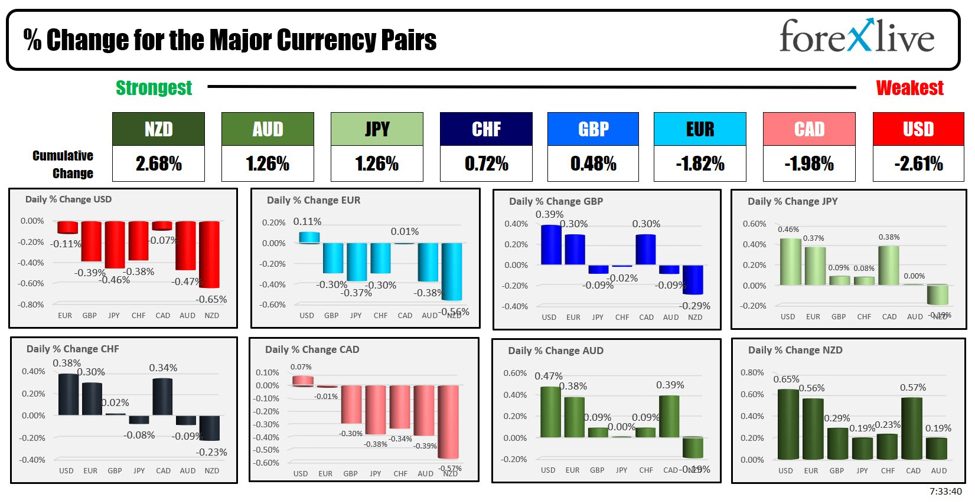

The NZD is the strongest and the USD is the weakest as the North American session begins.

The USD is lower (and the weakest) ahead of the FOMC rate decision which will take place at 2 PM today. At that time, the Fed will not only decide on whether it is 25 or 50 basis points but also the projection of the rate path over the next two meetings with the so-called dot plot as well as the projections for GDP, unemployment and PCE (both headline and core) inflation.

Looking at the central tendencies from last time the Fed published the dot plot and economic expectations in June, I would expect 2024 data to show GDP moving higher (from 2.1%) unemployment moving higher (from 4.0%), PCE both headline and core moving lower (from 2.6% and 2.8% respectively). The dot plot would also move lower as well from 5.1%. Last meeting, the Fed only projected 1 cut between now and the year end.

For 2025, my inkling is GDP staying the same (at 2.0% – why not), the unemployment rate moving higher (vs 4.2% last), PCE inflation and core PCE inflation moving lower from 2.3% currently (more toward 2% but would not be surprised if the Fed bias is on the upside). For 2026, it’s anyone’s guess (as is 2025 for that matter with a new administration).

With GDP moving higher in 2024, and unemployment moving higher as well it is a different dynamic versus what you might normally expect, but we know the Fed has said that it is not just about inflation anymore but employment as well. That has the Fed – with lags inclusive – thinking a cut is in order as policy is still restrictive. 25 or 50? The pricing has 50 as the odds on favorite but the arguments for a series of 25 cuts is also compelling.

Whether it is 25 or 50, much will depend on the wording of the statement (they could do 25 and it be a dovish 25), the Fed projections, and how Powell frames all of it. They could 25 and it be a dovish 25. They could do 50 and it be a hawkish 50 or they can do something in between. Adam posts on why the dot-plot is not helping along with other thoughts in his preview HERE.

Buckle in. It will be an interesting ride today.

A snapshot of the other markets as the North American session begins shows:

- Crude oil is trading down -$1.75 at $69.44. At this time yesterday, the price was at $69.18

- Gold is trading up $8.12 or 0.31% at $2577.07. At this time yesterday, the price was $2579.69.

- Silver is trading down nine cents or -0.32% at $30.58. At this time yesterday, the price is at $30.76.

- Bitcoin is trading at $59,763. At this time yesterday, the price was at $59,185

- Ethereum is trading at $2299.05 at this time yesterday, the price was at $2311.

In the premarket, the snapshot of the major indices are little changed after small changes yesterday. The S&P index is on a seven day up streak.

- Dow Industrial Average futures are implying a loss of -15.92 points. Yesterday, the index fell -15.90 points or -0.04% at 41606.18

- S&P futures are implying a gain of 1.49 points. Yesterday, the price eeked out a small 1.49 point gain or 0.03% at 5634.58 for its 7 consecutive up day.

- Nasdaq futures are implying a gain of 35.93 points. Yesterday, the index moved higher by 39.93 points or 0.20% at 17628.06.

Yesterday, the small-cap Russell 2000 was higher by 16.30 points or 0.74% at 2205.477.

European stock indices are trading lower:

- German DAX, -0.05%

- France CAC, -0.41%

- UK FTSE 100, -0.61%

- Spain’s Ibex, -0.10%

- Italy’s FTSE MIB, -0.05% (delayed 10 minutes).

Shares in the Asian Pacific markets closed higher

- Japan’s Nikkei 225, +0.49%

- China’s Shanghai Composite Index, +0.49%

- Hong Kong’s Hang Seng index, on holiday

- Australia S&P/ASX index, +0.18%

Looking at the US debt market, yields are higher despite the dollar weakness.

- 2-year yield 3.628%, +3.6 basis points. At the same Friday, the yield was at 3.569%

- 5-year yield 3.472%, +3.9 basis points at this time Friday, the yield was at 3.408%

- 10-year yield 3.681% is 3.9 basis points. At this time Friday, the yield is at 3.608%

- 30-year yield 3.994%, +4.1 basis points. At this time Friday, the yield is at 3.912%

Looking at the treasury yield curve,

- The 2-10 year spread is +5.5vbasis points. At this time yesterday, the yield spread was +4.3 basis points.

- The 2-30 year spread is +36.7 points. At this time yesterday, the yield spread was was +34.4 basis points.

In the European debt market, the 10 year yields are higher:

This article was written by Greg Michalowski at www.forexlive.com.

Source link