Fundamental

Overview

The USD got another boost

on Friday following the NFP report as the data beat expectations by a

big margin almost across the board. The market scaled back the rate cuts

expectations further with now just one cut expected by the end of the year.

The focus remains on

inflation and this week we get the US CPI report on Wednesday. This is the most

important event of the month. Another hot report will likely cause some trouble

in the markets with the stock market looking as the most vulnerable right now.

The best outcome would be a

soft report given the overstretched moves in the markets caused by the

repricing in rate cuts expectations. That would likely reverse most of the

recent trends and trigger a rally in bonds, risk assets like stocks and bitcoin

and lead to a selloff in the US Dollar.

On the CAD side, the BoC cut

interest rates by 50 bps at the last policy meeting but dropped the

line saying “if the

economy evolves broadly in line with our latest forecast, we expect to reduce

the policy rate further”, which suggests that we reached the peak in

“dovishness” and the central bank will now switch to 25 bps cuts and

will slow the pace of easing.

The Canadian Employment report on Friday beat expectations

across the board by a big margin. That and the NFP report made the market to

scale back rate cuts expectations from 67 bps of easing by year end to 41 bps.

There’s now just a 57% probability of a rate cut at the upcoming meeting.

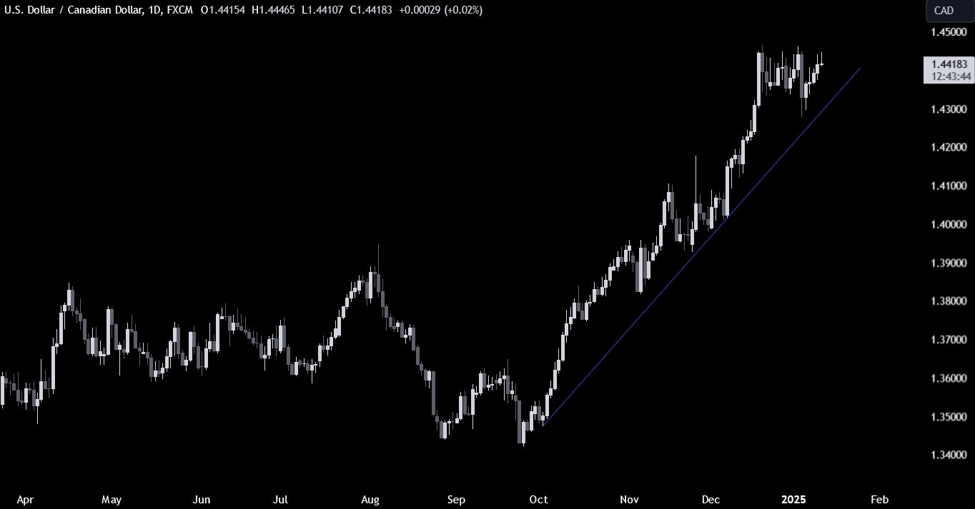

USDCAD

Technical Analysis – Daily Timeframe

On the daily chart, we can

see that USDCAD recently broke out of the recent range to the downside but

eventually erased the entire move lower and it’s now trading back near the top

of the range. From a risk management perspective, the buyers will have a better

risk to reward setup around the trendline to position for new highs. The

sellers, on the other hand, will want to see the price breaking lower to regain

control and start targeting new lows.

USDCAD Technical

Analysis – 4 hour Timeframe

On the 4 hour chart, we can

see that overall the pair has been ranging between the 1.4340 support and the 1.4460 resistance since the FOMC

decision. The buyers will want to see the price breaking higher to increase the

bullish bets into new highs, while the sellers will likely step in around the

resistance to position for the pullback into the trendline.

USDCAD Technical

Analysis – 1 hour Timeframe

On the 1 hour chart, we can

see that we have a minor upward trendline defining the current bullish momentum

on this timeframe. The buyers will likely lean on the trendline to position for

a break above the resistance and new highs. The sellers, on the other hand,

will look for a break below the trendline to target a drop into the major

trendline. The red lines define the average daily range for today.

Upcoming

Catalysts

Tomorrow, we get the US PPI data. On Wednesday, we have the US CPI report. On

Thursday, we get the latest US Jobless Claims figures.

This article was written by Giuseppe Dellamotta at www.forexlive.com.

Source link