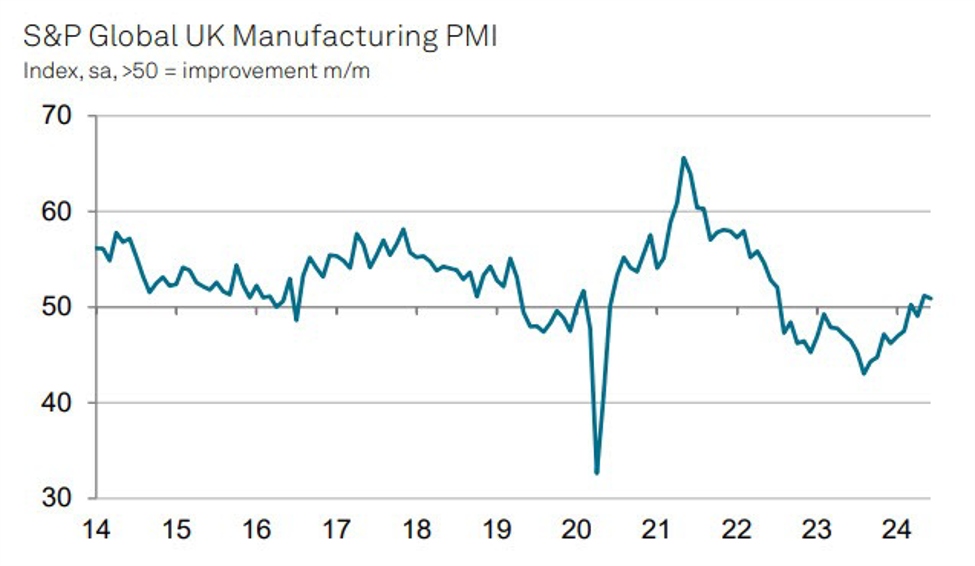

- Prior 51.2

It’s a slight revision lower to the initial reading but still reaffirms a marginal growth in UK’s manufacturing sector. Both output and new orders continued to expand for a second successive month. However, price pressures remain stubborn with input cost inflation rising to a 17-month high. That’s a troubling sign for the BOE. S&P Global notes that:

“The UK manufacturing sector is enjoying its strongest

spell of growth for over two years, with June seeing

output and new order growth sustained at robust rates

similar to May’s recent highs. The performance of the

domestic market remains a real positive, providing

a ripe source of new contract wins. In contrast, the

ongoing weak export performance is concerning, with

manufacturers reporting difficulties in securing new

business in several key markets including the US, China

and mainland Europe.

“Although June also saw manufacturers maintain a

relatively high degree of optimism towards the future,

this was not sufficient to lessen their focus on cost

minimisation and cash flow protection. This led to

further job losses, cuts to non-essential spending

and efforts to operate on leaner stock holdings. This

is coming from a backdrop of renewed cost inflation

pressure, with manufacturers’ input prices now rising at

the quickest pace since the start of 2023. This renewed

upward lurch in manufacturing prices will likely add to

concerns over the potential stubbornness of underlying

inflationary pressures among hawkish rate setters at the

Bank of England.”

This article was written by Justin Low at www.forexlive.com.

Source link