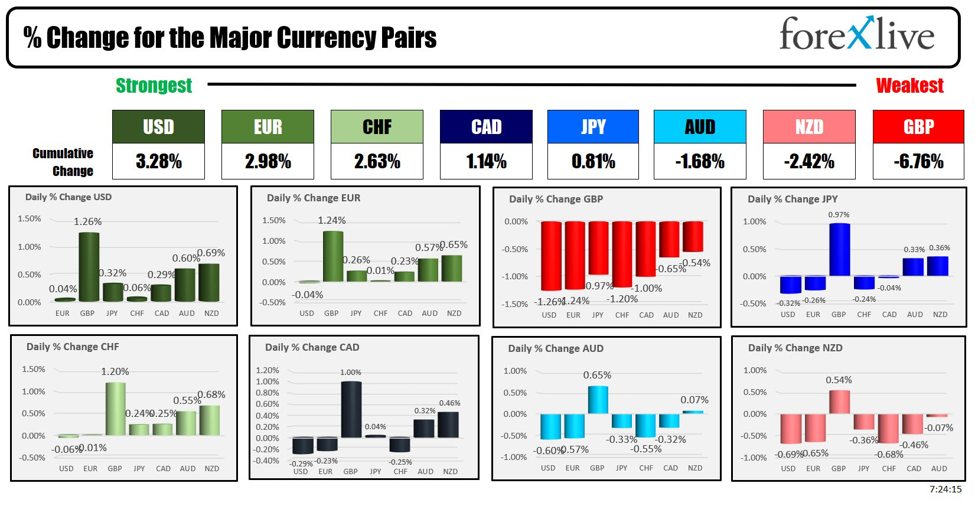

As the North American session begins the USD is the strongest and the GBP is the weakest.

In an interview with the Guardian, BOE Bailey held out the prospect of the Bank becoming a “bit more aggressive” in cutting interest rates provided the news on inflation continued to be good. Bailey also talked to the risk in the Middle East for an oil price shock. Some of the highlights:

-

The Bank of England is monitoring the Middle East crisis amid fears of an oil price shock.

-

Bailey is watching developments “extremely closely”.

-

There are limits to what can be done to prevent oil price rises if the conflict escalates.

-

Geopolitical concerns are very serious.

-

The economy has proved more resilient than expected.

-

The Bank may become “a bit more aggressive” in cutting interest rates if inflation continues to improve.

-

Inflation currently stands at 2.2%, just above the 2% target.

-

The government is right to focus on encouraging capital investment.

-

The UK faces structural issues including an ageing population, increased defence spending, and climate change.

-

Bailey defends the Bank’s response to the pandemic and global supply-chain bottlenecks.

-

He rejects criticism that the Bank left stimulus in place for too long.

The GBPUSD has tumbled lower from a high of 1.3270 to a new low in the current hourly bar at 1.3090. The range of 180 pips is much higher than the 98 pip range average over the last month of trading in the pair. Technically, the price has moved below the 38.2% retracement of the move up from the August low at 1.31396 (a close intraday risk level). Earlier in the day, the price tumbled below the 200-bar moving average of the 4-hour chart at 1.31937. The last time the price traded below that moving average was back on August 15 so breaking below was a significant shift in the technical bias.

Guiseppi Dellamotta commented that the positioning of the GBP – which was tilted strongly to the upside – certainly helped contribute contribute to the decline. You can see the liquidation in the price action (all those longs getting squeezed). The comments from the central banker were the catalyst as clearly the buyers turned to sellers.

In other economic news, Swiss PPI came in weaker -0.3% versus -0.1% expected.

Services PMI data add of the EU and UK were released with mixed results:

- Spanish Services PMI: Actual 57.0, Forecast 54.0, Previous 54.6 – BEAT forecast

- Italian Services PMI: Actual 50.5, Forecast 51.2, Previous 51.4 – MISSED forecast

- French Final Services PMI: Actual 49.6, Forecast 48.3, Previous 48.3 – BEAT forecast

- German Final Services PMI: Actual 50.6, Forecast 50.6, Previous 50.6 – MET forecast

- Eurozone Final Services PMI: Actual 51.4, Forecast 50.5, Previous 50.5 – BEAT forecast

- UK Final Services PMI: Actual 52.4, Forecast 52.8, Previous 52.8 – MISSED forecast

Germany is on holiday. China remains on their Golden Week holiday.

On the economic calendar today:

- 8:30 AM ET Unemployment Claims: Forecast 222K, Previous 218K

- 9:45 AM ET Final Services S&P Global PMI: Forecast 55.4, Previous 55.4

- 10 AM ET ISM Services PMI: Forecast 51.7, Previous 51.5

- 10 AM ET Factory Orders m/m: Forecast 0.1%, Previous 5.0%

A snapshot of the other markets as the North American session begins shows:

- Crude oil is trading up $1.38 and $71.54. At this time yesterday, the price was at $72.07

- Gold is trading down -$9.56 or -0.36% at $2648.57. At this time yesterday, the price was $2651.04.

- Silver is trading down -$0.29 or -0.95% at $31.52. At this time yesterday, the price is at $31.44

- Bitcoin is trading lower than this time yesterday at $60,518. At this time yesterday, the price was at $61,185

- Ethereum is trading lower than this time yesterday at $2341.07. At this time yesterday, the price was at $2456

In the premarket, the snapshot of the major indices trading marginally lower:

- Dow Industrial Average futures are implying a decline of-$76.25 points. Yesterday, the index gained 39.55 points or 0.09% at 42196.52

- S&P futures are implying a loss of -6.81 points. Yesterday, the index rose 0.79 points or 0.01% at 5709.54

- Nasdaq futures are implying a loss of -32.08 points. Yesterday, the index rose 14.76 points or 0.08% at 17925.12

Yesterday, the small-cap Russell 2000 fell -2.02 points or -0.09% at 2195.00

European stock indices are trading mixed:

- German DAX, -0.46%

- France CAC, -0.64%

- UK FTSE 100, +0.30%

- Spain’s Ibex, +0.23%

- Italy’s FTSE MIB, -0.62% (delayed by 10 minutes)

Shares in the Japan rebounded higher after yesterday’s declines. Hong Kong Hang Seng fell the first time after six straight days of gains: China is closed for the Golden Week.

- Japan’s Nikkei 225, +1.97%

- China’s Shanghai Composite Index, on holiday for Golden week

- Hong Kong’s Hang Seng index, -1.47%

- Australia S&P/ASX index, +0.09%

Looking at the US debt market, yields are mixed to higher:

- 2-year yield 3.662%, +2.5 basis points. At this time yesterday, the yield was at 3.616%

- 5-year yield 3.578%, +2.7 basis points. At this time yesterday, the yield was at 3.527%

- 10-year yield 3.807%, +2.2 basis points. At this time yesterday, the yield was at 3.760%

- 30-year yield 4.148%, +1.8 basis points. At this time yesterday, the yield was at 4.108%

Looking at the treasury yield curve it is steady today:

- The 2-10 year spread is at +14.6 basis points. At this time yesterday, the yield spread was +14.3 basis points.

- The 2-30 year spread is at +48.9 basis points. At this time yesterday, the yield spread was +49.1 basis points.

In the European debt market, the 10 year yields are mostly higher:

This article was written by Greg Michalowski at www.forexlive.com.

Source link