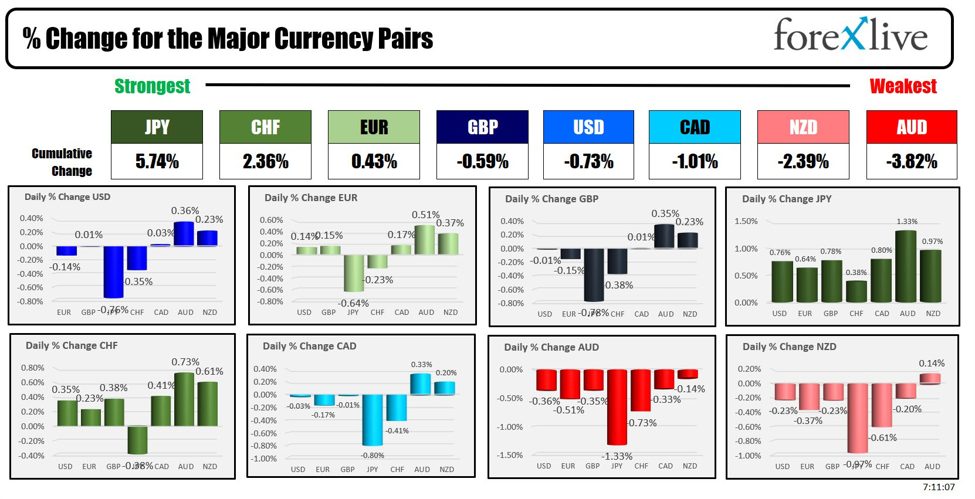

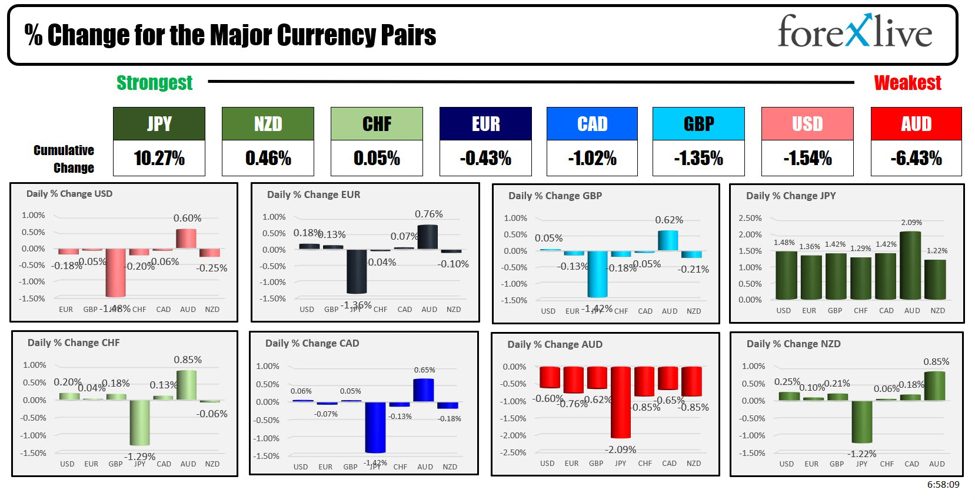

As the North American session begins, the JPY is the strongest and the AUD is the weakest. The USD is mixed to lower. TGIF to all traders. The USDJPY is reacting to the BOJ not raising and the Fed perhaps going 50 bps.

The day after the ECB cut, a number of ECB officials are speaking and says:

- ECB policymaker Robert Holzmann stated that there could be room for another rate cut in December, noting that the current monetary policy is on a positive trajectory. Holzmann expressed that inflation is less concerning now compared to when the ECB first started cutting rates in June. He is not against lowering rates but emphasized that timing is crucial. He highlighted that headline inflation is expected to rise temporarily in the coming months due to base effects, suggesting that October may not be the right time for another rate cut due to the limited amount of additional data available.

- ECB policymaker Olli Rehn stated that the ECB will continue to base its policy decisions on an assessment of the inflation outlook, core inflation dynamics, and the effectiveness of monetary policy transmission. Rehn noted that recent rate cuts have been supportive of economic growth, but current uncertainties in the economy underscore the need to rely on fresh data to guide future decisions.

- ECB policymaker Joachim Nagel commented that core inflation is moving in the right direction and expressed optimism that the ECB will reach its inflation goal by the end of next year.

In Japan, according to a Reuters poll, economists expect the Bank of Japan (BOJ) to keep rates unchanged in September but to raise them by the end of the year. None of the 52 surveyed economists predict a rate hike in September. About 54% (28 of 52) expect a rate increase by year-end, with the median forecast for the year-end interest rate being 0.50%, 25 basis points higher than the current rate. Among those expecting a rate hike, 18 of 23 economists predict it will occur in December, while the remaining 5 anticipate it in October.

Next week the FOMC will meet and there more of a debate about 50 bps vs 25 bps. The probability of a 50 basis point (bp) rate cut by the Federal Reserve has surged to around 40% within a few hours, up from under 20% less than 8 hours ago. This comes during the Fed’s blackout period, when officials are not communicating their monetary policy outlook. Before the blackout, Fed officials had not indicated any expectation of a cut larger than 25bp. The sudden increase in the probability of a 50bp cut suggests possible ‘leaks’ or signals from the Fed, potentially indicating a shift towards a more significant rate reduction. WSJs Timiraos stirred the pot yesterday when he talked of the Fed dillemma between going big or going small.

PS Former Fed Pres. William Dudley stated that there is a strong case for a 50 basis point interest rate cut by the Federal Reserve, though it is uncertain if the Fed will take that action. Dudley, who served as president and CEO of the Federal Reserve Bank of New York from 2009 to 2018 and was a permanent member of the FOMC, made these comments at the Bretton Woods Committee’s annual Future of Finance Forum in Singapore.

On the economic calendar today:

- Canada Capacity Utilization Rate: Forecast: 78.5%, Previous: 78.5

- US Wholesale Sales m/m: Forecast: -1.1%, Previous -0.6%,

- US Import Prices m/m: Forecast: -0.2%, Previous: +0.1

- US Prelim UoM Consumer Sentiment: Forecast: 68.3, Previous: 67.9 point. Current conditions Forecast 61.5, Previous 0.3. Expectations. Forecast 71.0. Previous 72.1

- US Prelim UoM Inflation Expectations: Previous: 2.8%

A snapshot of the other markets as the North American session begins shows:

- Crude oil is trading up $1.01 at $68.30. At this time yesterday, the price was at $68.30

- Gold is trading up $6.64 or 0.26% at $2517.84. At this time yesterday, the price was $2517.84

- Silver is trading up $0.10 or 0.35% at $28.75. At this time yesterday, the price is at $28.75

- Bitcoin is trading up $684 at $58,026. At this time yesterday, the price was at $58,026

- Ethereum is trading up $0.80 at $2348.70. At this time yesterday, the price was at $2348.70

In the premarket, the snapshot of the major indices are modestly higher after gains yesterday

- Dow Industrial Average futures are implying a gain of 75.23 points. Yesterday, the index rose 235.06 or 0.58% at 41096.77

- S&P futures are implying a gain of 11.74 points. Yesterday, the index rose 41.63 points or 0.75% at 5595.76

- Nasdaq futures are implying a a gain of 13.93 points. Yesterday, the index rose 174.15 points ro 1.00% at 17569.69

Yesterday, the small-cap Russell 2000 was higher by 25.58 points or 1.22% at 2129.42

European stock indices are trading higher:

- German DAX, +0.42%

- France CAC, +0.108%

- UK FTSE 100, +0.24%

- Spain’s Ibex, +0.69%

- Italy’s FTSE MIB, +0.05% (delayed 10 minutes).

Shares in the Asian Pacific markets closed modestly higher:

- Japan’s Nikkei 225, -0.68%. For the trading week the index rose 0.52%

- China’s Shanghai Composite Index, -0.48%. For the trading week the index fell -2.23%

- Hong Kong’s Hang Seng index, +0.75%. For the trading week the index fell -0.43%

- Australia S&P/ASX index, +0.30%. The trading week the index rose 1.1%

Looking at the US debt market, yields are little changed:

- 2-year yield 3.597%, -5.1 basis points. At the same Friday, the yield was at 3.660%

- 5-year yield 3.432% -3.3 basis points. At this time Friday, the yield was at 3.457%

- 10-year yield 3.653% -2.7 basis points. At this time Friday, the yield is at 3.664%

- 30-year yield 3.976%, -2.0 basis points. At this time Friday, the yield is at 3.92%

Looking at the treasury yield curve,

- The 2-10 year spread is +6.0 basis points. At this time yesterday, the yield spread was +3.7 basis points.

- The 2-30 year spread is +38.4 basis points. At this time yesterday, the yield spread was +37.8 basis points.

In the European debt market, the 10 year yields are mostly higher:

This article was written by Greg Michalowski at www.forexlive.com.

Source link