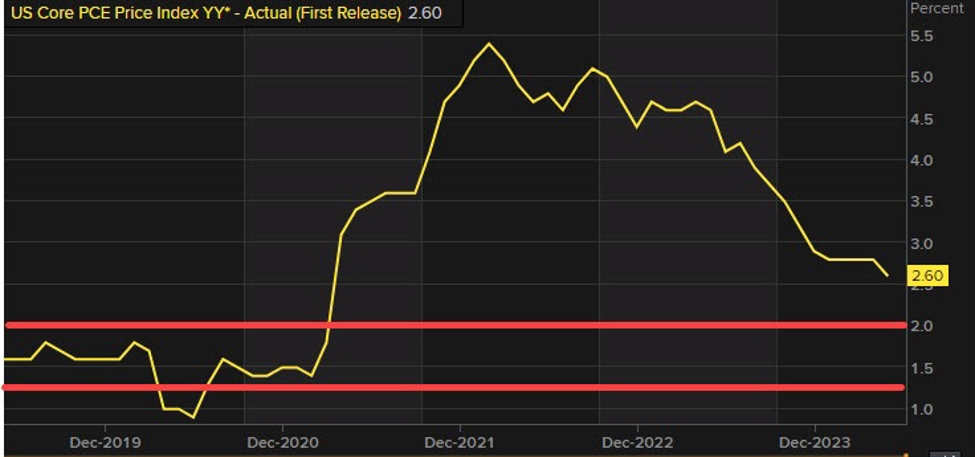

- Prior month core PCE 2.6%

- Core PCE MoM 0.2% versus 0.1% estimate. Unrounded was lower than the 0.2% gain at 0.188%

- Core PCE urine year 2.6% versus 2.5% estimate. Last month 2.6%

- PCE MoM 0.1% vs 0.1% estimate. The unrounded was lower than 0.1% at 0.0788%

- PCE YoY 2.5% versus 2.5% estimate and 2.6% prior

- Personal income +0.2% versus 0.4% estimate. Prior month revised down to 0.4% from 0.5%. Wages and salaries were up 0.3%.

- Personal spending 0.2% versus 0.4% last month (revised from 0.3%).

- Savings rate came in at 3.4% versus 3.5% last month

For the full report from the BEA click here

Other views:

- Annualized 3-month inflation rate 2.3% versus 2.9% prior.

- Annualized 6-month rate for core PCE 3.4% versus 3.3% prior.

The core PCE was a bit higher than expectations which is congruent with the core PCE data released yesterday through the GDP report.

Looking at the markets, yields remain lower:

- 2 year yield 4.412%, -3.1 basis points

- 5-year yield 4.106%, -2.7 basis points

- 10-year yield 4.221%, -2.5 basis points

- 30-year yield 4.465%, master .5 basis points

Looking at the stock futures:

- Dow Industrial Average average +254 points

- S&P of 43.03 points

- NASDAQ index up 200.92 points

The Fed pricing sees 67 basis points of cut by the end of the year with a cut in September priced in. That is little changed from pre-release levels.

This article was written by Greg Michalowski at www.forexlive.com.

Source link