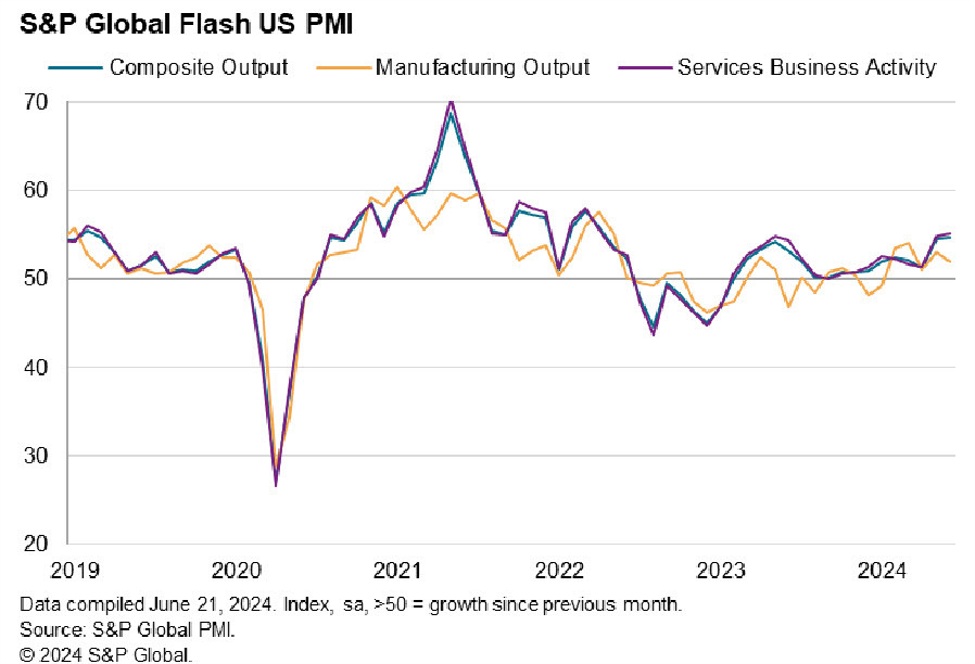

- 26-month high

- Prior was 54.8

- Manufacturing 51.7 vs 51.0 expected

- Prior manufacturing was 51.3

- Composite 54.6 vs 54.5

- Selling prices ‘at one of the lowest levels of the past four years’ and a five-month low

- “Improved business confidence for the year ahead, notably

in the service sector, as well as renewed pressure on

operating capacity from rising demand” - Services future prospects hit a five-month high

- Service sector payrolls rose to the

greatest extent for five months, helping reverse some of

the declines seen in the sector over the prior two months

The services number is above the highest economist estimate and points to an economy that’s strong and resilient. However the pricing numbers are also moving in the right direction and that could limit the hawkish reaction.

Chris Williamson, Chief Business

Economist at S&P Global Market Intelligence said:

“The early PMI data signal the fastest economic expansion

for over two years in June, hinting at an encouragingly

robust end to the second quarter while at the same time

inflation pressures have cooled.

The PMI is running at a level broadly consistent with the

economy growing at an annualized rate of just under 2.5%.

The upturn is broad-based, as rising demand continues to

filter through the economy. Although led by the service

sector, reflecting strong domestic spending, the expansion

is being supported by an ongoing recovery in

manufacturing, which so far this year is enjoying its best

growth spell for two years.

The survey also brings welcome news in terms of job

gains, with a renewed appetite to hire being driven by

improved business optimism about the outlook.

Selling price inflation has meanwhile cooled again after

ticking higher in May, down to one of the lowest levels seen

over the past four years. Historical comparisons indicate that the latest decline brings the survey’s price gauge into

line with the Fed’s 2% inflation target.”

Prices:

This article was written by Adam Button at www.forexlive.com.

Source link