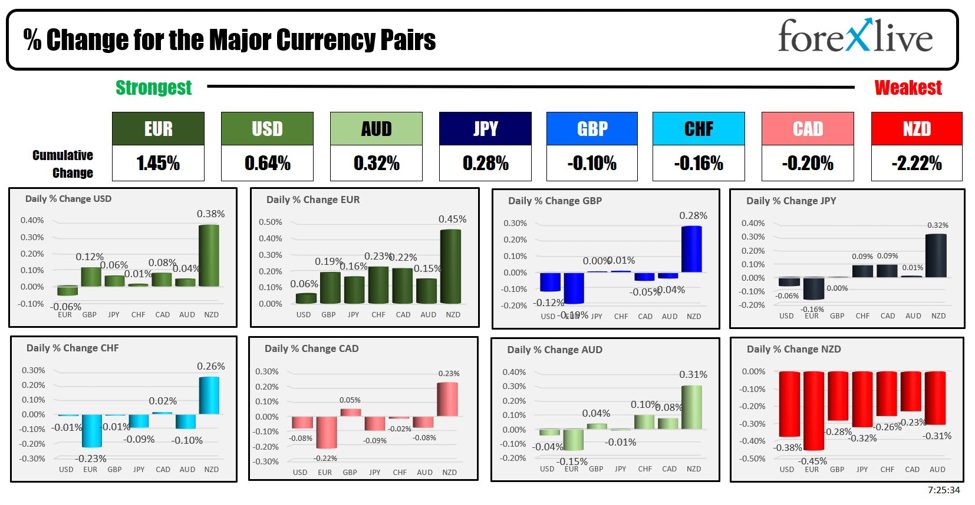

As the North American session begins, the EUR is the strongest and the NZD is the weakest. The USD is modestly higher after the shocking assassination attempt on Presidential candidate Trump over the weekend.

With expectations of a Trump victory rising, the knee-jerk reaction by the markets was for higher stocks and higher yields – at least at the moment. The yield curve is also steepening. Feelings from a Trump victory are that higher tariffs, and deportation of immigrants, would likely be inflationary (lead to trade war/more isolationism, and less workers for essential service jobs). He would also look to have rates lowered. All is to be determined.

The Republican National Convention starts today which will include the nomination (later this week) of former President Trump as the Republican nominee once again. In addition, the fallout from the assassination attempt will continue, with the focus on questions that need to be answered especially in regard to the total failure from a security standpoint. I would hope that a bipartisan review of what happened – and what did not – will yield the answers. In a country where guns are the norm, the rhetoric high, the division wide at the extremes of the bell curve of people (more than normal), and the candidates polarizing for their own reasons, this is the table that has been set. That needs to toned down.

The good news is rhetoric HAS been dialed down from the assassination event which is a good thing. What the future brings, how long it will be lower ahead of the election is unsure of course.

Onto the day, the NY Fed Manufactuing index for July will be released with estimate of -8.00 versus -6.00 last month. Canada wholesale trade and manufacturing sales will also be released (for May). Fed’s Powell will also speak at 12:30 PM ET. Feds Daly will also speak at 4:35 PM ET.

Goldman Sachs and BlackRock announced earnings today. They both beat expectations:

Goldman Sachs Group Inc (GS) Q2 2024 (USD)

- EPS: 8.62 (exp. 8.34) – BEAT

- Revenue: 12.73bln (exp. 12.46bln) – BEAT

BlackRock Inc (BLK) Q2 2024 (USD)

- Adjusted EPS: 10.36 (exp. 9.95) – BEAT

- Revenue: 4.81bln (exp. 4.85bln) – MISS

This week the earnings calendar includes earnings from other financials including Bank of America and Morgan Stanley, and a myriad of other industries. Johnson & Johnson, United Airlines, TSMC, Netflix, American Express are all scheduled to release. Below is that schedule:

Tuesday, July 16

- Bank of America

- United health group

- Progressive

- Morgan Stanley.

- Charles Schwab.

- PNC

- Interactive Brokers

- JB Hunt

Wednesday, July 17

- Johnson & Johnson

- United

- Alcoa

- Discover

- Kinder Morgan

Thursday, July 18

- Taiwan Semi Conductor

- Nokia

- DR Horton

- Netflix

- Intuitive Surgical

- PPG

Friday, July 19

- American Express

- Halliburton

- Comerica

- Travelers

When are the Magnificent 7 releasing its earnings this cycle?

- Alphabet, July 23

- Microsoft July 23

- Tesla July 23

- Amazon, July 25

- Meta Platforms, July 31

- Apple, August 1

- Nvidia, August 15

A snapshot of the other markets as the North American session begins shows:

- Crude oil is trading trading little changed from Friday’s close at $82.14. At this time Friday, the price was at $83.42

- Gold is trading up $8.56 or 0.36% at $2419.34. At this time Friday, the price was trading at $2,403

- Silver is trading unchanged $30.77. At this time Friday, the price is trading at $30.73

- Bitcoin trading sharply higher on flight to safety flows (?) at $62,549. At this time Friday, the price was trading at $57,353

- Ethereum is also trading sharply higher at $3342. At this time Friday, the price was trading at $3076.40

In the premarket, the snapshot of the major indices are trading higher. On Friday the Dow Industrial Average average closed just under a record level at 40,003.60. In premarket trading eight is above that level. The S&P index did close at a record level. The NASDAQ index closed below its record high closing level set on Wednesday at 18647.45. A snapshot of the implied openings from futures currently shows:

- Dow Industrial Average futures are implying a gain of 204 points. On Friday, the Dow Industrial Average rose 247.15 points or 0.62% at 40,000.91

- S&P futures are implying a gain of 19.4 points. On Friday, the S&P index closed higher by 30.79 points or 0.55% at 5615.34

- Nasdaq futures are implying a gain of 71 points. On Friday, the index closed higher by 115.04 points or 0.63% at 18398.45

European stock indices are trading lower:

- German DAX, -0.42%

- France CAC -0.64%

- UK FTSE 100, -0.32%

- Spain’s Ibex, -0.38%

- Italy’s FTSE MIB, -0.06% (delayed 10 minutes).

Shares in the Asian Pacific markets closed mixed. Today’s Japan bank holiday

- Japan’s Nikkei 225, on holiday

- China’s Shanghai Composite Index, +0.09%

- Hong Kong’s Hang Seng index, -1.52%

- Australia S&P/ASX index, +0.73%

Looking at the US debt market, yields are higher with a steeper your curve:

- 2-year yield 4.459%, unchanged. At this time Friday, the yield was at 4.501%

- 5-year yield 4.135%, +2.4 basis points. At this time Friday, the yield was at 4.137%

- 10-year yield 4.237%, +5.0 basis points. At this time Friday, the yield was at 4.208%

- 30-year yield 4.467%, +6.6 basis points. At this time Friday, the yield was at 4.419%

Looking at the treasury yield curve the 2 – 30 year span is positive by the slimmest of margins. The 2– 10 year spread is at its highest level (but still negative) since January 25.

- The 2-10 year spread is at -22.5 basis points. At this time yesterday, the spread was at -29.4 basis points.

- The 2-30 year spread is positive by 0.05 basis points. At this time yesterday, the spread was at -8.4 basis points.

In the European debt market, yields are mixed in the benchmark 10 year note sector:

This article was written by Greg Michalowski at www.forexlive.com.

Source link