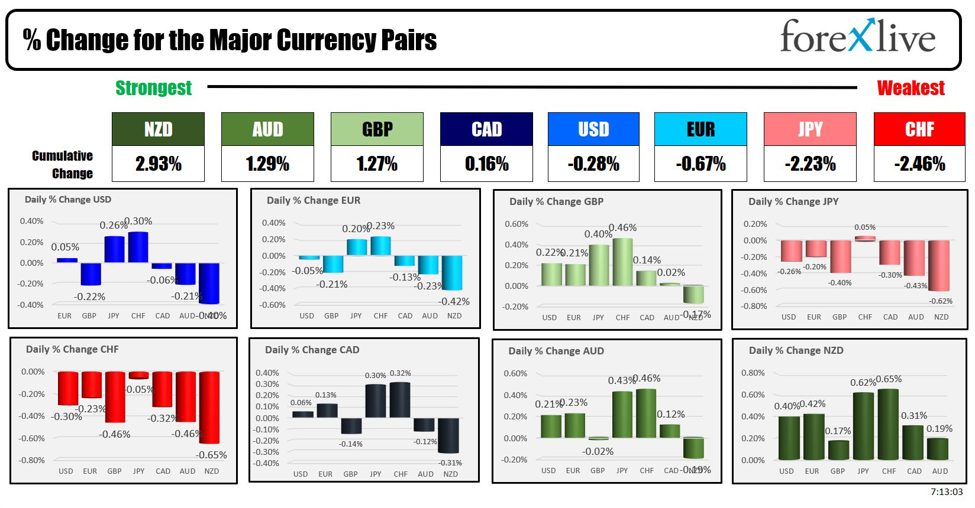

The NZD is the strongest and the CHF is the weakest as the NA session begins. The USD is mixed with gains vs the CHF and JPY balanced by declines vs the GBP, AUD and NZD. The EURUSD and USDCAD are little changed. The US PPI data will be reported today at 8:30 AM ET (CPI will be released tomorrow). The expectations and prior month shows:

- PPI Final Demand Year-on-Year (Jul): Est: 2.3%, Prior Period: 2.6%

- PPI Final Demand Month-on-Month (Jul): Est: 0.2%, Prior Period: 0.2%

- PPI ex Food/Energy Year-on-Year (Jul): Estl: 2.7%, Prior Period: 3.0%

- PPI ex Food/Energy Month-on-Month (Jul): Est: 0.2%, Prior Period: 0.4%

- PPI ex Food/Energy/Trade Year-on-Year (Jul): Prior Period: 3.1%

- PPI ex Food/Energy/Trade Month-on-Month (Jul): Prior Period: 0.0%.

In Europe today, the UK unemployment rate fell to 4.2%, but the number of people claiming unemployment increased by 135K versus 14.5 K estimate. German ZEW economic sentiment was lesson expectations and the prior month as was the EU economic sentiment index.

- GBP Claimant Count Change: Actual 135.0K, Forecast 14.5K, Previous 36.2K

- GBP Average Earnings Index 3m/y: Actual 4.5%, Forecast 4.6%, Previous 5.7%

- GBP Unemployment Rate: Actual 4.2%, Forecast 4.5%, Previous 4.4% (Positive impact)

- EUR German ZEW Economic Sentiment: Actual 19.2, Forecast 32.6, Previous 41.8 (Negative impact)

- EUR ZEW Economic Sentiment: Actual 17.9, Forecast 35.4, Previous 43.7 (Negative impact)

A snapshot of the other markets as the North American session begins shows:

- Crude oil is trading down $0.35 or -0.44% at $79.72. At this time yesterday, the price was $77.73

- Gold is trading down $5.95 or -0.24% or $2465.98. At this time yesterday, the price was trading at $2442.00

- Silver is trading down $0.14 or -0.53% or $27.80. At this time yesterday, the price is trading at $27.89

- Bitcoin is trading at $58,824. At this time yesterday, the price was trading at $59,829

- Ethereum is trading at $2641.10. At this time yesterday, the price was trading at $2673

In the premarket, the snapshot of the major indices are mixed after yesterday saw the Dow Industrial Average average fall, the S&P unchanged and the NASDAQ higher.

- Dow Industrial Average futures are implying a decline of -28.01 points. Yesterday, the Dow Industrial Average fall -140.53 or -0.36% at 39357.02

- S&P futures are implying a gain of 12.11 points. Yesterday the S&P index rose 0.23 points or 0.0% at 5344.38.

- Nasdaq futures are implying a gain of 56.97 points. Yesterday the index rose 35.31 points or 0.21% at 16780.61

Yesterday, the small-cap Russell 2000 fell -3.508 points or -0.17% at 2080.91.

European stock indices are trading mostly higher:

- German DAX, -0.15%

- France CAC, -0.37%

- UK FTSE 100, -0.12%

- Spain’s Ibex, +0.28%

- Italy’s FTSE MIB, -0.39% (delayed 10 minutes).

Shares in the Asian Pacific markets closed mixed:

- Japan’s Nikkei 225, + 3.45%

- China’s Shanghai Composite Index, +0.34%

- Hong Kong’s Hang Seng index, +0.36%

- Australia S&P/ASX index, +0.17%

Looking at the US debt market, yields are little changed:

- 2-year yield 4.000%, -1.5 basis points. At this time yesterday, the yield was at 4.050%

- 5-year yield 3.728%, -2.1 basis points. At this time yesterday, the yield was at 3.796%

- 10-year yield 3.890%, -1.9 basis points. At this time Friday, the yield was at 3.945%

- 30-year yield 4.194%, -0.3 basis points at this time Friday, the yield was at 4.230%

Looking at the treasury yield curve, the spreads are showing

- The 2-10 year spread is at -10.8 basis points. At this time yesterday, the spread was at -10.4 basis points.

- The 2-30 year spread is at +19.7 basis points. At this time yesterday, the spread was was 18.2 basis points.

In the European debt market, the benchmark 10-year yields are lower:

This article was written by Greg Michalowski at www.forexlive.com.

Source link