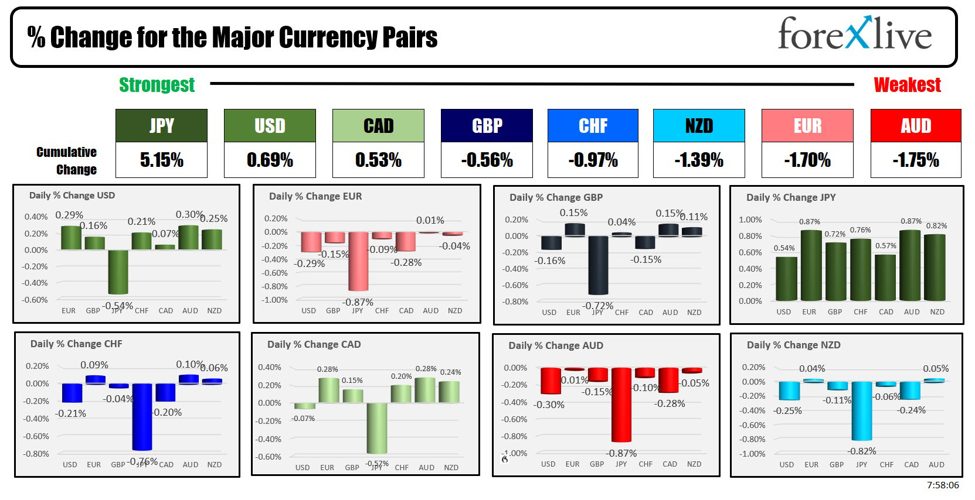

As the North American session begins, the JPY continues its move to the upside, while the AUD is the weakest of the majors. the USD is higher vs most currency pairs but is lower vs the JPY.

The USDJPY corrected higher yesterday in the US session but once the price reached the 100 hour MA, buyers turned to sellers keeping the bias in the favor of the sellers. I outlined that level in the video “USDJPY touches 100 -hour MA target at 157.16, time for sellers to act”. The USDJPY is trading at 156.23 after reaching a low today of 155.81 in the European session.

ECB deGuindos reiterated that September is a much more convenient time for taking decisions (and works with the vacation schedules).

In US politics, VP Harris got enough delegates to earn the Democrats nomination as their presidential candidate.

Oil prices are lower for the 4th day in a row as sluggish demand and concerned about China continue to weigh on the price. The PBOC IP rate yesterday in a surprise move.

The AUD and the NZD continue to be under pressure helped by China concerns as well. See the technical report from yesterday after key breaks of technical levels (“NZDUSD downtrend persists, breaches key Fibonacci level. AUDUSD also lower”)

The Bank of Canada meets tomorrow and the market is expecting a rate cut. Having said that, Eamonn posted that J.P. Morgan is leaning toward a no change at the meeting.

Stocks are mixed in pre-market trading with the Nasdaq futures implying a small decline, the Dow is modestly higher (40 points)The earnings calendar is full today. After the close, both Alphabet and Tesla will report. Visa and Texas Instruments will also report later today.

Below are some of the major releases this morning .

-

Lockheed Martin Corp (LMT) Q2 2024 (USD):Shares are up 1.14%

- EPS: $6.85 (exp. $6.46) BEAT

- Revenue: $18.12B (exp. $17.04B) BEAT

-

Sherwin-Williams Co (SHW) Q2 2024 (USD): Shares are up 5.48%

- EPS: $3.70 (exp. $3.48) BEAT

- EBITDA: $1.44B (exp. $1.33B) BEAT

- Net Sales: $6.27B (prev. $6.24B Y/Y)

- FY EPS view: $11.10-$11.40 (exp. $11.37)

-

Comcast Corp (CMCSA) Q2 2024 (USD):Shares are down -0.38%

- Adj. EPS: $1.21 (exp. $1.12) BEAT

- Revenue: $29.69B (exp. $30.02B) MISS

-

Philip Morris International Inc (PM) Q2 2024 (USD): Shares are up 2.13%

- Adj. EPS: $1.59 (exp. $1.57) BEAT

- Raises FY guidance; no share repurchases in 2024

-

Coca-Cola Co (KO) Q2 2024 (USD): Shares are up 1.70%

- Adj. EPS: $0.84 (exp. $0.81) BEAT

- Revenue: $12.4B (exp. $11.76B) BEAT

- Raises organic revenue forecast to 9-10%

-

MSCI Inc (MSCI) Q2 2024 (USD): Shares are up 4.73%

- EPS: $3.64 (exp. $3.55) BEAT

- Revenue: $707.95M (exp. $700M) BEAT

-

Quest Diagnostics Inc (DGX) Q2 2024 (USD):Shares are up 0.44%

- Adj. EPS: $2.35 (exp. $2.34) BEAT

- Revenue: $2.4B (exp. $2.39B) BEAT

- Lifts FY guidance

-

General Motors Co (GM) Q2 2024 (USD): Shares are up 4.86%

- Adj. EPS: $3.06 (exp. $2.75) BEAT

- Revenue: $47.97B (exp. $45.46B) BEAT

- Raised FY outlook

-

Kimberly-Clark Corp (KMB) Q2 2024 (USD):Shares are down -0.79%

- Adj. EPS: $1.96 (exp. $1.71) BEAT

- Revenue: $5.03B (exp. $5.1B) MISS

-

PulteGroup (PHM) Q2 2024 (USD):

- EPS: $3.83 (exp. $3.27) BEAT

- Q2 orders: $4.4B (exp. $4.49B) MISS

-

GE Aerospace (GE) Q2 2024 (USD):Share are up 3.27%

- EPS: $1.20 (exp. $0.99) BEAT

- Revenue: $8.22B (exp. $8.46B) MISS

-

United Parcel Service Inc (UPS) Q2 2024 (USD): Shares are down -7.71%

- EPS: $1.79 (exp. $1.99) MISS

- Revenue: $21.8B (exp. $22.18B) MISS

-

Spotify Technology SA (SPOT) Q2 2024 (EUR): Shares are up 13.56%

- EPS: €1.33 (exp. €1.06) BEAT

- Revenue: €3.81B (exp. €4.0B) MISS

A snapshot of the other markets as the North American session begins shows:

- Crude oil is trading down $-0.46 or -0.58% at $77.89. At this time yesterday, the price was at $78.18

- Gold is trading down up $11.88 or 0.50% at $2408.10. At this time yesterday, the price was trading at $2395.70

- Silver is trading down two cents or -0.09% at $29.05. At this time yesterday, the price is trading at $28.81

- Bitcoin trading down at $66,770. At this time yesterday, the price was trading at $67,432

- Ethereum is also trading higher at $3519.20. At this time yesterday, the price was trading at $3494.80

In the premarket, the snapshot of the major indices are trading mixed :

- Dow Industrial Average futures are implying a gain of 40 points. Yesterday, the Dow Industrial Average rose 127.91 points or 0.32% at 40415.45

- S&P futures are implying a gain of 6.98 points. Yesterday, the S&P index closed higher by 59.41 points or 1.08% at 5564.40

- Nasdaq futures are implying a decline of -4.25 points. Yesterday, the index rose 280.63 points or 1.58% at 18007.57

- Yesterday, the Russell 2000 index rose 36.30 points or 1.66% at 2220.64

European stock indices are trading higher across the board:

- German DAX, +1.21%

- France CAC +0.28%

- UK FTSE 100, +0.05%

- Spain’s Ibex, +0.58%

- Italy’s FTSE MIB, +0.45% (delayed 10 minutes).

Shares in the Asian Pacific markets closed mostly lower:.

- Japan’s Nikkei 225, -0.01%

- China’s Shanghai Composite Index, -1.65%

- Hong Kong’s Hang Seng index, -0.94%

- Australia S&P/ASX index, +0.508%

Looking at the US debt market, yields are trading lower:

- 2-year yield 4.516%, -0.6 basis points. At this time yesterday, the yield was at 4.523%

- 5-year yield 4.161%, -1.8 basis points. At this time yesterday, the yield was at 4.161%

- 10-year yield 4.233%, -2.7 basis points. At this time yesterday, the yield was at 4.225%

- 30-year yield 4.450%, -2.8 basis points. At this time yesterday, the yield was at 4.426%

Looking at the treasury yield curve ):

- The 2-10 year spread is at -28.2 basis points. At this time yesterday, the spread was at -29.8 basis points.

- The 2-30 year spread is -6.5 basis points. At this time yesterday, the spread was at -9.8 basis points

In the European debt market, the benchmark 10 year yields are lower:

This article was written by Greg Michalowski at www.forexlive.com.

Source link