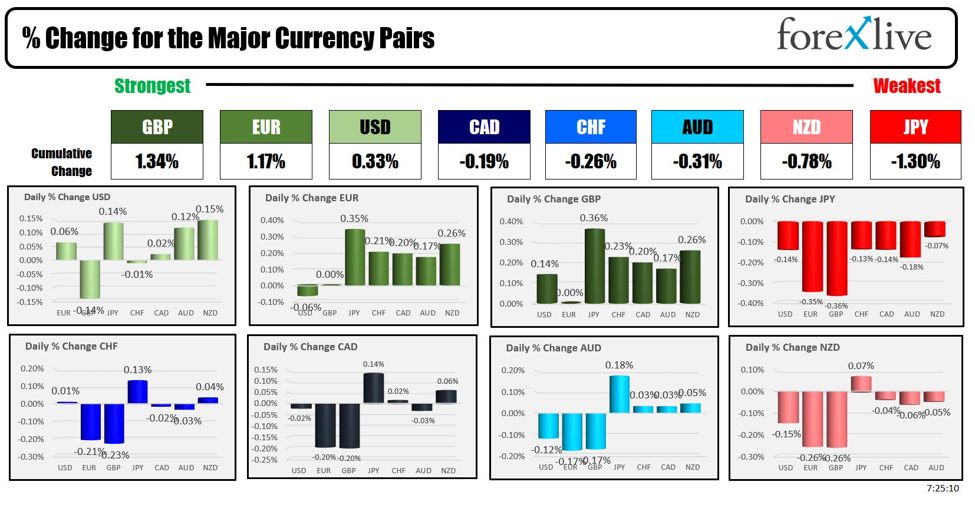

As the North American session begins, the GBP is the strongest and the JPY is the weakest. The USDJPY moved down to test a key swing level (and found buyers). The US stocks – after closing at records in the S&P and the Nasdaq – are little changed. European markets are higher. Yields in the US are higher (little changed in the EU).

This week US CPI and PPI data will be released (on Thursday and Friday). Fed Chair Powell will speak on Capitol Hill on Tuesday and Wednesday. The U.S. Treasury will auction off 3, 10, and 30-year coupon issues to test the debt market demand on Tuesday, Wednesday, and Thursday (we know there will be supply).

In New Zealand, the RBNZ will announce its rate decision this week.

Some brief comments via Westpac on what to expect:

- we are not anticipating any change in the OCR – which will remain at 5.5% – or the guidance that “…monetary policy needs to remain restrictive to ensure inflation returns to target within a reasonable timeframe”.

- The overall tone of the RBNZ’s communication is likely to be similar to that seen in May, when the Bank pushed out the timing of its first policy easing to August next year.

- The RBNZ will emphasise the upside risks to inflation emanating from the less contractionary than expected Budget 2024. But they will balance this with some dovish messages around potential downside risks to growth as the economy continues to stall and the labour market eases.

In the UK today, BOE’s Jonathan Haskel said that he prefers to hold interest rates until there is more certainty that inflation pressures have sustainably subsided. He is closely monitoring labor market conditions and inflation indicators, such as services inflation. Recent wage data suggests a rise in the “underlying” unemployment rate, and he notes that considerable second-round effects are currently at play but are expected to fade over the coming years.

ECBs Knot reiterated the general feeling that there is no reason to cut rates in July, but they are comfortable with the progress in disinflation

A little technicals to start the trading week….the USDJPY moved down to test the lows from June 27 and June 28 which was also near the high from April 29 at 160.209. Holding that level is key for the buyers. The rebound has moved up to 161.11 and back above the 200 hour MA at 161.03, but below the 100 hour MA at 161.227. The battle is on to start the trading week for the USDJPY pair.

In politics over the weekend:

- The leftwing New Popular Front has become the dominant force in France’s National Assembly with the most powerful faction being the far-left France Unbowed. They in total won 182 seats in the parliamentary election. In comparison, Macron’s centrist alliance secured 168 seats. The far-right National Rally (RN) and allies took 143 seats. With no party achieved a majority in France’s parliamentary elections, it leads to a fragmented assembly. Morevover, President Emmanuel Macron’s pro-business bloc, which came second, cannot form a government with France Unbowed. The far-right National Rally, which came third, also will not form a government with Macron’s party or the left. While opposition to the far right remains strong, political fragmentation is increasing. Stalemate.

- In the US, the bell continues to toll for Pres. Biden to step down. However, he remains committed to running. Former Pres. Trump can sit back and smile as the Dems do the work for him for now.

- UK went right last week after ousting the Tories after a 14-year run.

The pattern is to oust whos in. No one is happy.

A snapshot of the other markets as the North American session begins shows:

- Crude oil is trading down $0.66 or -0.81% at $82.50. At this time Friday, the price was at $83.92

- Gold is trading up down $16.03 or -0.67% at $2375.41. At this time Friday, the price was trading at $2366.30

- Silver is trading trade and $0.13 or -0.40% at $31.08. At this time on Friday, the price is trading at $30.64

- Bitcoin trading higher at $57,109. At this time Friday, the price was trading up at $55,325

- Ethereum is also trading higher at $3048.90 at this time Friday, the price was trading at $2940.30

In the premarket, the snapshot of the major indices are trading little changed in the premarket futures market. The S&P and NASDAQ indices closed at record levels on Friday. The NASDAQ index closed at a record level each of the four trading days last week (Thursday was a holiday).

- Dow Industrial Average futures are implying a gain of 18 points. On Friday, the Dow Industrial Average rose 67.87 points or 0.17% at 39375.88

- S&P futures are implying a gain 0.31 points. On Friday, the S&P index rose 30.19 points or 0.55% at 5567.20 (a new record)

- Nasdaq futures are implying a gain of 6.03 points. On Friday, the index rose 164.46 points or 0.90% at 18352.76 (a new record)

European stock indices are trading higher:

- German DAX, +0.33%

- France CAC +0.15%

- UK FTSE 100, +0.21%

- Spain’s Ibex, +0.53%

- Italy’s FTSE MIB, +0.65% (delayed 10 minutes)..

Shares in the Asian Pacific markets were lower

- Japan’s Nikkei 225, -0.32%

- China’s Shanghai Composite Index, -0.93%

- Hong Kong’s Hang Seng index, -1.55%

- Australia S&P/ASX index, -0.76%

Looking at the US debt market, yields are higher

- 2-year yield 4.636%, +3.8 basis points. At this time Wednesday, the yield was at 4.685%

- 5-year yield 4.258%, +4.1 basis points.. At this time Wednesday, the yield was at 4.297%

- 10-year yield 4.309%, +3.7 basis points. At this time Wednesday, the yield was at 4.335%

- 30-year yield 4.504%, +3.5 basis points. At this time Wednesday, the yield was at 4.509%

Looking at the treasury yield curve the spreads became less negative from Friday’s levels at this time:

- The 2-10 year spread is at -32.7 basis points. At this time Wednesday, the spread was at -35.0 basis points.

- The 2-30 year spread is at -13.6 basis points. At this time Wednesday, the spread was at -17.7 basis points.

In the European debt market, yields are mixed in the benchmark 10 year note sector:

4o

This article was written by Greg Michalowski at www.forexlive.com.

Source link