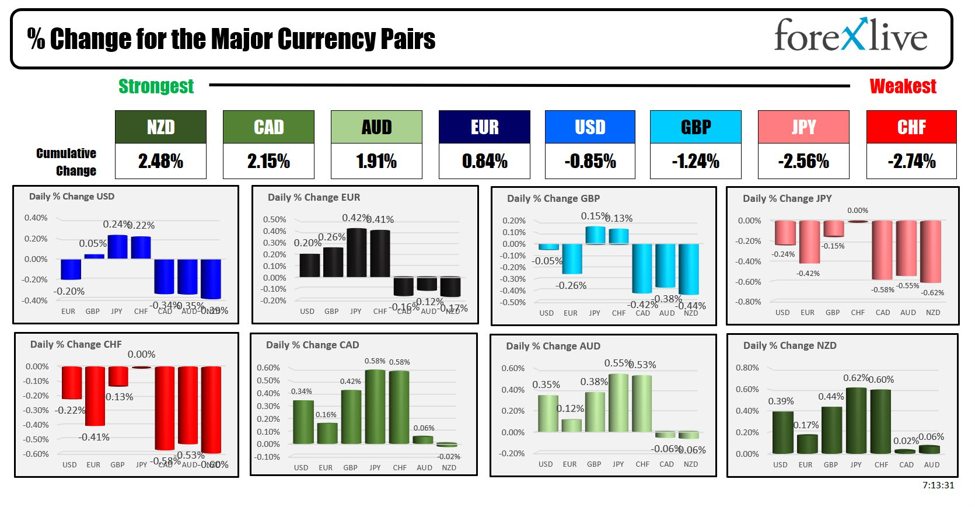

The NZD is the strongest and the CHF is the weakest as the North American session begins. Today at 8:30 AM, the US PCE data will be released for the month of April. The core PCE is the favored inflation measure for the Fed.

Adam previewed the release yesterday (CLICK HERE) that the consensus is +0.3% m/m but it’s on the razor’s edge as all estimates are nearly-evenly split between +0.2% and +0.3% with the average at +0.25%. Take that as downward bias to the headline..

Other inflation numbers to watch:

- PCE core year-over-year expected at 2.8%, the same as last month

- PCE expected at 0.3% m/m and 2.7% y/y

The focus is going to be on core and in particularly core services ex-housing but don’t discount the headline number. A reading below 2.7% — and something like 2.5% — starts to look awfully close to target even if lapping some high commodity prices is doing much of the lifting.

Adam posted that

The other half of the report focuses on income and spending. The latest round of comments from Fed officials highlighted strong wage growth as a concern. I think that’s a lagging indicator but it’s worth keeping in mind as incomes are expected up 0.3% m/m. Spending is forecast to keep pace with that at +0.3% but I wonder if the US consumer outperforms yet again.

Overnight, the ECB CPI data came in stronger than expected which helped to push up the EURUSD ahead of the interest rate decision next week:

- EUR Core CPI Flash Estimate y/y: Actual: 2.9%, Forecast: 2.7%, Previous: 2.7%

- EUR CPI Flash Estimate y/y: Actual: 2.6%, Forecast: 2.5%, Previous: 2.4%

ECBs Panetta said that the CPI data was neither good nor bad and that policy would still remain restrictive even after several rate cuts.

A snapshot of the other markets as the North American session begins shows

- Crude oil is trading unchanged at $77.91 . At this time yesterday, the price was at $79.08

- Gold is trading +$0.64 or 0.03% at $2344.40. At this time yesterday, the price was higher at $2335.46

- Silver is trading up $0.15 or 0.49% at $31.31. At this time yesterday, the price was at $31.31

- Bitcoin currently trades at $68,395. At this time yesterday, the price was trading at $67,811

- Ethereum is trading at $3805.50. At this time yesterday, the price trading at $3736.20

In the premarket, the snapshot of the major indices are lower after yesterday’s declines: The major US indices are on pace for a lower close

- Dow Industrial Average futures are implying a decline of -9.48 points. Yesterday, the index fell -330.06 point or -0.86% at 38111549

- S&P futures are implying a decline of -6.98 points. Yesterday, the index fell -31.49 points or -0.60% at 5235.47

- Nasdaq futures are implying a decline of -49.10 points. Yesterday, the index fell -183.50 points or -1.08% at 16737.08

European stock indices are trading higher today in the US morning snapshot:

- German DAX, -0.07%

- France CAC , unchanged

- UK FTSE 100, +0.44%

- Spain’s Ibex, -0.10%

- Italy’s FTSE MIB, +0.15% (delayed 10 minutes).

Shares in the Asian Pacific markets were mostly lower:

- Japan’s Nikkei 225, +1.14%

- China’s Shanghai Composite Index, -0.16%

- Hong Kong’s Hang Seng index, -0.83%

- Australia S&P/ASX index, +0.96%

Looking at the US debt market, yields are trading lower after yesterday’s sharp moves to the upside. The coupon auctions this week were less than stellar, forcing yield to the upside:

- 2-year yield 4.941%, +1.2 basis points. At this time yesterday, the yield was at 4.958%

- 5-year yield 4.579%, +0.9 basis points. At this time yesterday, the yield was at 4.611%

- 10-year yield 4.556%, +0.2 basis points. At this time yesterday, the yield was at 4.589%

- 30-year yield 4.683%, -0.2 basis points. At this time yesterday, the yield was at 4.713%

Looking at the treasury yield curve spreads remain in negative territory but moved more toward parity (steeper curve)

- The 2-10 year spread is at -38.7 basis points. At this time yesterday, the spread was at -36.8 basis points.

- The 2-30 year spread is at -25.9 basis points. At this time yesterday, the spread was at -24.2 basis points.

In the European debt market yields in the benchmark 10-year yields are higher::

This article was written by Greg Michalowski at www.forexlive.com.

Source link