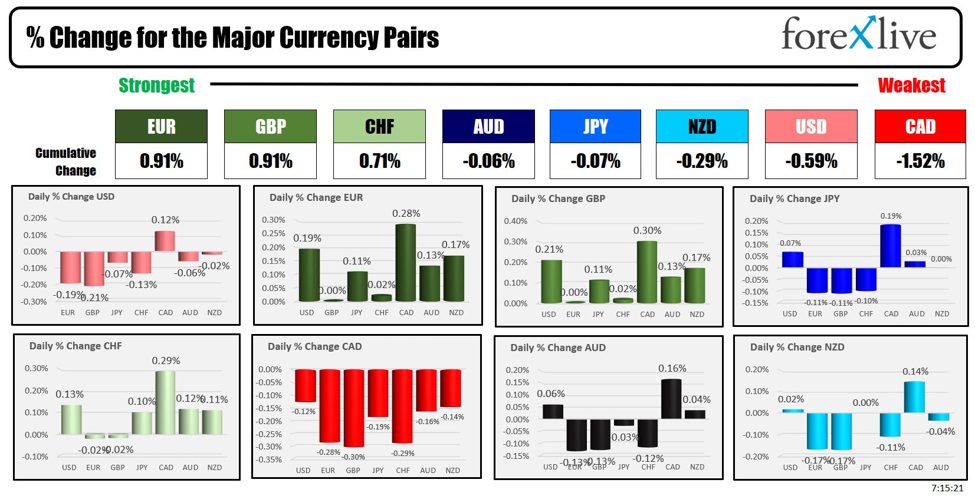

As the North American session begins, the EUR is the strongest and the CAD is the weakest. The USD is mostly lower but only modestly lower as most of the major currencies are scrunched together today. Low to high trading ranges are modest today with 5 of the 6 major currency pairs vs the USD less than 30 pips. The NZDUSD range is only 20 pips, THe EURUSD is 26 pips and the USDCHF is 20 pips. The GBPUSD trading range is 34 pips which is the most “active” of the major currency pairs. There is simply not a lot going on.

Today the focus is on the US CPI. For previews:

What is the distribution of forecasts for the US CPICPI importance is fadingBoA What we expect from US June CPI.

In addition to the CPI data, initial jobless claims are expected at 236K vs 238K last week (at 8:30 AM ET). The US treasury will auction 30 year bond at 1 PM ET.

US yields are little changed ahead of the data. The US major stock indices are lower ahead of the data. Yesterday, the S&P closed at a new record for the 6th consecutive day. The Nasdaq closed at a new record for the 7th consecutive day.

A snapshot of the other markets as the North American session begins shows:

- Crude oil is trading near unchanged at $82.10. At this time yesterday, the price was at $81.26

- Gold is trading up in dollars and $0.15 or 0.43% at $2381. At this time yesterday, the price was trading at $2378.40

- Silver is trading up $0.13 or 0.35% or $30.89. At this time on yesterday, the price is trading at $31.02

- Bitcoin trading higher at $58,788. At this time yesterday, the price was trading at $58,509

- Ethereum is also trading higher at $3148.40. At this time yesterday, the price was trading at $3111.90

In the premarket, the snapshot of the major indices are trading lower. The S&P and NASDAQ continued their string of record-high closing levels yesterday. The S&P has now closed higher for sixth consecutive days. The NASDAQ index has closed higher for seventh consecutive days.

- Dow Industrial Average futures are implying a decline of -63.36 points. Yesterday, the Dow Industrial Average rose 429.39 points or 1.09% at $39,721.70.

- S&P futures are implying a decline of -6.91 points. Yesterday, the S&P index rose 56.95 points or 1.02% at 5633.92.

- Nasdaq futures are implying a decline of -17.13 points. Yesterday, the index rose 218.16 points or 1.18% at 18647.45.

European stock indices are trading higher after rebounding higher yesterday:

- German DAX, +0.30%

- France CAC +0.35%

- UK FTSE 100, +0.20%

- Spain’s Ibex, +0.39%

- Italy’s FTSE MIB, 0.06% (delayed 10 minutes).

Shares in the Asian Pacific markets closed higher:

- Japan’s Nikkei 225, +0.94%

- China’s Shanghai Composite Index, +1.06%

- Hong Kong’s Hang Seng index, +2.06%

- Australia S&P/ASX index, +0.93%

Looking at the US debt market, yields are higher ahead of the CPI data and the 30 year bond auction

- 2-year yield 4.636%, +0.4 basis points. At this time yesterday, the yield was at 4.609%

- 5-year yield 4.247%, +0.9 basis points.. At this time yesterday, the yield was at 4.223%

- 10-year yield 4.293%, +1.4 basis points. At this time yesterday, the yield was at 4.274%

- 30-year yield 4.479% +1.0 basis points. At this time yesterday, the yield was at 4.468%

Looking at the treasury yield curve the spreads are a touch more negative in trading today:

- The 2-10 year spread is at -34.5 basis points. At this time yesterday, the spread was at -33.5 basis points.

- The 2-30 year spread is at -15.7 basis points. At this time yesterday, the spread was at -14.2 basis points.

In the European debt market, yields are higher in the benchmark 10 year note sector:

This article was written by Greg Michalowski at www.forexlive.com.

Source link