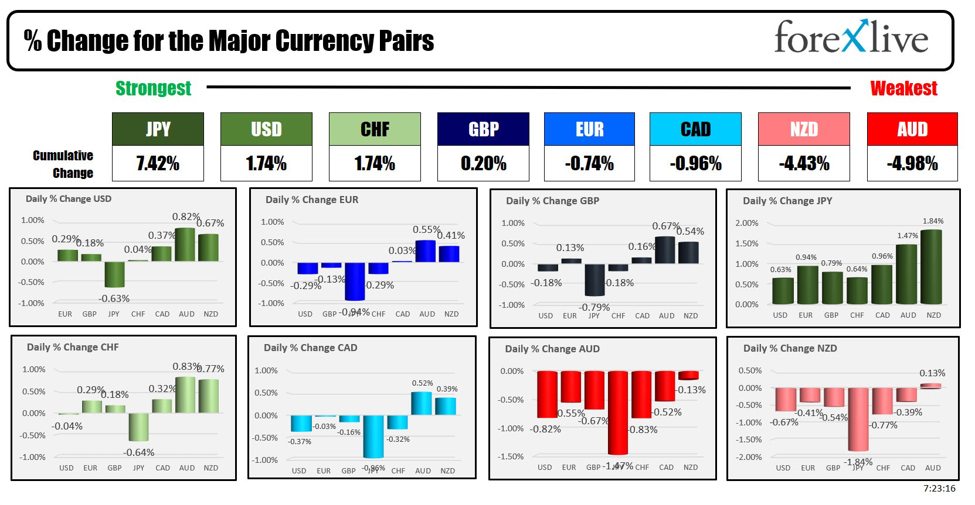

As the North American session begins, the JPY is the strongest and the AUD is the weakest. The USD is stronger as traders return from the Labor Day holiday. It is full steam ahead now to the US presidential debate (assuming solving the mic issue), which will culminate in the Presidential Election Day 62 days and 19 hours from today.

In Europe today:

Switzerland Economic Data:

- Swiss CPI eased to 1.1% year-on-year in August (expected: 1.2%, previous: 1.3%). The MoM came in at 0.0% vs 0.1% estimate (was -0.2% last month).

- Inflation is well below the Swiss National Bank’s (SNB) Q3 forecast of 1.5%.

- Analysts suggest that this data might increase the SNB’s confidence in inflation control.

- The low inflation rate could lead to the SNB allowing the Swiss franc (CHF) to weaken.

- GDP QoQ Q2 came in at 0.7% vs 0.5% estimate. YoY came in at 1.8% vs 1.4% estimate (0.6% last quarter)

Justin posted earlier the implications for the SNB. In summary:

Last week, SNB Chairman Thomas Jordan remarked that the strong Swiss franc is not making things easier for the Swiss economy, hinting that the central bank may be closely monitoring the situation and considering its next move regarding the currency’s direction. Previously, when the SNB was hiking rates, a stronger franc was necessary to counteract imported inflation and prevent it from spiraling out of control, a strategy that successfully kept inflation in check. However, recent lower inflation data indicates that imported inflation is no longer an issue for the SNB; rather, the strong franc is now contributing negatively to price pressures. In the latest report, services inflation was at 2.2%, but the headline inflation rate was just 1.1%, with core inflation at 1.3%. With imported inflation decreasing due to the strong franc—evidenced by the EUR/CHF exchange rate touching a record low in August—the SNB might consider intervening in the market again. While they have various tools at their disposal, adjusting monetary policy settings could be more effective. A 50 basis points rate cut to weaken the franc is certainly under consideration, especially as markets have yet to fully price in such a move.

The CHF is stronger despite the fall in inflation today with a gain of 0.29% vs the EUR. It is near unchanged vs the USD.

Looking at the economic calendar today

- 9:30 am CAD Manufacturing PMI: Previous 47.8

- 9:45 am USD Final Manufacturing PMI: Previous 48.0

- 10:00 am USD ISM Manufacturing PMI: Forecast 47.5, Previous 46.8

- 10:00 am USD ISM Manufacturing Prices: Forecast 52.5, Previous 52.9. Employment was 43.4 last month for a point of reference

- 10:00 am USD Construction Spending m/m: Forecast -0.1%, Previous -0.3%

The market in the US will be focused on the US jobs report on Friday. NFP is expected to rise by 165K vs 114K last month with the unemployment rate dipping to 4.2% from 4.3% last month. Ahead of that, ADP report on jobs will be reported on Thursday along with the Services ISM data (including the employment component).

A snapshot of the other markets as the North American session begins shows:

- Crude oil is trading down $1.10 or -1.47% at $72.47.

- Gold is trading down $-10.90 or -0.43% at $2488.47

- Silver is trading down down $0.24 or -0.87% at $28.28

- Bitcoin is trading at $59,129 near unchanged.

- Ethereum is trading at $2509.40 down -$45

In the premarket, the snapshot of the major indices are lower after on Friday major indices rose.

- Dow Industrial Average futures are implying a decline of -239.08 points. On Friday, the index rose to an 28.03 points or 0.55% at 41563.09

- S&P futures are implying a decline of -34.40 points. On Friday the index rose 56.44 points or 1.01% at 5648.39.

- Nasdaq futures are implying a decline of -143.64 points. On Friday the index rose 197.19 points or 1.13% at 17713.62

on Friday, the small-cap Russell 2000 rose 14.65 points or 0.67% at 2217.63

European stock indices are trading lower

- German DAX, -0.28%

- France CAC, -0.19%

- UK FTSE 100, -0.48%

- Spain’s Ibex, -0.62%

- Italy’s FTSE MIB, -0.48% (delayed 10 minutes).

Shares in the Asian Pacific markets closed lower:

- Japan’s Nikkei 225, -0.04%

- China’s Shanghai Composite Index, -0.29%

- Hong Kong’s Hang Seng index, -0.23%

- Australia S&P/ASX index, -0.08%

Looking at the US debt market, yields are little changed:

- 2-year yield 3.931%, +0.4 basis points

- 5-year yield 3.718%, +0.3 basis points

- 10-year yield 3.911%, unchanged

- 30-year yield 4.193%, -0.2 basis points

Looking at the treasury yield curve,

- The 2-10 year spread is at -1.8 basis points

- The 2-30 year spread is at last 26.3 basis points.

This article was written by Greg Michalowski at www.forexlive.com.

Source link