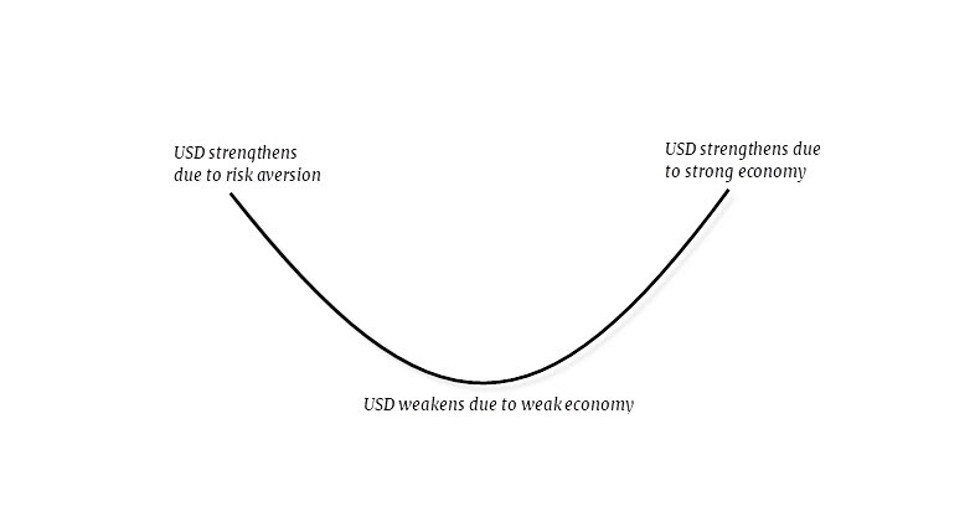

The idea of the dollar smile theory is pretty much this:

But amid the unwinding of the carry trade since Friday, there is something worth noting about the dollar under these circumstances. The global selloff proved that even with risk aversion in markets, the dollar struggled for the most part. So, what gives?

As the boom meets a bust, traders are getting a reality check. The carry trade mostly depended on this one thing. Traders were borrowing yen at low interest to buy risky assets i.e. US stocks mostly. That’s the simplest way to put it. So, the BOJ hiking rates plus the yen surging led to a double whammy which shook markets since Friday.

That is not to mention with all the panic surrounding the state of the US economy with markets suddenly wanting to believe that the Fed has to step in with emergency rate cuts. Pfft.

So, looking at the state of things, markets are now figuring out the one thing that can really hurt it the most. And that is when leverage gets out of control and come back to bite at investors.

A flight to safety during such an event typically should bolster the dollar’s standing but considering the circumstances, the dollar seems to be the one caught on the opposite side of the unwinding too. It doesn’t help when the solution for investors is to go kicking and screaming, and asking help from the Fed.

Taking that as a case in point, the dollar smile theory may yet have changed to a dollar frown theory – at least for now:

That being said, with the Fed poised to cut rates, it will also keep a lid on any outsized dollar rally from hereon. But a more robust economy in general will at least keep the dollar in good standing and not exercise the Fed put too quickly.

But if other parts of the economy start to show more warning signs like the labour market, the dollar might quickly find itself in hot water once again.

And to pile on the misery, it will also trigger worries about the outlook for US stocks. In turn, that might bring us back to the episode from last Friday and this Monday again. That especially if USD/JPY also continues to plunge alongside a declining equities market.

In the normal case of risk aversion, the dollar is a comfort for traders in general. But when we’re now caught in the storm of the carry trade unwind, the dollar really needs a strong economy to work for it in order to stand its ground.

This article was written by Justin Low at www.forexlive.com.

Source link