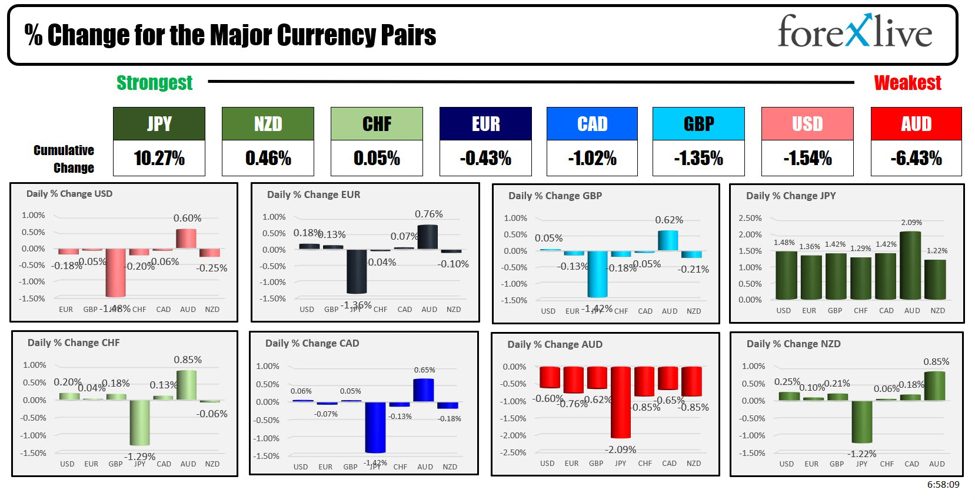

The JPY is the strongest and the AUD is the weakest as the North American session begins. The BOJ did hike rates to 0.25% as leaked yesterday. Meanwhile Australia’s trimmed mean CPI was weaker than expected helping to weaken the AUD. The Fed rate decision is later today as is earnings from Meta. After the close yesterday, Microsoft disappointed, but AMD did not. Nevertheless, despite MSFT shares being down -3% in premarket trading, soon after the release it was over twice that decline. AMD shares are up 8.64%.

The Bank of Japan (BOJ) raised its policy rate to 0.25% from 0.10% in its July 31, 2024, meeting, with dissent from Nakamura and Noguchi. The BOJ will taper bond purchases to ¥3 trillion by Q1 2026, reducing monthly bond buying by ¥400 billion each quarter, and will review this plan in June 2025. The BOJ noted gradual inflation increases and moderate economic recovery, indicating potential future rate hikes based on economic conditions.

BOJ Governor Kazuo Ueda stated that Japan’s economy is recovering moderately, emphasizing the importance of monitoring financial and FX markets and their impact on the economy and prices. He pointed out that there are upside risks to prices and judged it appropriate to adjust the degree of easing. Real interest rates remain significantly negative, supporting the economy, and the BOJ plans to taper JGB purchases predictably while ensuring stability.

Ueda indicated that private consumption remains solid despite the impact of inflation, with wage hikes becoming more widespread, which will continue to support private consumption. He does not believe that the rate hike will significantly harm the economy and mentioned no specific ceiling for the policy rate, implying that it could go beyond 0.50%. The BOJ will analyze the impact of previous rate hikes when considering additional increases and will closely watch economic indicators such as wages, inflation, service prices, and the GDP output gap.

He noted that it is hard to comment on the FX impact of a stronger yen on the economy and prices, but it is an important risk factor. Ueda also mentioned that the weak yen was not the primary reason for the rate hike, and the BOJ’s central price outlook was not significantly influenced by it. The major issue is determining where to stop raising rates when approaching the neutral rate, which Japan is still far below.

PS The USDJPY cracked below the 200 day MA at 151.67 today.

The core CPI out of Australia showed a 0.8% rise for the quarter which was lower than the 1.0% expected. That weakened the AUD further (it has been on a downward trajectory of course) and may keep the RBA from raising rates to tame inflation at the August meeting next week.

The FOMC rate decision is at 2 PM with the press conference at 2:30 PM with Chair Powell. WSJ Timiraos stressed that the first 3 paragraphs are key with the statement being voted on by policy makers. Here is his cheat sheet for your guide.

The Fed is expected to keep rates unchanged, but September is pretty much fully priced in by the market. What wordsmithing will the Fed chose IF they do intend to lay the pipe for a cut at the next meeting?

IN stock news as earnings progress this week, Microsoft, Starbucks, AMD and Pinterest reported after the close yesterday. What are their stocks doing today in pre-market trading?

- Microsoft, -3.6% (now)

- Starbucks up 3.59%

- AMD, +8.53%

- Pinterest, -10.63% after disappointing earnings and guidance.

Looking at other big cap stocks: Nvidia is up 6.55%, Amazon is down -0.19%, Google +0.70%, Apple +0.67%, Tesla up 1.1%. Morgan Stanley named Nvidia as one of it’s Top Picks. Nvidia earnings won’t be announced until mid-month.

A slew of earnings were reported this morning. Below are the summary and whether they beat, met or missed expectations:

Mastercard Inc (MA)

- Adj. EPS: $3.59 (expected $3.51) – Beat

- Revenue: $6.96 billion (expected $6.85 billion) – Beat

Boeing Co (BA)

- Adj. EPS: -$2.90 (expected -$1.97) – Miss

- Revenue: $16.87 billion (expected $17.23 billion) – Miss

Altria Group Inc (MO)

- Adj. EPS: $1.31 (expected $1.30) – Beat

- Revenue (ex. excise taxes): $5.28 billion (expected $5.39 billion) – Miss

Garmin Ltd (GRMN)

- EPS: $1.56 (expected $1.40) – Beat

- Revenue: $1.51 billion (expected $1.42 billion) – Beat

Kraft Heinz Co (KHC)

- EPS: $0.78 (expected $0.74) – Beat

- Revenue: $6.48 billion (expected $6.55 billion) – Miss

Marriott International Inc (MAR)

- Adj. EPS: $2.50 (expected $2.47) – Beat

- Revenue: $6.44 billion (expected $6.48 billion) – Miss

Automatic Data Processing Inc (ADP)

- Adj. EPS: $2.09 (expected $2.06) – Beat

- Revenue: $4.77 billion (expected $4.74 billion) – Beat

T-Mobile US (TMUS)

- Adj. EPS: $2.49 (expected $2.28) – Beat

- Revenue: $19.77 billion (expected $19.55 billion) – Beat

Humana Inc (HUM)

- Adj. EPS: $6.96 (expected $5.85) – Beat

- Revenue: $29.54 billion (expected $28.51 billion) – Beat

GE Healthcare (GEHC)

- EPS: $1.00 (expected $0.98) – Beat

- Revenue: $4.8 billion (expected $4.87 billion) – Miss

DuPont (DD)

- EPS: $0.97 (expected $0.85) – Beat

- Revenue: $3.171 billion (expected $3.05 billion) – Beat

- Outlook: FY EPS view $3.70-3.80 (expected $3.63), FY Revenue view $12.4-12.5 billion (expected $12.26 billion)

After the bell today, Meta (Facebook), Qualcomm, Carvana, Lam Research, Western Digital. Tomorrow, Amazon, Apple, Intel, Coinbase and DraftKings highlight the releases.

On the economic calendar today:

USD: ADP Non-Farm Employment Change

- Estimate: 147K

- Previous: 150K

CAD: GDP m/m

- Estimate: 0.1%

- Previous: 0.3%

USD: Employment Cost Index q/q

- Estimate: 1.0%

- Previous: 1.2%

USD: Pending Home Sales m/m

- Estimate: 1.4%

- Previous: -2.1%

A snapshot of the other markets as the North American session begins shows:

- Crude oil is trading up up $2.61 or 3.49% at $77.34. At this time yesterday, the price was at $75.37

- Gold is trading up $10.07 or 0.43% at $2421 . At this time yesterday, the price was trading at $2388.29

- Silver is trading up $0.24 or 0.84% at $28.62. At this time yesterday, the price is trading at $27.79

- Bitcoin trading at $66,062. At this time yesterday, the price was trading at $66,658

- Ethereum is trading at $3318.90. At this time yesterday, the price was trading at $3338.60

In the premarket, the snapshot of the major indices is to the upside ahead of the FOMC rate decision later today

- Dow Industrial Average futures are implying a gain of 57 points . Yesterday, the Dow Industrial Average rose 203.40 points or 0.50% at 40743.344

- S&P futures are implying a gain of 53 points . Yesterday the S&P index closed lower five -27.10 points or -0.50% at 5436.45

- Nasdaq futures are implying a gain of 304 points . Yesterday the index closed lower by -222.78 points or -1.29% at 17147.42

- Yesterday, the Russell 2000 index rose 7.80 points or 0.35% at 2243.14

European stock indices are trading mixed.

- German DAX, +0.454%

- France CAC, +1.08%

- UK FTSE 100, +1.22%

- Spain’s Ibex, -0.17%

- Italy’s FTSE MIB, -0.10% (delayed 10 minutes).

Shares in the Asian Pacific markets closed higher:.

- Japan’s Nikkei 225, 1.49%

- China’s Shanghai Composite Index, +2.06%

- Hong Kong’s Hang Seng index, +2.01%

- Australia S&P/ASX index, +1.75%

Looking at the US debt market, yields are trading marginally lower:

- 2-year yield 4.356%, -0.3 basis points. At this time yesterday, the yield was at 4.389%

- 5-year yield 4.027%, -0.9 basis points. At this time yesterday, the yield was at 4.066%

- 10-year yield 4.133%, -0.7 basis points. At this time Friday, the yield was at 4.170%

- 30-year yield 4.390%, -0.9 basis points. At this time Friday, the yield was at 4.423%

Looking at the treasury yield curve, the spreads are little changed from yesterday

- The 2-10 year spread is at -22.4 basis points. At this time yesterday, the spread was at -21.9 basis points.

- The 2-30 year spread is at 3.4 basis points. At this time yesterday, the spread was +3.5 basis points.

In the European debt market, the benchmark 10-year yields are lower:

This article was written by Greg Michalowski at www.forexlive.com.

Source link