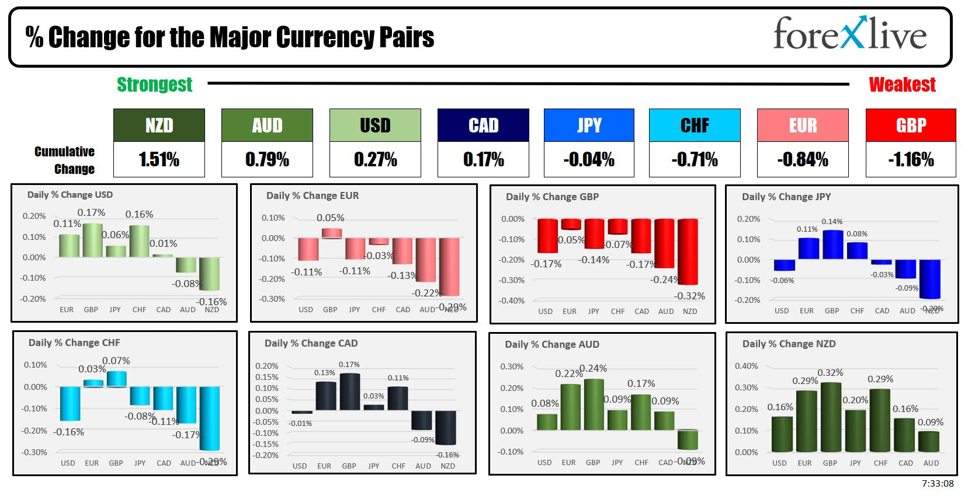

As the NA session begins the NZD is the strongest and the GBP is the weakest. The USD is mixed.

In Japan all hands are on deck to slow the JPYs fall.

Overnight,Japan’s officials, including Masato Kanda, Finance Minister Suzuki, and Chief Cabinet Secretary Hayashi, emphasized the need for stable foreign exchange (FX) levels and are prepared to take action if there are excessive FX movements. They believe that FX rates should reflect economic fundamentals and see no issue with Japan being added to the US currency monitoring list. Suzuki highlighted the importance of coordinating with international partners to manage FX policies and avoid harmful, disorderly movements in the FX market.

BOJ Deputy Governor Shinichi Uchida noted that while the Japanese economy is recovering moderately, there are still some weak signs and significant uncertainty surrounding the economic and price outlook. He mentioned that underlying inflation is expected to gradually accelerate. However, the Bank of Japan has yet to finalize the specifics of its bond tapering plan, although the size of the reduction in bond purchases is anticipated to be significant.

Finally, there was a report that the BOJ will meet with bond market participants on July 9-10 to discuss its bond tapering plan. I would expect that leaks on the scale of the reduction are expected afterward.

Japan’s core CPI y/y missed estimate (Actual: 2.5%, Estimate: 2.6%, Prior: 2.2%), Manufacturing PMI missed estimate (Actual: 50.1, Estimate: 50.6, Prior: 50.44).

PS.The BOJ will have their next policy meeting on July 31

The Europe Flash PMI data was released with France, Germany and EU all missing both manufacturing and services. In the UK they beat estimates for Manufacturing but missed on services. Overall, it was not great data for the series.

-

France: Manufacturing PMI missed estimate (Actual: 45.3, Estimate: 46.8, Prior: 46.44), Services PMI missed estimate (Actual: 48.8, Estimate: 50.0, Prior: 49.34).

-

Germany: Manufacturing PMI missed estimate (Actual: 43.4, Estimate: 46.4, Prior: 45.4), Services PMI missed estimate (Actual: 53.5, Estimate: 54.4, Prior: 54.24).

-

Eurozone: Manufacturing PMI missed estimate (Actual: 45.6, Estimate: 48.0, Prior: 47.34), Services PMI missed estimate (Actual: 52.6, Estimate: 53.5, Prior: 53.24).

-

United Kingdom: Manufacturing PMI beat estimate (Actual: 51.4, Estimate: 51.3, Prior: 51.24), Services PMI missed estimate (Actual: 51.2, Estimate: 53.0, Prior: 52.9).

In the UK retail sales did come in stronger than expectations (2.9% vs 1.5% estimate) after months of disappointed data, but it did not stop the GBPUSD from moving lower. Yesterday, the BOE kept rates unchanged but it was perceived as setting the table for a cut ahead. Looking at the details, retail sales volume rose across all main sectors. Food store sales were up 1.2%, department store sales up 1.7%, and textile, clothing, and footwear store sales were up 5.4% on the month. UK elections up next on July 4.

A snapshot of the other markets as the North American session begins shows:

- Crude oil is trading down $0.14 or -0.18% at $81.14. At this time yesterday, the price was at $80.84.

- Gold is trading up $7.22 or +0.21% at $2367.20. At this time yesterday, the price was trading at $2339.61

- Bitcoin trades sharply lower at $63,870. At this time yesterday, the price was trading up at $66056.

- Ethereum is also trading lower at $3506.90. At this time yesterday, the price was trading at $3597.60

In the premarket, the snapshot of the major indices are trading lower in premarket trading

- Dow Industrial Average futures are implying a decline of -11 points. Yesterday, the Dow Industrial Average rose 299.90 points or 0.77% at 39134.77.

- S&P futures are implying a decline of -6.27 points. Yesterday, the S&P index closed down -13.86 points or -0.25% at 5473.16.

- Nasdaq futures are implying a decline of -35.25 points. Yesterday, NASDAQ index snapped its seven day win streak with a decline of -140.84 points or -0.79% at 17721.89

European stock indices are trading lower in European trading is it reacts negatively to the data this morning:

- German DAX, -0.52%.

- France CAC -0.55%

- UK FTSE 100, -0.50%

- Spain’s Ibex, -1.15%

- Italy’s FTSE MIB, -1.05% (delayed 10 minutes)..

Shares in the Asian Pacific markets were mixed

- Japan’s Nikkei 225, -0.09%

- China’s Shanghai Composite Index, -0.24%

- Hong Kong’s Hang Seng index, -1.67%

- Australia S&P/ASX index, +0.34%

Looking at the US debt market, yields are lower.

- 2-year yield 4.700%, -2.9 basis points. At this time Tuesday, the yield was at 4.729%

- 5-year yield 4.235%, -3.0 basis points. At this time Tuesday, the yield was at 4.266%

- 10-year yield 4.226%, -2.8 basis points. At this time Tuesday, the yield was at 4.246%

- 30-year yield 4.372%, -2.1 basis points. At this time Tuesday, the yield was at 4.380%

Looking at the treasury yield curve the spreads are steady

- The 2-10 year spread is at -47.6 basis points. At this time Friday, the spread was at -48.3 basis points.

- The 2-30 year spread is at -33.0 basis points. At this time Friday, the spread was at -35.0 basis points.

European benchmark 10 year yields are lower:

This article was written by Greg Michalowski at www.forexlive.com.

Source link