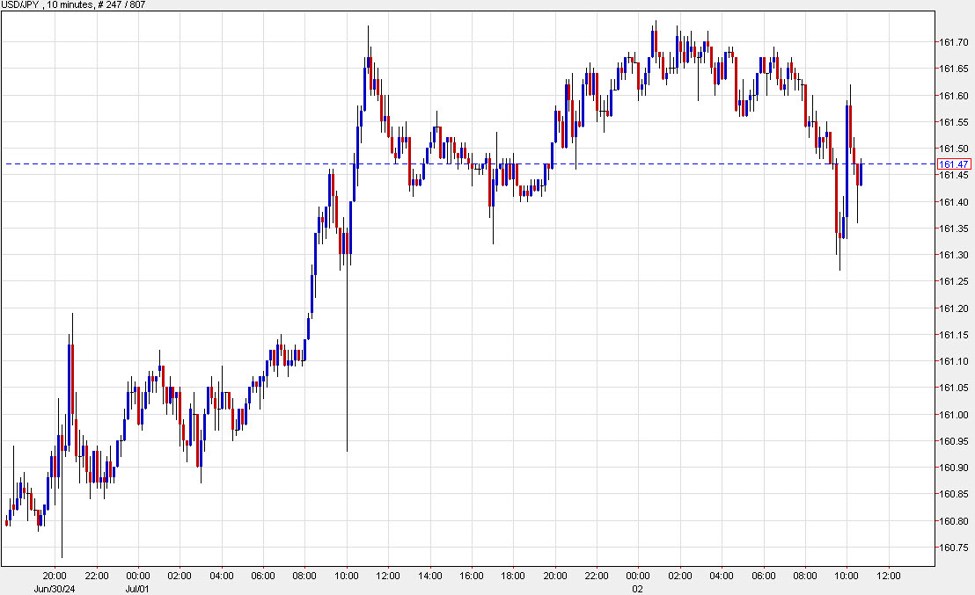

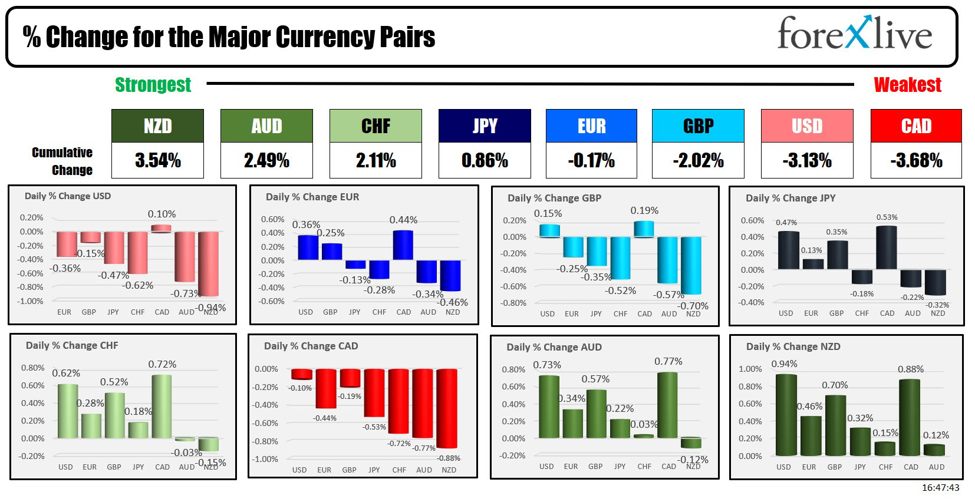

The US dollar initially rose on the release of the JOLTS data but has since given most of it back. Job openings were at 8.14 million compared to 7.91m expected in May.

There were two caveats though:

1) The prior was revised lower. April job openings were trimmed to 7.919m from 8.059m. That April reading is the lowest since 2021 and if you take the two-month average, puts it right about where it was forecast, though with less momentum.

2) Government jobs rose by 179,000. That was a large portion of the 230,000 beat on the consensus while private job openings only improved by 42,000. There was strong growth in manufacturing and education/health with a decline in leisure/hospitality.

The dollar move also came at the same time as Fed Chair Jerome Powell spoke in Sintra. He didn’t offer any blockbuster headlines but he struck the same cautiously dovish tone as he has for some time. The market continues to price in 48 basis points in easing this year.

This article was written by Adam Button at www.forexlive.com.

Source link