- Final Services PMI 52.9 vs. 52.9 expected and 55.0 prior.

- Final Composite PMI 53.0 vs. 52.8 expected and 54.1 prior.

Key findings:

- Business activity growth solid, but down from April’s high.

- Hiring activity rises but labour market tightness a

constraint. - Slowest increase in prices charged for over three years.

Comment:

Joe Hayes, Principal Economist at S&P Global Market

Intelligence, which compiles the survey, said:

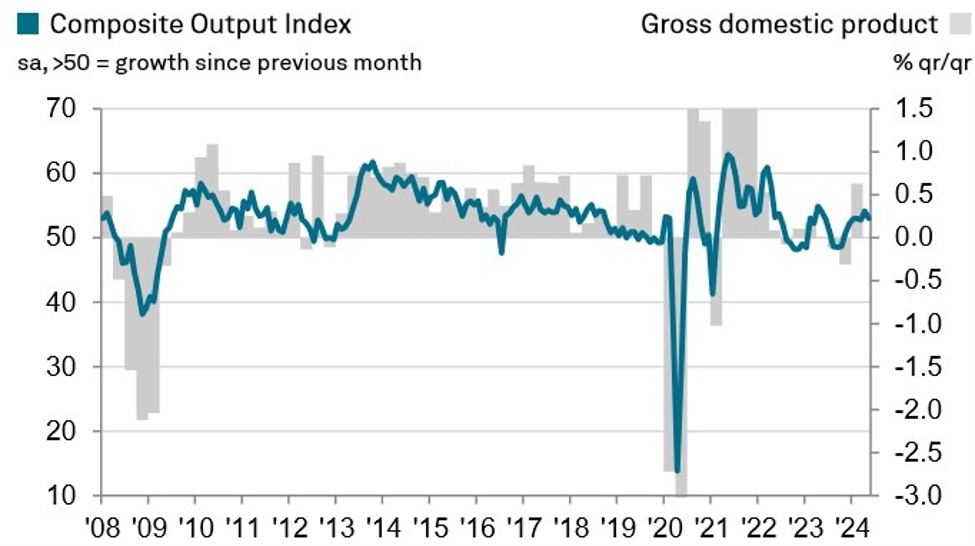

“The PMI survey for May showed another reasonable rate

of expansion in the UK service sector. Taken in tandem with

our earlier-released manufacturing survey, the PMIs imply

GDP growth of around 0.3% so far in the second quarter.”

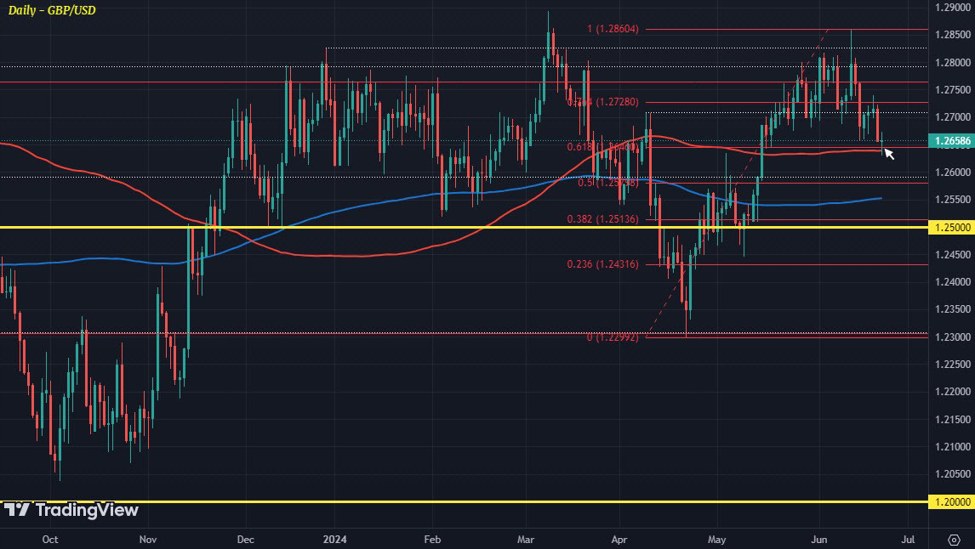

“Of particular interest to the immediate outlook for the

UK economy will be the prices measures, with the Bank of

England potentially moving to cut interest rates as soon as

this month. The PMI surveys show prices for UK services

rising at the slowest pace for over three years. That’s now

three months on the trot that selling price inflation in the

service sector has eased – this will be very encouraging to

the Monetary Policy Committee and suggests the trajectory

of services prices is moving in the right direction.”

“It is worth noting however that the PMI’s gauge of UK

services inflation is still sitting well above its pre-pandemic

trend, which may give more weight to those suggesting the

Bank of England hold out until August to loosen policy.”

This article was written by Giuseppe Dellamotta at www.forexlive.com.

Source link