We’ve seen this before.

The market probes the Japanese Ministry of Finance and its willingness to intervene, gets close to the line in the sand and then retreats. It then regroups and tries again.

That has been the playbook through out the past year and there is no sign the market is changing gears.

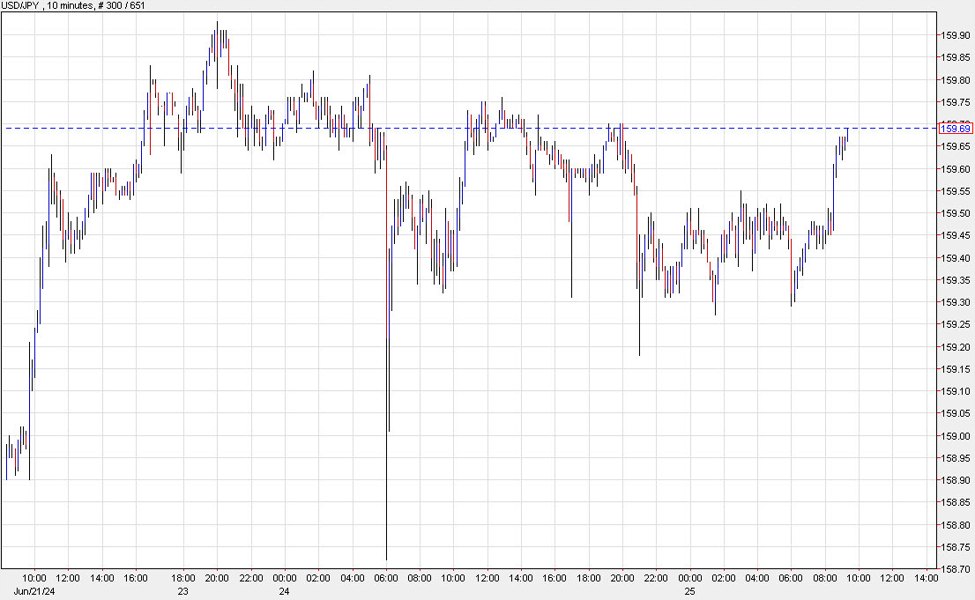

USD/JPY got as high as 159.93 this week before a quick retreat to 158.75 on intervention fears. It’s since regrouped and has worked its way to 159.69.

The message here is that it’s going to test 160.00 again and won’t stop until something cracks in the US economy (bad data) or the MoF gets involved again. From here, I don’t think the risk-reward is great to squeeze out another 20 pips.

This article was written by Adam Button at www.forexlive.com.

Source link