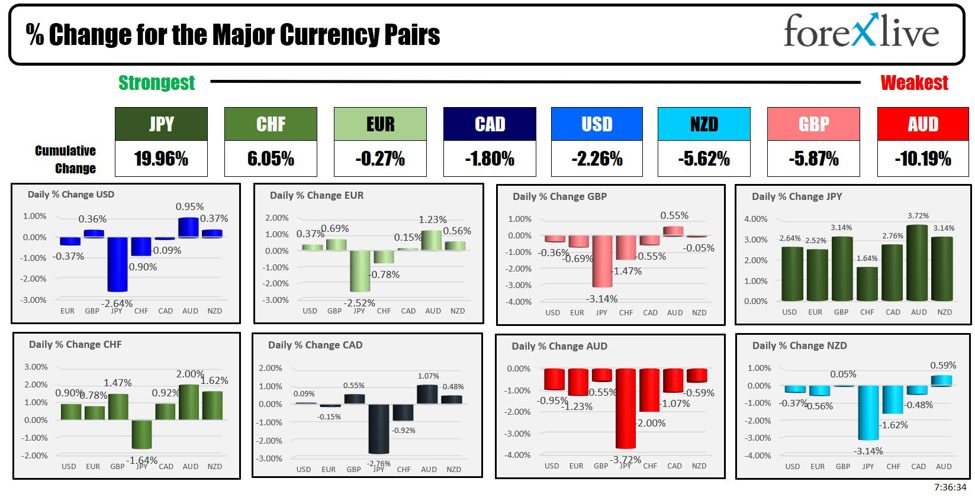

The JPY is the strongest and the AUD is the weakest as the NA session begins. The JPYs move comes as traders continue to exit the “carry trade” where they borrowed JPY to buy, buy buy. The Nikkei fell -12.4% the worst day since Black Monday. The level is now -5.99% on the year.

The fall has US stocks moving sharply lower with the S&P down -3.21%. The Nasdaq is down -4.74% in volatile trading (worst since Spetember 2022 when the index fell -5.16%.

The Vix is up to 60% now.

A snapshot of the The Mag 7 are doing worse:

- Meta is down -6.79%

- Apple is down -7.62%

- Amazon is down -6.55%

- Alphabet is down -5.80%

- Microsoft is down -4.23%

- Nvidia is down -13.14%

- Tesla is down -9.00

Bitcoin is sharply lower as traders are stopped out and run for the exits (not the safe haven people thought). The price of bitcoin reached $70016.on July 29. It traded as low as $49647 today. Gold is also sharply lower.

US rates are sharply lower with the 2-year down -14 bps. The 10-year is down -8.2%. US Mortgage rates moved down to 6.40% (on Friday and likely lower today). The high was at 7.80% in October 2023 and 7.22% in early May.

Market is now pricing in a 50 basis point cut by the Fed in September (99%). November is pricing in a 87% chance of 50 basis point cut. December is pricing in an 86% chance of 25 basis points, and January is pricing in an 83% chance of another 25 basis points.

A snapshot of the other markets as the North American session begins shows:

- Crude oil is trading down -$1.65 or -2.24% at $71.88. At this time yesterday, the price was at $76.19

- Gold is trading down- $51 or -2.05% at $2391. At this time yesterday, the price was trading at $2460.

- Silver is trading down $1.70 or -5.96% $26.84.. At this time yesterday, the price is trading at $28.92

- Bitcoin is trading at $51,265. At this time yesterday, the price was trading at $64,609 and traded as high at $70,01

- Ethereum is trading at $2280.70. At this time yesterday, the price was trading at $3149.90

In the premarket, the snapshot of the major indices are sharply lower.

- Dow Industrial Average futures are implying a loss of -989 points. Yesterday, the Dow Industrial Average fell -610.71 points or -1.51% at 39737.27.

- S&P futures are implying a loss of -191 points. Yesterday the S&P index closed lower by -100.14 points or -1.84% at 5346.55.

- Nasdaq futures are implying a loss of -960 points. Yesterday the index closed lower by – 417.98 points or -2.43% at 16776.16

European stock indices are trading sharply lower as they react to lower global stocks

- German DAX, -3.31%.

- France CAC, -2.64%

- UK FTSE 100, -2.91%.

- Spain’s Ibex, -3.33%

- Italy’s FTSE MIB, -3.68% (delayed 10 minutes).

Shares in the Asian Pacific markets closed lower.As mentioned, the Nikkei had it’s worst day since 1987.

- Japan’s Nikkei 225, -12.408%

- China’s Shanghai Composite Index, -1.54%

- Hong Kong’s Hang Seng index, -1.46%

- Australia S&P/ASX index, -3.70%

Looking at the US debt market, yields are continuing to move lower as the markets react to lower growth/lower stocks.

- 2-year yield 3.725%, -14.7 basis points. At this time yesterday, the yield was at 4.134%

- 5-year yield 3.509%, -10.9 basis points. At this time yesterday, the yield was at 3.807%

- 10-year yield 3.709%, -8.4 basis points. At this time Friday, the yield was at 3.941%

- 30-year yield 4.045%, -6.5 basis points. At this time Friday, the yield was at 1.241%

Looking at the treasury yield curve, the spreads are little changed from yesterday

- The 2-10 year spread is at -13 basis points. At this time yesterday, the spread was at -19.0 basis points.

- The 2-30 year spread is at last 32.1 basis points. At this time yesterday, the spread was +10.4 basis points.

In the European debt market, the benchmark 10-year yields are lower:

This article was written by Greg Michalowski at www.forexlive.com.

Source link