate despite the higher-than-expected inflation figures and a less

dovish Powell last week. The market’s pricing remained largely unchanged at

three rate cuts by the end of 2025.

This is generally a signal

that the market is fine with the current pricing, and we would need stronger

reasons to price out the remaining rate cuts. This could lead to some general

US Dollar weakness in the short term.

On the CAD side, we had the

Canadian

CPI this week and the data came in stronger than expected. This decreased

the chances of a 50 bps cut in December with the market now seeing 90 bps of

easing by the end of 2025 compared to 98 bps before the CPI report.

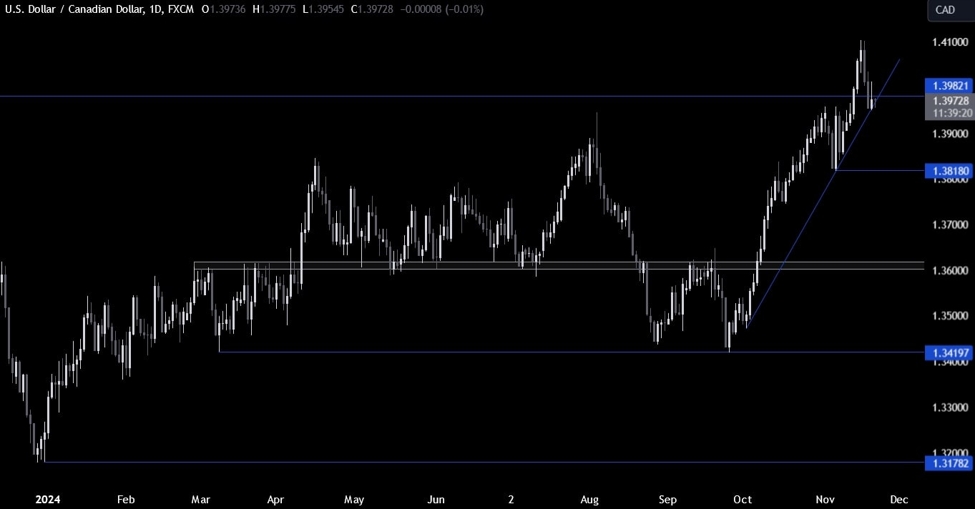

USDCAD

Technical Analysis – Daily Timeframe

On the daily chart, we can

see that USDCAD pulled back into a key support

zone around the 1.3960 level where we can also find the major trendline

for confluence.

This is where the buyers will likely step in with a defined risk below the

support to position for a rally into new highs. The sellers, on the other hand,

will want to see the price breaking lower to increase the bearish bets into the

1.3818 level next.

USDCAD Technical

Analysis – 4 hour Timeframe

On the 4 hour chart, we can

see more clearly the support zone around the 1.3960 level. There’s not much

else we can add here as the buyers will look for a bounce and a rally into new

highs, while the sellers will look for a break lower to increase the bearish

bets into the 1.3818 level.

USDCAD Technical

Analysis – 1 hour Timeframe

On the 1 hour chart, there’s

nothing more we can add as we are now trading right at the support zone and we

will see in the next days who’s going to prevail. The red lines define the average daily range for today.

Upcoming

Catalysts

Today we get the latest US Jobless Claims figures, while tomorrow we conclude

the week with the US PMIs.

This article was written by Giuseppe Dellamotta at www.forexlive.com.

Source link