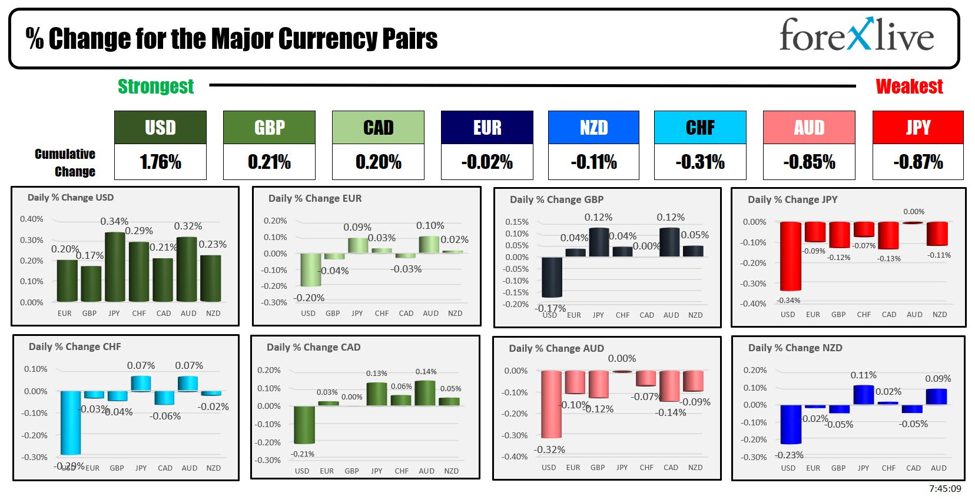

The USD is the strongest and the JPY is the weakest as the North American session begins. Yesterday was a push-me, pull-me type of day fundamentally in the US with CPI coming in less than expectations (for the 2nd consecutive month), but later in the day, the FOMC rate decision was more hawkish as the Fed signaled only 1 cut between now and the end of the year. Many thought the bias would be shifted more to 2 after the CPI (with 6 months to go in the calendar year). Nick Timiraos of the WSJ characterized the Fed slant as a “trust but verify” approach. He noted that Powell stressed the need for confidence in a sustained decline in inflation, mentioning “confidence” 20 times during his press conference. The Fed caution monthly inflation due to forecasting challenges and a desire to avoid credibility issues. NOTE: NY Fed’s WIlliams will moderate a speech by Treasury Sec. Yellen at the NY Economic Club at 12 noon today. Williams is an influential member on the FOMC with a permanent vote being the NY Fed President.

The USD moved higher after the decision with the major indices retracing some of the declines from the CPI induced dollar tumble from earlier in the day. Today we are seeing more follow-through upticks in rates with a steeper curve.

In the US stock market yesterday, the Nasdaq and S&P carved out yet another record close. The Dow 30 did decline. That pattern is being seen this morning with the pre-market futures implying gains in the S&P and Nasdaq and the Dow lower.

US yields are higher in pre-market trading.

The US PPI data will outline the costs for the produces with the final demand MoM expected at 0.1% vs 0.5% last month and the Ex Food and Energy at 0.3% (vs 0.5%). The YoY numbers are expected to rise to 2.5% from 2.2% for the headline due to calendar effects. The core is expected to remain unchanged at 2.4%.

Overnight, ECBs Muller said that it is too early to say when the next cut can happen and Vasle said more rate cuts if baseline scenario holds, but added some risks to inflation remains helped by higher wages.

The weekly US jobless claims are also scheduled to be released. Last week, the number tilted higher to 229K. The expectation is for 225K. The continuing claims is expected at 1.798M vs 1.792M last week.

A snapshot of the other markets as the North American session begins shows:

- Crude oil is trading down $0.74 or -0.94% at $77.76. At this time yesterday, the price was at $78.78

- Gold is trading down $16.43 or -0.71% at $2308.10. At this time yesterday, the price was at $2312.63

- Silver is trading down $0.56 or -1.92% at $29.10. At this time yesterday, the price was trading at $29.34

- Bitcoin trades lower at $67,774. At this time yesterday, the price was trading up at $67,775

- Ethereum is also trading lower $3498.80. At this time yesterday, the price was trading at $3534.50

In the premarket, the snapshot of the major indices are trading marginally higher after record closes once again for the S&P and NASDAQ indices. Tesla shareholders voted for Elon Musk’s $56 billion pay package. Broadcom shares are also higher after beating earnings expectations (are we still announcing earnings?) and declaring a 10 for one stock split (jumping on the Nvidia bandwagon of announcing the split)..

- Dow Industrial Average futures are implying a loss of -98.10 points. Yesterday, the Dow Industrial Average fell -35.21 points or -0.09% at 38712.22

- S&P futures are implying a gain of 8.7 points points. Yesterday, the S&P index closed at another record level with a gain of 45.71 points or 0.85% at 5421.02

- Nasdaq futures are implying a gain of 130 points. Yesterday, NASDAQ index also closed at a record level after a gain of 264.89 points or 1.53% at 17608.44

Tesla shares are trading up 6.63%, while Broadcom shares are up 13.87%

European stock indices are trading lower today in the US morning snapshot:

- German DAX, -1.08%

- France CAC -1.17%

- UK FTSE 100, 0.3%

- Spain’s Ibex, -0.62%

- Italy’s FTSE MIB, -1.12% (delayed 10 minutes).

Shares in the Asian Pacific markets were mixed:

- Japan’s Nikkei 225, -0.40%

- China’s Shanghai Composite Index, -0.28%

- Hong Kong’s Hang Seng index, +0.97%

- Australia S&P/ASX index, +0.44%

Looking at the US debt market, yields higher with a steeper yield curve. The U.S. Treasury will continue their coupon auctions with the sale of 30 year bonds today:

- 2-year yield 4.753%, +0.4 basis points. At this time yesterday, the yield was at 4.838%

- 5-year yield 4.314%, +1.2 basis points. At this time yesterday, the yield was at 4.412%

- 10-year yield 4.318%, +2.3 basis points. At this time yesterday, the yield was at 4.398%

- 30-year yield 4.481%, +3.2 basis points. At this time yesterday, the yield was at 4.529%

Looking at the treasury yield curve the spreads are moving more positive (but is still negative):

- The 2-10 year spread is at -43.8 basis points. At this time Friday, the spread was at -44.0 basis points.

- The 2-30 year spread is at -27.2 basis points. At this time Friday, the spread was at -30.7 basis points.

In the European debt market, yields are higher in the benchmark 10 year yields:

This article was written by Greg Michalowski at www.forexlive.com.

Source link