US stocks opened lower and are going even lower after some weaker data. The S&P global manufacturing PMI was we can expected followed by the ISM PMI data also coming in lower. Construction spending completed the hat-trick with lower than expected results.

The poor economic data has the two-year down -7 basis points at 3.856%, the 10-year down -8.0 basis points at 3.831%, and the 30-year down -7.3 basis points at 4.123%.

The US stocks are also not taking the data well with the Dow industrial average down close to -500 points and the NASDAQ index tumbling by -306 points or -1.73%. The S&P index is down -1.31%.

Looking at the US dollar:

- USDJPY moved to a new session low and broke below the 100-hour moving average and 50% midpoint of the August trading range at 145.53. Support buyers did come in near its 200-hour moving average at 145.204. The low price reached 145.11 before bouncing back higher. It currently is trading at 145.35.

- USDCHF also fell to session lows. Its move lower took the price to the converged 100 and 200-hour moving averages at 0.84784 (blue and green lines on the chart below). Buyers came in against those moving averages on the first look, and have pushed the price back up to 0.8493 currently. It would take a move below those two moving averages to increase the bearish bias. The high price is today and Friday stalled near the 38.2% retracement of the August trading range near 0.8532.

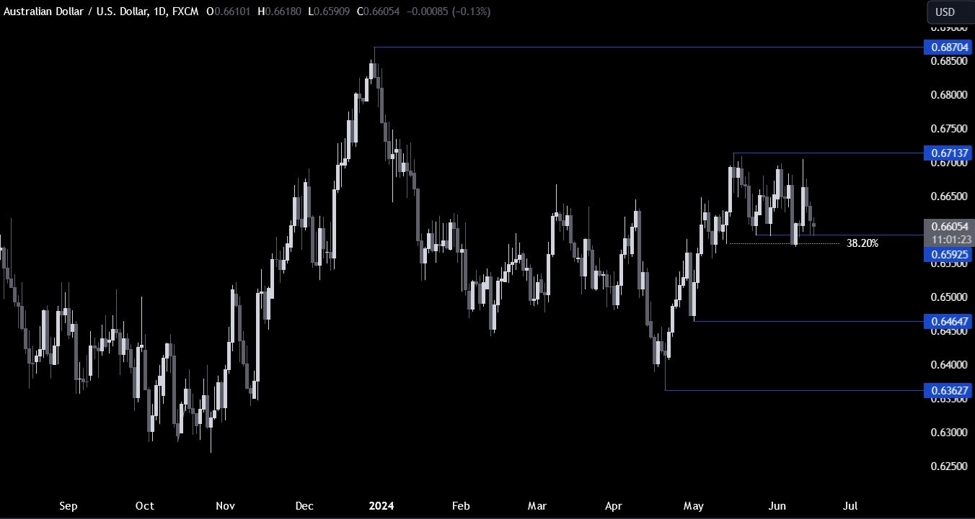

AUDUSD saw selling as risk-off/commodity selling pushed it lower today. Looking at the hourly chart, the pair started the day near its 100 hour MA (blue line currently at 0.67814). The subsequent fall took the price below the 200-hour MA at 0.6772 (higher green line). The momentum lower increased and the pair reached its rising 100-bar moving average on the four-hour chart at 0.67166. Getting and staying below that level would open the door for further selling probing with the August 22 corrective low nare 0.6696 (call it 0.6700) the next key target. .

Crude oil is down -4.05%. Copper iss down -3.59, and the DBB ETF – a base metal fund – is down -3.5%

This article was written by Greg Michalowski at www.forexlive.com.

Source link