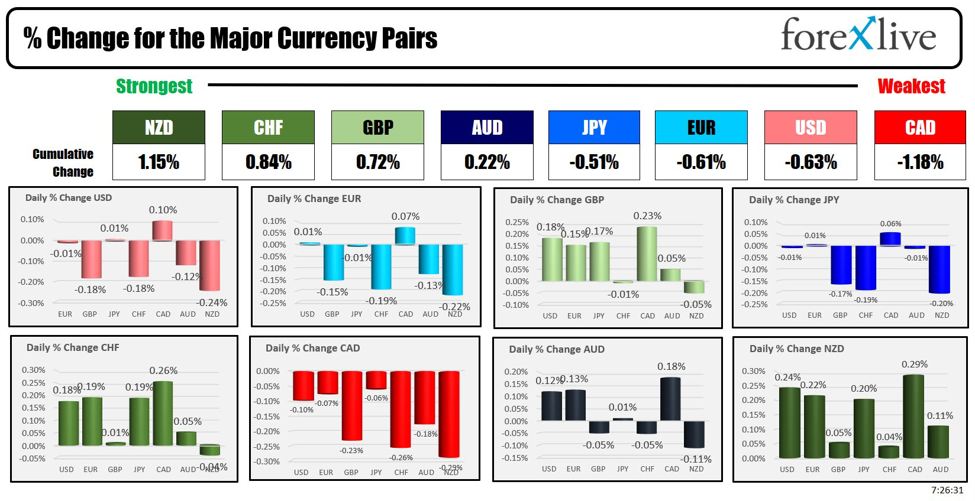

As the North American session begins, the NZD is the strongest and the CAD is the weakest . The USD is mostly, but modestly lower. Stocks are little changed after gains yesterday clawed back some of Friday’s declines. European shares are mixed/little changed. The US yields to start the US session are up by above 1-2 basis points along the yield curve. Crude oil is lower after a rebound day yesterday. Tomorrow US CPI will be released at 8:30 AM ET.

The Bank of Japan (BoJ) reportedly sees little need to raise interest rates next week, according to Bloomberg sources. However, officials are not ruling out a possible rate hike later this year or in early 2025, depending on economic and market conditions. Staying in Japan, Morgan Stanley warns that US equities could be at risk from a further unwinding of yen-funded carry trades if the Federal Reserve cuts rates aggressively. Back on August 5, the Nikkei moved down -12.4 % in a single day and that led to other sharp falls in the US and other global indices. An initial Federal Open Market Committee (FOMC) rate cut of more than 25 basis points could strengthen the yen and lead to further withdrawal of Japanese investments from US assets. The note suggests that a rapid decline in US front-end rates could cause the yen to strengthen further, potentially triggering an adverse reaction in US risk assets. While the likelihood of a 50 basis point rate cut by the Fed has decreased slightly since last Friday’s non-farm payroll data, market pricing still shows about a 30% probability. The Fed decision will take place on September 18th

Meanwhile, the European Central Bank (ECB) is set to meet on September 12, 2024, with a rate cut widely anticipated due to a weakening economic outlook. Current inflation is nearing 2%, and longer-term forecasts remain stable around this level. However, the recent flow of economic data suggests a deteriorating outlook, prompting expectations for updated ECB macroeconomic forecasts during the meeting. These forecasts are likely to include downward revisions to inflation for 2025 and 2026, influenced by factors such as lower oil prices and a stronger euro. Growth forecasts may also be revised lower. No new forward guidance is expected from this meeting.

IN the UK today, the July ILO unemployment rate remained steady at 4.1%, in line with expectations and slightly lower than the prior 4.2%. Employment change for July showed a strong increase of 265,000, surpassing the expected 123,000, but August payrolls fell by 59,000, following a downward revision for July. Wage growth figures were mixed; average weekly earnings, including bonuses, rose by 4.0%, slightly below the expected 4.1%, while earnings excluding bonuses matched the expected 5.1%. In real terms, both total pay and regular pay have decreased to 1.1% and 2.2% respectively for the three months to July, down from 1.6% and 2.4% in the three months to June, providing some comfort for the Bank of England regarding wage pressures. However, the data from the Office for National Statistics (ONS) carries uncertainty due to ongoing caveats about the estimates.

There are no economic releases in the US or Canada today, but the US treasury will auction 3 year notes at 1 PM. Also despite the Fed Blackout period, FOMCs Bowman and Barr will be speaking. I have to expect, the speeches will NOT be on the economy or policy, but regulatory in scope.

A snapshot of the other markets as the North American session begins shows:

- Crude oil is trading down -$1 dollar at $67.70. At this time yesterday, the price was at $68.63

- Gold is trading up $0.29 or 0.01% at $2506.17. At this time yesterday, the price was at $2496.95

- Silver is trading up $0.12 or 0.43% at $28.42. At this time yesterday, the price is at $28.12

- Bitcoin is trading up $200 and $57,264. At this time yesterday, the price was at $55,225

- Ethereum is trading up $12.30 in $2354. At this time yesterday, the price was at $2311.70

In the premarket, the snapshot of the major indices are mixed/modestly changed after gains yesterday

- Dow Industrial Average futures are implying fall of -22 points.. Yesterday, the index rose 484.18 points or 1.20% at 40829.60

- S&P futures are implying a gain of 2.4 points. Yesterday, the index rose 62.63 points or 1.16% at 5471.06

- Nasdaq futures are implying a gain of 6 points. Yesterday, the index rose 193.77 points or 1.16% at 16884.60

Yesterday, the small-cap Russell 2000 rose 23.67 points or 1.13% at 2115.07

European stock indices are also rebounding to the upside today

- German DAX, -0.52%

- France CAC, +0.12%

- UK FTSE 100, -0.57%

- Spain’s Ibex, +0.10%

- Italy’s FTSE MIB, -0.70% (delayed 10 minutes).

Shares in the Asian Pacific markets closed modestly higher:

- Japan’s Nikkei 225, -0.16%

- China’s Shanghai Composite Index, +0.28%

- Hong Kong’s Hang Seng index, +0.22%

- Australia S&P/ASX index, +0.30%

Looking at the US debt market, yields are little changed:

- 2-year yield 3.674%, +0.8 basis points. At the same Friday, the yield was at 3.695%

- 5-year yield 3.502%, +1.5 basis points.. At this time Friday, the yield was at 3.529%

- 10-year yield 3.717%, +1.8 basis points. At this time Friday, the yield is at 3.741%

- 30-year yield 4.018%, +1.9 basis points. At this time Friday, the yield is at 4.047%

Looking at the treasury yield curve,

- The 2-10 year spread is +4.2 basis points. At this time yesterday, the yield spread was +5.0 basis points.

- The 2-30 year spread is less 34.2 basis points. At this time yesterday, the yield spread was +35.6 basis points.

In the European debt market, the 10 year yields are modestly higher:

This article was written by Greg Michalowski at www.forexlive.com.

Source link