The Canadian dollar is strengthening today with the help of a few tailwinds:

- WTI crude oil is up $2.43 to $77.17, largely on geopolitical tailwinds but US inventories also tightened

- US equities are ripping higher in a pro-risk move, with the Nasdaq up 2.5% as we near month end

- The Fed decision today is likely to signal an openness to rate cuts, weighing on the US dollar

- Canadian GDP rose 0.2% in May compared to 0.1% expected. June prelim estimate +0.1% m/m

- Annualized GDP is near 2% compared to 1.4% expected

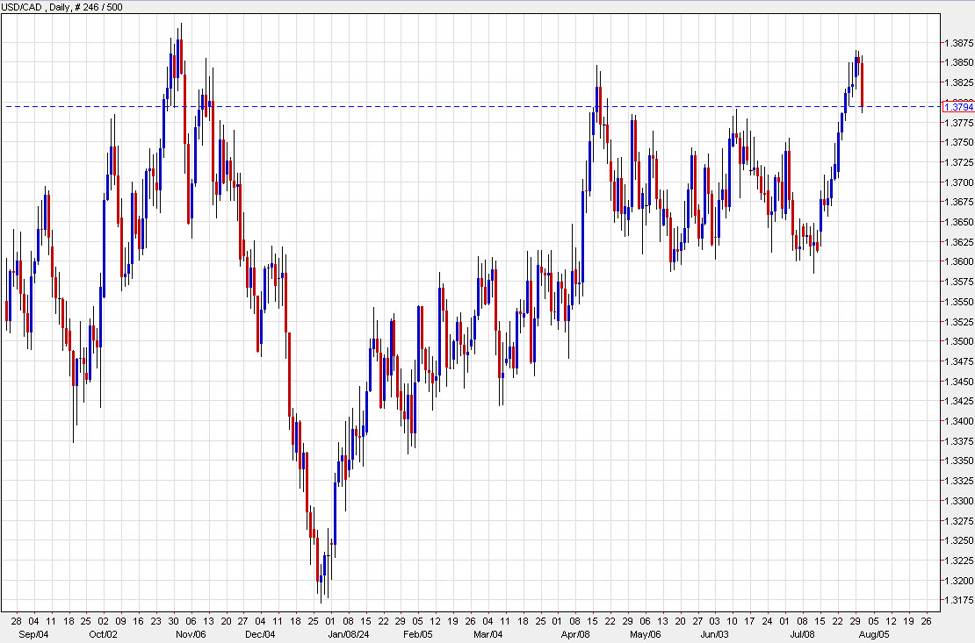

USD/CAD is down 53 pips to 1.3793 in a break lower after rising steadily for more than two weeks. The turn comes after the pair ran into resistance at the October highs near 1.39. That level has offered strong resistance on four previous occasions dating back to 2022.

I suspect some of this move is related to month-end and position squaring ahead of the FOMC decision at 2 pm ET. A US rate move is highly unlikely but the market is fully priced for a September move.

Interestingly, the market has begun to aggressively price in a third-consecutive BOC rate cut on September 4 as that’s now pegged at about 85% with one more cut beyond that fully priced in for year end.

Here is what RBC had to say after today’s GDP report:

Today’s GDP report reveals that Canadian GDP grew slightly faster than

expected in May, and was on balance stronger in Q2. Still, early indicators for

June, including wholesale sales (-0.6%), manufacturing sales (-2.6%), and

retail sales (-0.3%) all suggested that the momentum is waning towards the end

of the quarter. Importantly, the higher than expected quarterly print would

still on balance suggest another decline in per-capita GDP in Q2. We think the

economic backdrop should give the Bank of Canada room to deliver another

interest rate cut in their next meeting in September

This article was written by Adam Button at www.forexlive.com.

Source link