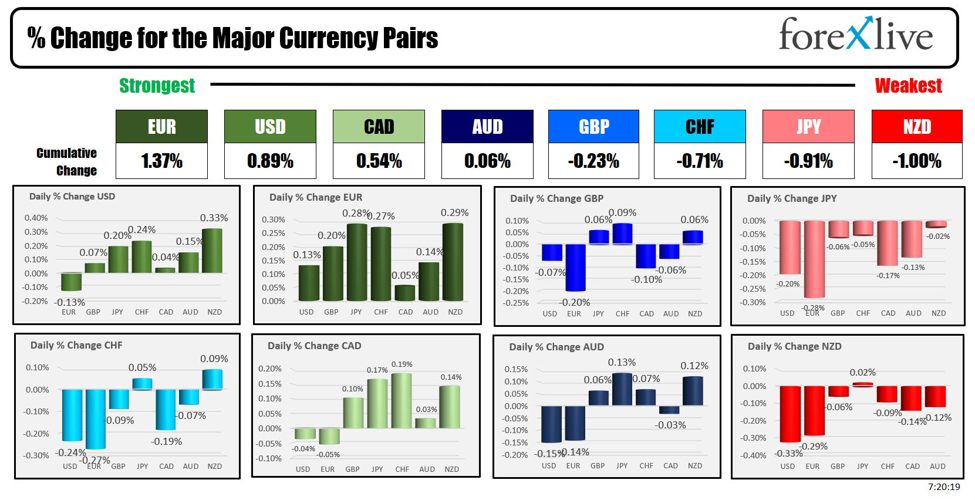

The EUR is the strongest and the NZD is the weakest as the North American session begins. The USD is starting the new trading week – heading into the US session – mostly stronger. The greenback is only lower vs the EUR . The EURUSD was lower earlier in the day, but has risen in the European session. ECB’s Lane emphasized not overreacting to monthly inflation data, noting the need to distinguish between noise and signal. He acknowledged bumps in inflation and significant wage increases in some countries but expected cost pressures to ease next year. Lane highlighted the unresolved questions about inflation momentum, which won’t be clear by July. He mentioned the impact of euro currency movements on policy, noting recent changes are not significant. Lane also stated that the peak effect of current rates on inflation is yet to be seen.

Fed speak today will be highlighted by Fed’s William (12 PM), Harker (1 PM), and Cook (9PM ET). The Empire manufacturing index will be released at 8:30 AM ET with the expectations at -9.0 vs. -15.6 last month.

A snapshot of the other markets as the North American session begins shows:

- Crude oil is trading up down -$0.11 or -0.14% at $78.34. At this time Friday, the price was at $78.97

- Gold is trading down -$13.78 or -0.59% at $2318.72. At this time Friday, the price was at $2331.80

- Silver is trading down -$0.30 or -1.02% at $29.23. At this time Friday, the price was trading at $29.25

- Bitcoin trades lower at $65,786. At this time Friday, the price was trading up at $67,051

- Ethereum is also trading lower at $3520.60. At this time Friday, the price was trading at $3516.04

In the premarket, the snapshot of the major indices are trading lower.

- Dow Industrial Average futures are implying a decline of 76.16 points. On Friday, the Dow Industrial Average fell -57.92 points or -0.15% at 38589.17.

- S&P futures are implying a 0.65 points. On Friday, the S&P index closed down -2.14 points or -0.04% at 5421.61.

- Nasdaq futures are implying a gain of 45 points. On Friday, NASDAQ index also closed at a record level with a gain of 21.32 points or 0.13% at 17688.88.

European stock indices are trading lower again today in the US morning snapshot. For the week, the major indices are all sharply lower as political concerns continue to weigh on investor sentiment. :

- German DAX, gain of 0.24%. Last week the index fell -2.99%

- France CAC gain of 0.40%. Last week the index plunged -6.23%, its worst week since February 2022.

- UK FTSE 100, unchanged. Last week the index fell -1.19%

- Spain’s Ibex, decline of -0.37%. Last week the index fell -3.60%

- Italy’s FTSE MIB, gain of 0.62% (delayed 10 minutes).. Last week the index fell -5.76% (its worst week since March 2023)

Shares in the Asian Pacific markets were mixed:

- Japan’s Nikkei 225, -1.03%

- China’s Shanghai Composite Index, -0.55%

- Hong Kong’s Hang Seng index, -0.03%

- Australia S&P/ASX index, -0.31%

Looking at the US debt market, yields are higher.

- 2-year yield 4.723%, +3.0 basis points. At this time yesterday, the yield was at 4.666%

- 5-year yield 4.266%, +4.0 basis point. At this time yesterday, the yield was at 4.203%

- 10-year yield 4.259%, +4.7 basis points. At this time yesterday, the yield was at 4.197%

- 30-year yield 4.398%, +4.7 basis points. At this time yesterday, the yield was at 4.341%

Looking at the treasury yield curve the spreads are steady

- The 2-10 year spread is at 46.5 basis points. At this time Friday, the spread was at -46.8 basis points.

- The 2-30 year spread is at -32.5 basis points. At this time Friday, the spread was at -32.5 basis points.

This article was written by Greg Michalowski at www.forexlive.com.

Source link