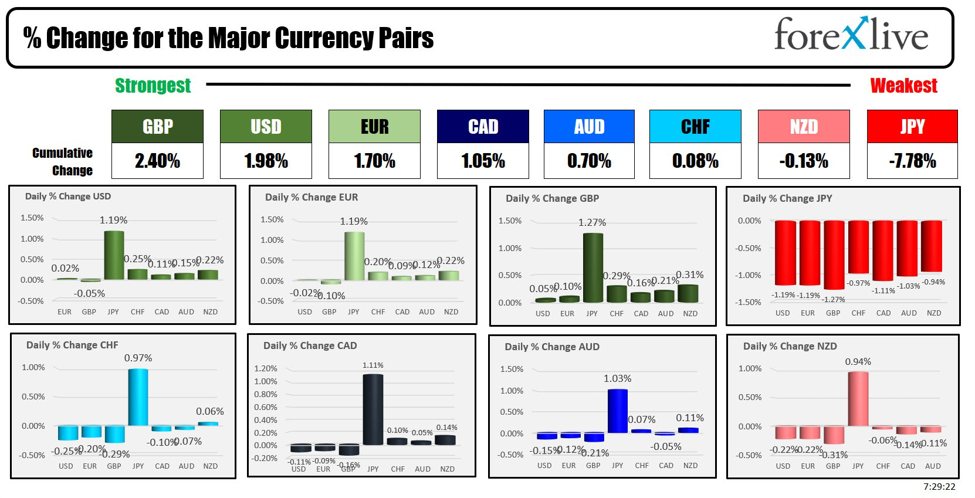

As the North American session begins, the GBP is the strongest and the JPY is the weakest. The USD is stronger. The Bank of Japan (BOJ) left interest rates unchanged at 0.25% during its September 2024 monetary policy meeting. This was as expected. The BOJ noted that Japan’s economy is recovering moderately, though some weaknesses remain. Inflation expectations are rising moderately, with inflation likely to align with the BOJ’s price target by the second half of the projection period, extending through fiscal 2026. Consumption is increasing gradually, and the economy is expected to grow above potential. The BOJ also highlighted the need to monitor financial and foreign exchange market fluctuations, as their impact on prices has grown.

In his press conference afterwards, BOJ Governor Ueda’s on various topics said:

Japan’s Economy and Recovery:

- Japan’s economy is recovering moderately, though some weaknesses remain.

- Recent data confirms the economy is moving in line with the BOJ’s outlook.

- Private consumption is improving as wages grow, leading to an improved economic outlook.

Inflation and Prices:

- Inflation risks have diminished somewhat, reducing the urgency for immediate policy changes.

- Recent data suggests the BOJ may raise its outlook on underlying inflation.

- The impact of a weak yen on import price inflation is expected to fade.

- Wage hikes are starting to reflect in services prices.

Monetary Policy:

- The BOJ will continue adjusting the degree of easing if the economic and price outlook materializes.

- Japan’s interest rate is likely still below the neutral rate despite hikes.

- Monetary policy will not be used to control forex rates.

- Easy monetary conditions remain in place as real rates are negative.

Financial and Market Uncertainty:

- High uncertainties surrounding the economy and prices require vigilant monitoring.

- Financial markets remain unstable, but BOJ will take the next policy step when the economic outlook is clearer.

- Criticism on insufficient communication after the July market rout is acknowledged, and the BOJ plans to communicate more frequently.

Global Trends and Impact:

- Overseas trends, especially uncertainties, are a concern for the inflation outlook.

- The BOJ’s main scenario is for the U.S. economy to achieve a soft landing, which would have minimal negative impact on Japan’s economy.

Yesterday, the BOE kept rates unchanged. BOE policymaker Catherine Mann weighed in “the day after” and emphasized the need to maintain restrictive monetary policy to combat persistent inflationary pressures in the UK. She advocated for keeping rates higher for longer, suggesting that cutting rates too soon could risk a resurgence in inflation. Mann noted that inflation risks, particularly in services, remain elevated in the UK, which influenced her decision not to vote for a rate cut in August. She holds a cautious stance on beginning the rate-cutting cycle, agreeing that inflation may remain above target for an extended period, making her reluctant to support rate cuts under current conditions.

Today UK retail sales beat on estimates again in August (+1.0% vs +0.4% estimate) with a rise in almost all categories. Some supermarkets and clothing retailers reported a boost because of warmer weather and end-of-season sales. And looking to sales volumes in the three months to August, that is seen up 1.2% when compared with the three months to May. Overall, it’s a positive picture to wrap up the summer period in the UK. That will help to give the BOE more breathing room in keeping rates higher for the time being. Below is a look at the change in the different categories.

Last week, the ECB cut rates as expected. Today, ECB Vice President Luis de Guindos emphasized that the European Central Bank will have more substantial data by December compared to October, leaving policy decisions open for future deliberation. He highlighted the uncertainty in current economic conditions, stressing the need for flexibility. De Guindos suggested that the ECB is prepared to act based on incoming information, keeping the possibility of further adjustments on the table. Cut… keep rates steady…cut, etc is the pattern (although they can’t explicitly say it).

The Federal Reserve is coming off its first cut since March 2020 this week, and Philadelphia Fed Pres. Harker is scheduled to be the first speaker (at 2 PM). There may be others who come out of the “black out” room and express their views on the Fed’s “recalibration” of the policy rate.

A snapshot of the other markets as the North American session begins shows:

- Crude oil is trading down -$0.27 or -0.3% at $70.88. At this time yesterday, the price was at $70.57

- Gold is trading up $28.70 or 1.11% at $2614.70. At this time yesterday, the price was $2588.70

- Silver is trading up $0.55 or 1.79% $31.32. At this time yesterday, the price is at $31.14

- Bitcoin is trading at $63,475. At this time yesterday, the price was at $62,587.

- Ethereum is trading at $2548.20. At this time yesterday, the price was at $2433.20

In the premarket, the snapshot of the major indices trading lower after sharp gains yesterday

- Dow Industrial Average futures are implying a gain of 5.25 points. Yesterday, the index rose 522.09 points or 1.26% at 42,025.19

- S&P futures are implying a loss of -12.39 points. Yesterday, the price rose 95.38 points or 1.70% at 5713.64

- Nasdaq futures are implying a loss of -58 points. Yesterday, the index rose 440.68 points or 2.51% at 18013.98

Yesterday, the small-cap Russell 2000 was higher by 46.36 points or 2.10% in 2252.70

European stock indices are trading mostly lower:

- German DAX, -0.65%

- France CAC, -0.76%

- UK FTSE 100, -0.78%

- Spain’s Ibex, +0.28%

- Italy’s FTSE MIB, -0.18% (delayed 10 minutes).

Shares in the Asian Pacific markets closed higher

- Japan’s Nikkei 225, +1.53%

- China’s Shanghai Composite Index, +0.03%

- Hong Kong’s Hang Seng index, +1.36%

- Australia S&P/ASX index, +0.21%

Looking at the US debt market, yields are mixed with the shorter end higher and the longer lower (flatter yield curve):

- 2-year yield 3.610%, +0.6 basis points. At the same Friday, the yield was at 3.577%

- 5-year yield 3.408%, +0.1 basis points. At this time Friday, the yield was at 3.473%

- 10-year yield 3.735%, -0.4 basis points. At this time Friday, the yield is at 3.715%

- 30-year yield 4.061%, -1.3 basis points. At this time Friday, the yield is at 4.046%

Looking at the treasury yield curve, is similar to yesterday’s levels at this time

- The 2-10 year spread is +12.4 basis points. At this time yesterday, the yield spread was +13.3 basis points.

- The 2-30 year spread is +45.1 basis points. At this time yesterday, the yield spread was was 45.1 basis points.

In the European debt market, the 10 year yields are little changed:

This article was written by Greg Michalowski at www.forexlive.com.

Source link