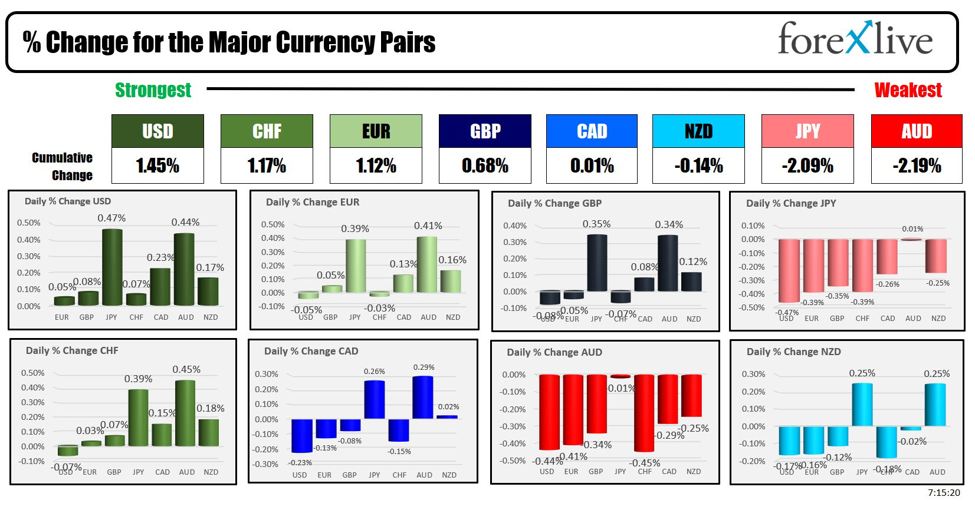

As the North American session begins, the USD is the strongest and the AUD is the weakest. The JPY is just behind the AUD as one of the weakest currencies after comments from Japan Finance Minister and BOJs Ueda failed to scare sufficiently JPY sellers. The JPY is working on its 3rd day in a row lower (higher USDJPY and other JPY pairs).

Suzuki’s comments emphasize cautious monitoring of foreign exchange movements, stressing the importance of stability and the negative impact of a weak yen. He highlighted the urgency in observing market fluctuations without committing to specific FX levels or defending absolute thresholds. Suzuki expressed a readiness to intervene if necessary to address rapid and undesirable shifts in currency values, aiming for movements that reflect economic fundamentals.

Ueda, while addressing the Diet, emphasized that the Bank of Japan’s (BOJ) monetary policy primarily targets inflation, not the yen rate, although it acknowledges the significant impact of FX movements on the economy. He noted that the weak yen increases import costs, affecting the economy and potentially inflation trends. While the BOJ does not aim to control FX rates directly, it considers them as one of many factors influencing the economy. Ueda stated that if yen volatility significantly affects inflation trends, the BOJ might adjust monetary policy accordingly. He anticipates trend inflation to gradually approach 2%, and the BOJ is prepared to modify its monetary stance earlier than expected if inflation risks or actual rates deviate significantly from their forecasts. Additionally, Ueda mentioned that the BOJ will continue its daily bond buying, adjusting the amount based on market developments but maintaining the current pace for now. He also highlighted that the Japanese economy is recovering, albeit with weaknesses, and expressed readiness to adapt to economic shocks with all available means, including unconventional measures. Rapid, one-sided yen falls were characterized as undesirable for the economy.

Geopolitically, Israel sees no signs of breakthrough in the truce talks in Gaza. However, Israeli delegation is still in Cairo. Yesterday it was reported that Palestine had accepted an agreement, but the agreement was not what Israel proposed. So it was immediately rejected.

The economic calendar in Europe was minimal with German industrial production falling -0.4% versus -0.6% expected. The calendar in the North American session isn’t any more lively with wholesale inventories (revised) to be released at 10 AM ET. The estimate is -0.4% +0.4% last month. The weekly oil inventory data will be 10:30 AM with crude oil stocks expected to show a drawdown of -1.066M and gasoline stocks expected at -1.255M. The private data released yesterday showed a build of 0.509M in oil stocks and a build of 1.460M for gasoline. Today crude oil is down around $-0.90.

On the Fed speaking circuit today, Fed Gov. Lisa Cook, Fed’s Collins and and Fed Gov. Jefferson are all expected to voice their views on things after the Fed decision last week.

Note that the Bank of England will meet tomorrow and after recent decision at 7 AM ET.

A snapshot of the other markets as the North American session begins currently shows.:

- Crude oil is trading down $0.82 or -1.05% at $77.56.. At this time yesterday, the price was at $78.28

- Gold is trading unchanged at $2313.58. At this time yesterday, the price was higher at $2313.32

- Silver is trading near unchanged at $27.22. At this time yesterday, the price was at $27.26

- Bitcoin currently trades at $62,357. At this time yesterday, the price was trading at $53,811

In the premarket, the US major indices are trading lower after mixed/little changed values yesterday:

- Dow Industrial Average futures are implying a decline of -17.26 points. Yesterday, the index rose 31.99 points or 0.08% at 38884.27.

- S&P futures are implying a decline of -10.20 points yesterday, the S&P index rose 6.90 points or 0.13% at 5187.71.

- Nasdaq futures are implying a decline of -44.12 points. Yesterday the index fell -16.69 points or -0.10% at 16332.56.

European stock indices are trading mostly higher:

- German DAX, +0.31%

- France CAC , closed for holiday

- UK FTSE 100, +0.27%

- Spain’s Ibex, +0.51%.

- Italy’s FTSE MIB, -0.22% (delayed 10 minutes)..

Shares in the Asian Pacific markets were mixed/higher:

- Japan’s Nikkei 225, -1.63%

- China’s Shanghai Composite Index, -0.61%

- Hong Kong’s Hang Seng index, -0.90%

- Australia S&P/ASX index, +0.14%

Looking at the US debt market, yields are higher. Today the U.S. Treasury will auction off 10-year notes. Yesterday, the three year note was auctioned with solid demand (tail was negative and bid-to-cover numbers were higher than the six-month average). Tomorrow they will auction off 30-year bonds:

- 2-year yield 4.842%, +1.5 basis points. At this time yesterday, the yield was at 4.822%

- 5-year yield 4.497%, +2.6 basis points. At this time yesterday, the yield was at 4.476%

- 10-year yield 4.487%, +2.7 basis points. At this time yesterday, the yield was at 4.473%

- 30-year yield 4.628%, +2.4 basis points. At this time yesterday, the yield was at 4.619%

Looking at the treasury yield curve spreads the yield curve is steeper (but still negative):

- The 2-10 year spread is at -35.5 basis points. At this time yesterday, the spread was at – 34.9 basis points

- The 2-30 year spread is at -21.4 basis points. At this time yesterday, the spread was at -19.8 basis points

European benchmark 10-year yields are higher.

This article was written by Greg Michalowski at www.forexlive.com.

Source link