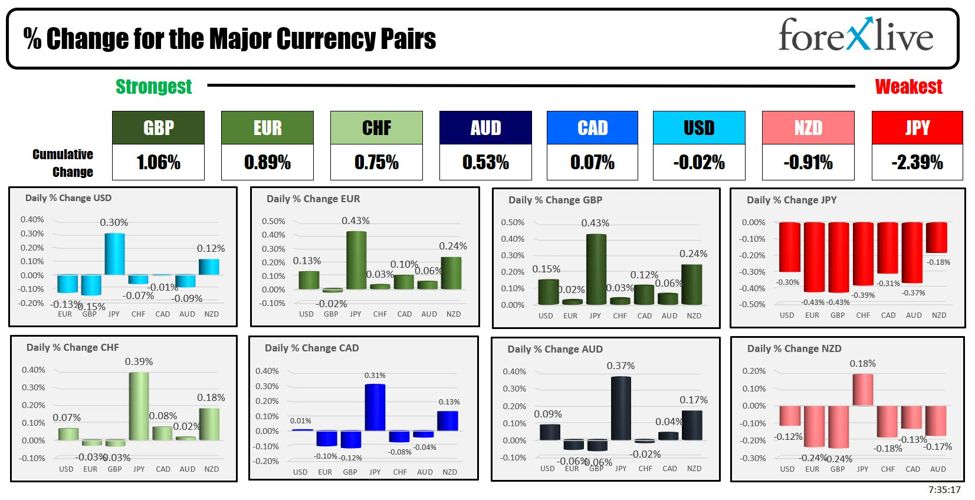

As the North American session begins the GBP is the strongest and the JPY is the weakest. The USD is mixed/little changed with gains vs the JPY and NZD, declines vs the EUR and GBP, and little changed vs the other major currencies. The US will have a data down as different loads economic releases ahead of the Independence Day holiday tomorrow. The US jobs report will be released on Friday

The USDJPY continues to move higher and traded just short of 162.000 today.

In the US today, Challenger layoffs came in lower at 48.786K vs 63.81K last month. Later today, the ADP National Employment data for June will be released at 8:15 AM ET with expectations of 160K versus 152K last month. Recall last month the data was much lower than the BLS non-farm payroll value of 272K . The disparity between both reports often leads to little reaction by the market, but it still is ahead of the BLS report and who’s to say it isn’t more accurate anyway?

Also released today will be US trade data, initial jobless claims (estimate 235K), Canadian trade data, factory orders (estimate 0.2%), and ISM nonmanufacturing data (estimate 52.5 versus 53.8 last month). For comparative purposes, the employment component last month came in at 47.1, while the prices paid was at 58.1.

Later this afternoon at 2 PM, the FOMC meeting minutes will be released. Finally, the weekly EIA will inventory data will also be released at 10:30 AM today. Late yesterday, the private crude oil inventory data showed a surprise -9.163M drawdown, but gasoline did show a build of +2.468M . Estimates are for -0.680M oil drawdown, and a gasoline drawdown of -1.32M.

A snapshot of the other markets as the North American session begins shows:

- Crude oil is trading up five cents at $82.85. At this time yesterday, the price was at $84.07

- Gold is trading up $16.50 or 0.71% at $2345.66. At this time yesterday, the price was trading at $2321.69

- Silver is trading trade up $0.70 or 2.37% at $30.20. At this time on yesterday, the price is trading at $29.27

- Bitcoin trades lower at $60,219. At this time yesterday, the price was trading up at $62,680

- Ethereum is also trading at $3297.80. At this time yesterday, the price was trading at $3448.10

In the premarket, the snapshot of the major indices are trading little changed in premarket trading after gains yesterday at the S&P and NASDAQ index to new record high closes

- Dow Industrial Average futures are implying a gain of 31.15 points. Yesterday, the Dow Industrial Average rose 162.33 points or 0.41% at 39331.86. The all-time high close for the Dow Industrial Average which is 40,003.60.

- S&P futures are implying a gain of 0.24 points. Yesterday, the S&P index rose 33.90 points or 0.62% at 5509.02. That was a record close.

- Nasdaq futures are implying a decline of -5.64 points. Yesterday, the NASDAQ index rose 149.46 points or 0.84% at 18028.76. That was a record closing level

European stock indices are trading higher:

- German DAX, +1.01%

- France CAC +1.56%

- UK FTSE 100, +0.56% ahead of the election tomorrow

- Spain’s Ibex, +1.20%

- Italy’s FTSE MIB, was 1.3% (delayed 10 minutes)..

Shares in the Asian Pacific markets were mixed

- Japan’s Nikkei 225, +1.26%

- China’s Shanghai Composite Index, -0.49%

- Hong Kong’s Hang Seng index, +1.18%

- Australia S&P/ASX index, +0.28%

Looking at the US debt market, yields are mixed with the shorter end higher and the longer end lower.

- 2-year yield 4.772%, +3.4 basis points. At this time yesterday, the yield was at 4.747%

- 5-year yield 4.412%, +1.6 basis points. At this time yesterday, the yield was at 4.403%

- 10-year yield 4.437%, +0.2 basis points. At this time yesterday, the yield was at 4.443%

- 30-year yield 4.595%, -1.3 basis points basis points. At this time yesterday, the yield was at 4.609%

Looking at the treasury yield curve the spreads became more negative after recent gains toward parity

- The 2-10 year spread is at -33.7 basis points. At this time yesterday, the spread was at -30.3 basis points. A week ago, the spread was at -50.6 basis points

- The 2-30 year spread is at -17.9 basis points. At this time yesterday, the spread was at -13.8 basis points. A week ago the spread was at -37.3 basis points

This article was written by Greg Michalowski at www.forexlive.com.

Source link