Fundamental

Overview

Last week, the Fed finally started its easing cycle and decided to do it with a 50 bps

cut. The market was already leaning towards a 50 bps move, so it wasn’t a

surprise.

The larger cut was framed

as kind of a risk management move with the dot plot showing two more 25 bps

cuts by the end of the year and less than the market expected in 2025.

The US Dollar didn’t get a

boost despite the rise in Treasury yields as the market might be focusing more

on global growth expectations. Now that the decision is behind us though, the

focus will be on the economic data.

If we start to see an

improvement, then Treasury yields will likely continue to rise and lead to a

reprising in the dovish expectations potentially supporting the greenback in

the short-term.

Conversely, if the data

weakens, the market will likely go ahead with expecting more 50 bps cuts by

year-end and weighing on the US Dollar.

On the CAD side, the latest

soft Canadian CPI raised the probabilities for a 50

bps cut at the upcoming meeting as BoC’s Macklem hinted to a possibility of

delivering larger cuts in case growth and inflation were to weaken more than

expected. The market sees a 58% probability for such a move.

USDCAD

Technical Analysis – Daily Timeframe

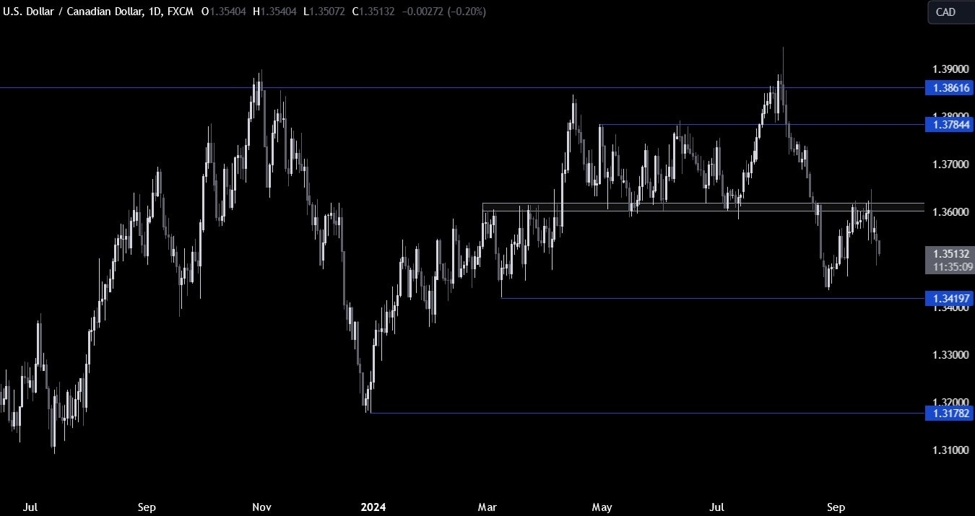

On the daily chart, we can

see that USDCAD probed above the key resistance around the 1.36 handle but

eventually got smacked back down. The sellers increase the bearish bets yesterday

as we got a breakout on the lower timeframes from a two-week long range.

The target should now be

the 1.34 handle. The buyers, on the other hand, will likely step in around the

1.34 handle to position for a rally back into the 1.36 resistance.

USDCAD Technical

Analysis – 4 hour Timeframe

On the 4 hour chart, we can

see the breakout of the two-week long range yesterday and the increase in the

bearish momentum. If we get a pullback, the sellers will likely lean on the trendline

to position for the continuation of the downtrend. The buyers, on the other

hand, will want to see the price breaking higher to pile in for a rally into

the 1.36 resistance.

USDCAD Technical

Analysis – 1 hour Timeframe

On the 1 hour chart, we can

see that we have a strong resistance zone around the 1.3550 level where we can

find the confluence

of the previous swing low level, the 61.8% Fibonacci

retracement level and the trendline.

The sellers will likely pile

in there to position for more downside, while the buyers will look for a break

to the upside to target a rally into the 1.36 handle. The red lines define the average daily range for today.

Upcoming

Catalysts

Today we have the US Consumer Confidence report. On Thursday, we get the

latest US Jobless Claims figures. On Friday, we conclude the week with the Canadian

GDP and the US PCE.

This article was written by Giuseppe Dellamotta at www.forexlive.com.

Source link